3 Stocks Estimated To Be Trading At A Discount Of Up To 49.4%

As the U.S. stock market navigates a surge in earnings reports and ongoing tariff discussions, major indices like the Dow Jones and S&P 500 are showing resilience with recent gains. In this environment, identifying undervalued stocks can be particularly valuable for investors seeking opportunities amidst fluctuating economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Palomar Holdings (PLMR) | $112.26 | $218.55 | 48.6% |

| Lyft (LYFT) | $14.51 | $28.60 | 49.3% |

| Gogo (GOGO) | $15.63 | $30.29 | 48.4% |

| First Commonwealth Financial (FCF) | $16.70 | $32.97 | 49.4% |

| EQT (EQT) | $51.69 | $103.18 | 49.9% |

| Duolingo (DUOL) | $340.31 | $675.08 | 49.6% |

| BioLife Solutions (BLFS) | $20.73 | $40.00 | 48.2% |

| ATRenew (RERE) | $3.38 | $6.51 | 48.1% |

| Atlantic Union Bankshares (AUB) | $31.68 | $62.54 | 49.3% |

| ACNB (ACNB) | $41.83 | $80.94 | 48.3% |

Click here to see the full list of 173 stocks from our Undervalued US Stocks Based On Cash Flows screener.

Let's explore several standout options from the results in the screener.

Verra Mobility (VRRM)

Overview: Verra Mobility Corporation offers smart mobility technology solutions across the United States, Australia, Europe, and Canada, with a market cap of approximately $4.03 billion.

Operations: The company generates revenue through Parking Solutions ($81.01 million), Commercial Services ($413.18 million), and Government Solutions ($398.54 million).

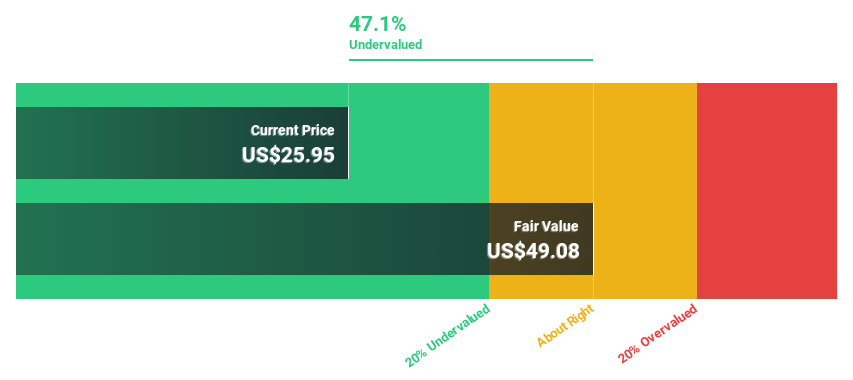

Estimated Discount To Fair Value: 47.5%

Verra Mobility appears undervalued, trading at US$25.14 against a fair value estimate of US$47.89, suggesting significant upside potential based on discounted cash flow analysis. Despite high debt levels and a recent drop from the Russell 2000 Dynamic Index, its earnings are forecast to grow significantly at 46.8% annually over the next three years, outpacing the broader U.S. market's growth expectations. Recent executive changes may also bolster strategic initiatives in commercial services.

- The growth report we've compiled suggests that Verra Mobility's future prospects could be on the up.

- Take a closer look at Verra Mobility's balance sheet health here in our report.

First Commonwealth Financial (FCF)

Overview: First Commonwealth Financial Corporation is a financial holding company that offers a range of consumer and commercial banking products and services in the United States, with a market cap of approximately $1.73 billion.

Operations: The company generates revenue primarily from its banking segment, which amounted to $454.63 million.

