ASX Penny Stocks To Watch In August 2025

Australian shares have shown resilience by largely shaking off Wall Street's recent downturn, and with U.S. indexes rebounding, the ASX 200 appears to be aligning with global market trends. As household spending data looms, potentially influencing the Reserve Bank of Australia's upcoming decisions, investors are keenly observing sectors that may offer growth opportunities. Penny stocks—though a term from past trading days—remain relevant for those seeking potential in smaller or newer companies; when these stocks are backed by strong financials, they can present surprising value and potential for significant returns.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.40 | A$114.64M | ✅ 3 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.05 | A$96.71M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.39 | A$74.36M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.94 | A$453.29M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.33 | A$2.66B | ✅ 5 ⚠️ 1 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.76 | A$465.36M | ✅ 4 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.96 | A$995.23M | ✅ 4 ⚠️ 2 View Analysis > |

| Sugar Terminals (NSX:SUG) | A$0.99 | A$358.2M | ✅ 2 ⚠️ 2 View Analysis > |

| Austco Healthcare (ASX:AHC) | A$0.38 | A$138.44M | ✅ 4 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.835 | A$147.8M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 460 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Airtasker (ASX:ART)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Airtasker Limited operates a technology-enabled online marketplace for local services in Australia, with a market cap of A$163.57 million.

Operations: The company's revenue is derived from two segments: New Marketplaces, generating A$2.09 million, and Established Marketplaces, contributing A$46.89 million.

Market Cap: A$163.57M

Airtasker Limited, with a market cap of A$163.57 million, operates debt-free and has sufficient cash runway for over three years due to positive free cash flow. Despite trading at 74.7% below its estimated fair value, the company remains unprofitable with a negative return on equity of -97.04%. Revenue is forecast to grow by 14.3% annually, supported by stable weekly volatility and a seasoned management team averaging 4.5 years in tenure. Short-term assets exceed liabilities significantly; however, profitability is not expected within the next three years as losses have increased at 2.2% per year over five years.

- Take a closer look at Airtasker's potential here in our financial health report.

- Gain insights into Airtasker's future direction by reviewing our growth report.

Big River Industries (ASX:BRI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Big River Industries Limited, with a market cap of A$121.68 million, operates in the manufacture, distribution, and retail of timber and building products across Australia and New Zealand.

Operations: Big River Industries generates revenue through its Panels segment, which contributes A$130.54 million, and its Construction segment, accounting for A$276.87 million.

Market Cap: A$121.68M

Big River Industries, with a market cap of A$121.68 million, operates in the timber and building products sector across Australia and New Zealand. Despite being unprofitable with a negative return on equity of -16.01%, it trades at 57.6% below its estimated fair value, suggesting potential undervaluation compared to peers. The company’s debt is satisfactorily managed with operating cash flow covering 39.8% of its debt obligations, while short-term assets exceed both short-term and long-term liabilities significantly. Although dividend coverage by earnings is weak, forecasted earnings growth of 102.97% per year indicates potential future profitability improvements amidst stable weekly volatility.

- Unlock comprehensive insights into our analysis of Big River Industries stock in this financial health report.

- Review our growth performance report to gain insights into Big River Industries' future.

Cobram Estate Olives (ASX:CBO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cobram Estate Olives Limited is involved in olive farming and the production and marketing of olive oil across Australia, the United States, and internationally, with a market cap of A$1.10 billion.

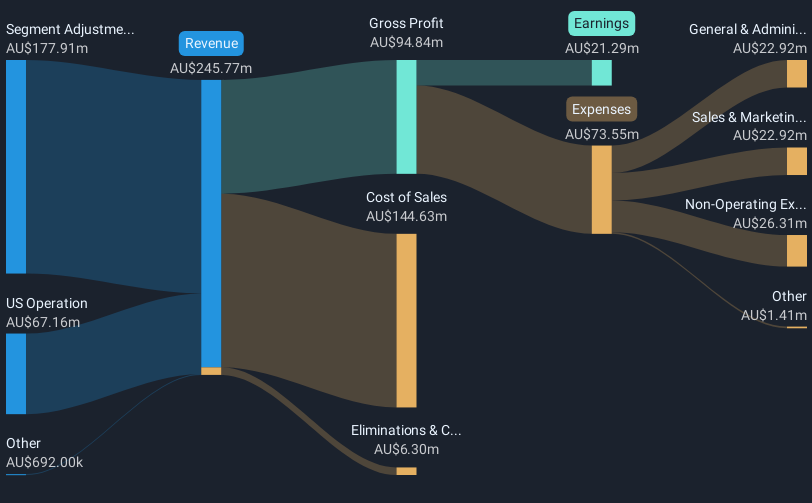

Operations: The company's revenue is primarily derived from its US operation, which generated A$67.16 million.

