The Bull Case For Public Service Enterprise Group (PEG) Could Change Following Major Clean Energy Savings Success

- In recent news, Public Service Enterprise Group reported that its Clean Energy Future-Energy Efficiency programs have helped nearly 465,000 New Jersey customers save a combined US$720 million annually and receive approximately US$740 million in rebates, while also helping over 18,500 businesses complete around 28,000 efficiency projects.

- An interesting outcome is the avoidance of about 2.1 million metric tons of carbon emissions per year, reflecting a material environmental impact and progress towards sustainability goals.

- We’ll now consider how these significant energy savings and environmental achievements may influence Public Service Enterprise Group’s longer-term investment outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

Public Service Enterprise Group Investment Narrative Recap

To be a shareholder in Public Service Enterprise Group, you would need to see value in the transition to clean energy and infrastructure modernization, driven by stable regulated investments and high customer engagement. The news about substantial energy savings and carbon emissions avoidance through the Clean Energy Future-Energy Efficiency programs highlights operational momentum and a proactive stance toward sustainability, but does not appear to fundamentally shift the near-term focus on regulatory changes or the primary risk of cost pressures from inflation and nuclear operations.

Among recent announcements, PSEG’s strong Q2 2025 financial results, featuring higher sales and net income, are especially relevant, showing that while large-scale investments in energy efficiency programs are ongoing, the company continues to deliver steady earnings growth. This operational consistency may support the case for ongoing infrastructure investment, but also reminds investors to monitor balance sheet health as spending remains elevated.

However, with the positive news also comes the persistent question of how political and regulatory uncertainty, including potential changes to the way utilities build new generation, could affect...

Read the full narrative on Public Service Enterprise Group (it's free!)

Public Service Enterprise Group is expected to generate $12.5 billion in revenue and $2.4 billion in earnings by 2028. This outlook assumes annual revenue growth of 5.1% and a $0.6 billion increase in earnings from the current $1.8 billion.

Uncover how Public Service Enterprise Group's forecasts yield a $88.50 fair value, in line with its current price.

Exploring Other Perspectives

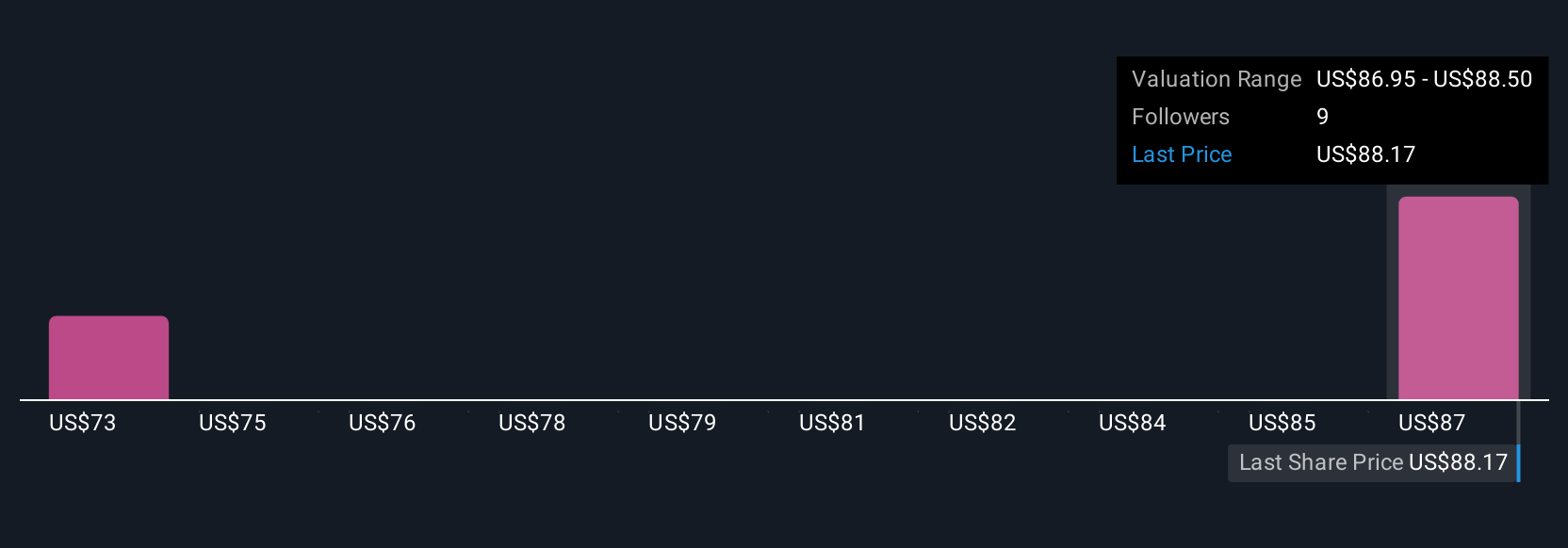

Simply Wall St Community members provided three fair value estimates ranging from US$73.03 to US$88.50 per share. With regulatory outcomes still uncertain, you can explore how these varied outlooks may reflect different expectations for the company's ability to respond to policy shifts.

Explore 3 other fair value estimates on Public Service Enterprise Group - why the stock might be worth 19% less than the current price!

Build Your Own Public Service Enterprise Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Public Service Enterprise Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Public Service Enterprise Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Public Service Enterprise Group's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10