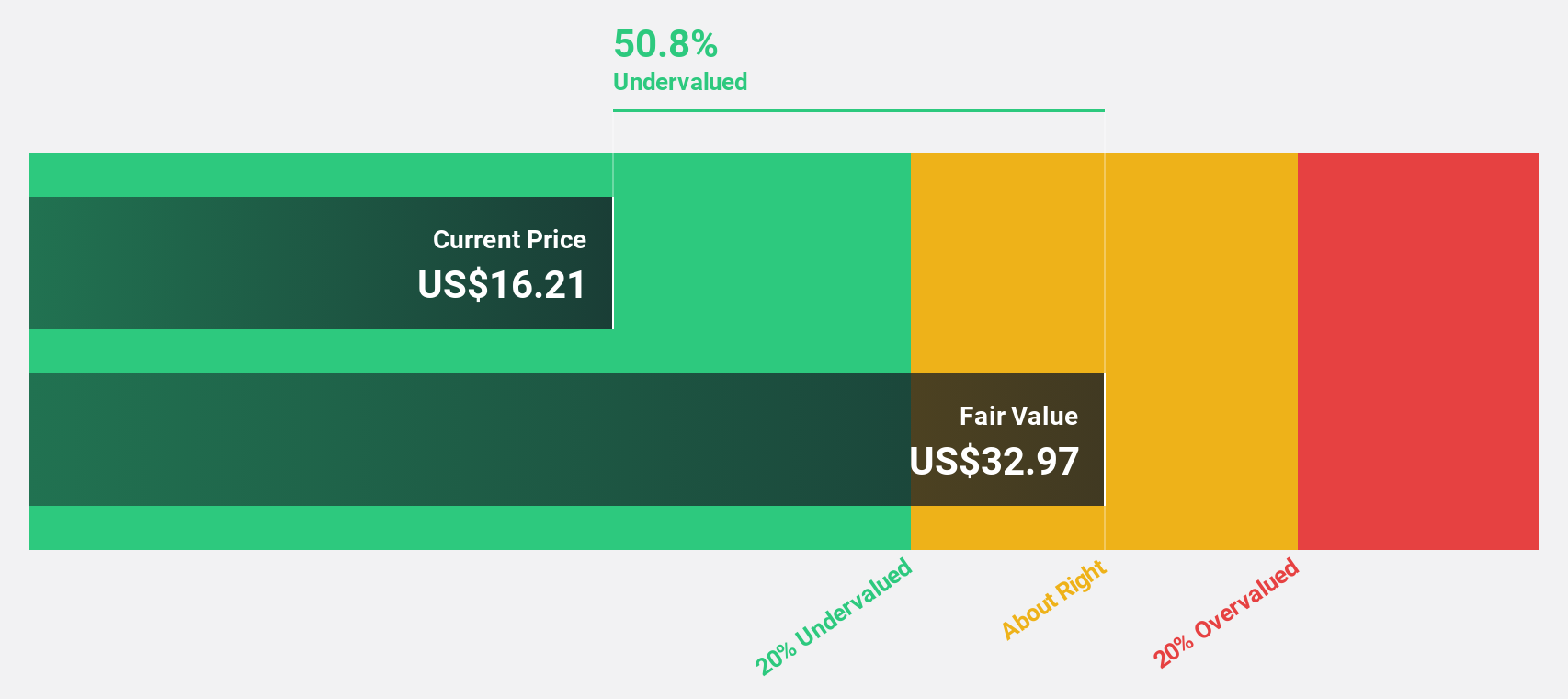

Estimated Discount To Fair Value: 49.4%

First Commonwealth Financial is trading at US$16.7, significantly below its fair value estimate of US$32.97, indicating it is undervalued based on discounted cash flow analysis. The company reported a decline in net income for Q2 2025 but maintains strong earnings growth prospects at 21.4% annually over the next three years, surpassing U.S. market expectations. Recent share repurchase programs and a consistent dividend yield of 3.23% further enhance investor appeal despite some impairments noted in recent results.

- Our comprehensive growth report raises the possibility that First Commonwealth Financial is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of First Commonwealth Financial stock in this financial health report.

ATRenew (RERE)

Overview: ATRenew Inc. operates a platform for pre-owned consumer electronics transactions and services in China, with a market cap of approximately $754.79 million.

Operations: The company generates revenue primarily through its retail electronics segment, which reported CN¥17.33 billion.