Market Cap: A$1.1B

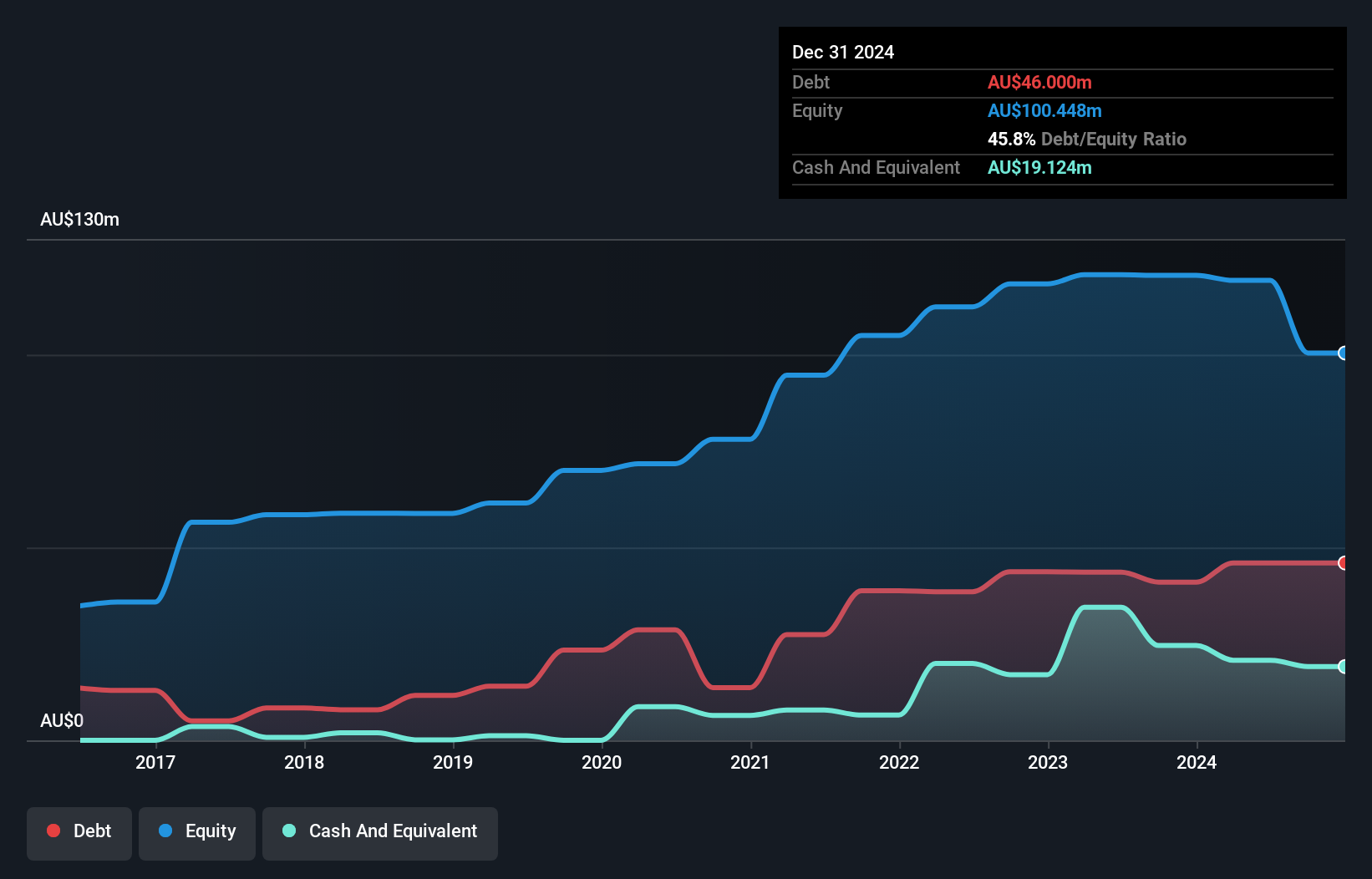

Cobram Estate Olives, with a market cap of A$1.10 billion, shows promising growth characteristics within the penny stock landscape. The company's earnings surged by 104.8% last year, outpacing industry averages and demonstrating high-quality past earnings. Despite a high net debt to equity ratio of 78.3%, interest payments are well covered by EBIT at 4.6 times coverage, indicating manageable debt levels relative to cash flow capabilities. The board and management team bring seasoned expertise with tenures averaging over four years for management and over ten years for directors, enhancing governance stability amidst robust operational performance metrics.

- Dive into the specifics of Cobram Estate Olives here with our thorough balance sheet health report.

- Evaluate Cobram Estate Olives' prospects by accessing our earnings growth report.

Key Takeaways

- Embark on your investment journey to our 460 ASX Penny Stocks selection here.

- Curious About Other Options? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10