How Pacira BioSciences’ (PCRX) Johnson & Johnson MedTech Collaboration Is Shaping Its Market Reach

- Pacira BioSciences recently announced a collaboration with Johnson & Johnson MedTech to expand the promotion and sales reach of ZILRETTA, an extended-release treatment for osteoarthritis knee pain, across multiple physician specialties in the United States.

- This partnership enables ZILRETTA to access a broader patient base by leveraging Johnson & Johnson MedTech’s established early intervention sales force, potentially increasing its visibility beyond orthopedic practices.

- We'll examine how Johnson & Johnson MedTech’s early intervention sales force may reshape Pacira’s investment narrative and market opportunities.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Pacira BioSciences Investment Narrative Recap

To be a shareholder in Pacira BioSciences, you need to believe in the company’s potential to expand patient access and drive adoption of its pain management therapies, especially through partnerships like the newly announced collaboration with Johnson & Johnson MedTech for ZILRETTA. This move directly targets uncertainties around ZILRETTA’s market uptake, a key near-term catalyst and risk, by leveraging an established sales force to accelerate physician adoption and potentially ease reimbursement hurdles. The impact could be meaningful for addressing one of Pacira’s most important growth bottlenecks, though commercial execution and reimbursement integration remain obstacles to monitor.

Among recent updates, new long-term follow-up data for PCRX-201 showed sustained improvements in osteoarthritis patients’ pain and mobility after a single injection, adding to Pacira’s development pipeline. This announcement complements the ZILRETTA news, highlighting the company’s broader strategy to diversify and build market presence through both near-term partnerships and longer-term innovation in pain management.

On the flip side, investors should also keep in mind how delays in reimbursement pathway adoption could impact revenue timing for ZILRETTA and other products...

Read the full narrative on Pacira BioSciences (it's free!)

Pacira BioSciences' outlook estimates revenues of $918.1 million and earnings of $106.8 million by 2028. This is based on an expected annual revenue growth rate of 9.3% and a $210.5 million increase in earnings from a current loss of $-103.7 million.

Uncover how Pacira BioSciences' forecasts yield a $30.80 fair value, a 34% upside to its current price.

Exploring Other Perspectives

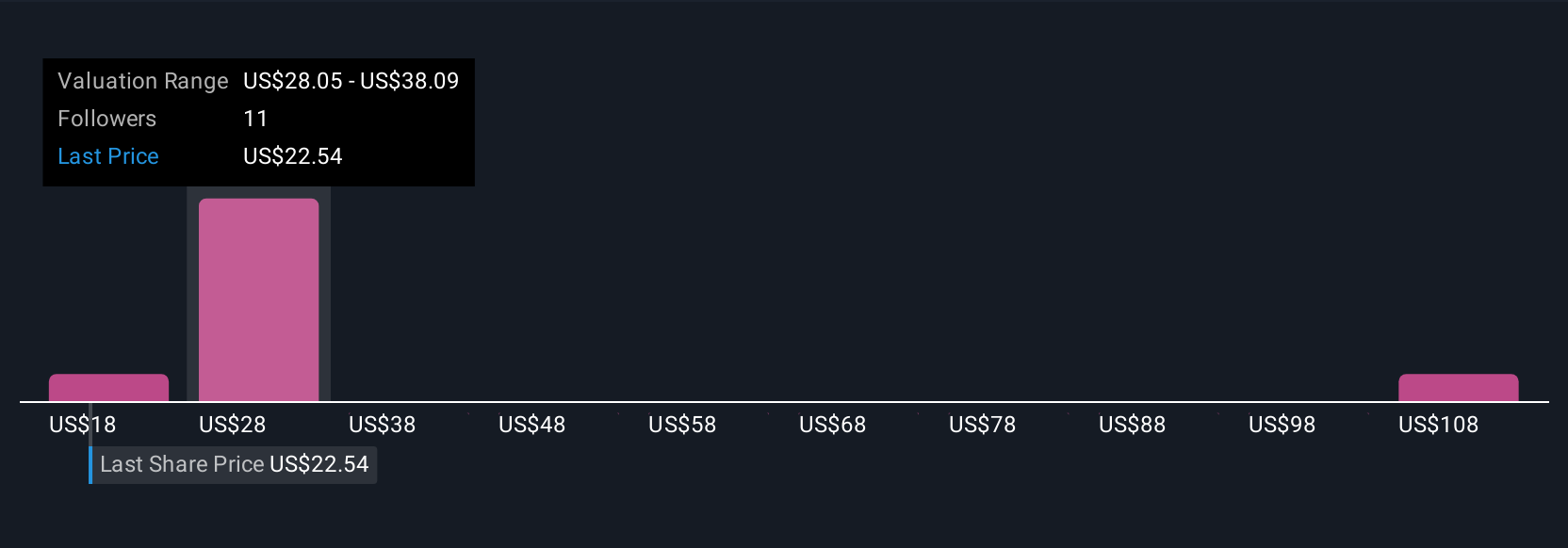

Four members of the Simply Wall St Community estimate Pacira’s fair value between US$18 and US$127, with a current share price of US$22.94. While some see substantial upside, the pace of customer adoption for new reimbursement models could determine how quickly Pacira closes the gap to these targets.

Explore 4 other fair value estimates on Pacira BioSciences - why the stock might be worth over 5x more than the current price!

Build Your Own Pacira BioSciences Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pacira BioSciences research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Pacira BioSciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pacira BioSciences' overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10