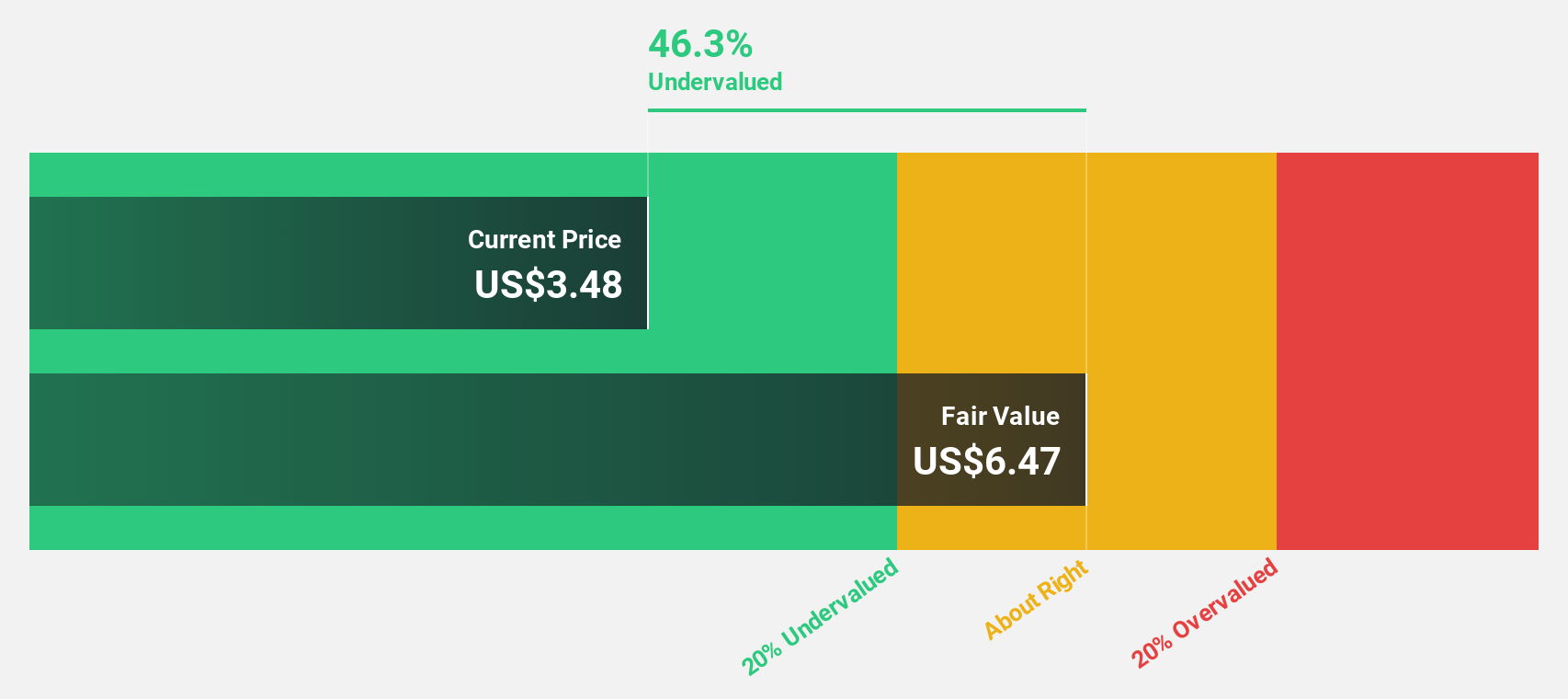

Estimated Discount To Fair Value: 48.1%

ATRenew is trading at $3.38, considerably below its fair value estimate of $6.51, highlighting its undervaluation based on discounted cash flow analysis. The company recently became profitable and forecasts robust earnings growth of 81.8% annually, outpacing the U.S. market's 14.7%. A new $50 million share repurchase program underscores management's confidence in future prospects while leveraging existing cash reserves to enhance shareholder value amidst strong revenue projections exceeding 20% annually.

- The analysis detailed in our ATRenew growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of ATRenew.

Key Takeaways

- Unlock more gems! Our Undervalued US Stocks Based On Cash Flows screener has unearthed 170 more companies for you to explore.Click here to unveil our expertly curated list of 173 Undervalued US Stocks Based On Cash Flows.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10