Top ASX Dividend Stocks To Consider In August 2025

As the ASX200 reached an all-time intra-day high of 8,827 points, driven by strong performances in the Materials and Energy sectors, investors are closely watching for opportunities amidst these record levels. In this dynamic market environment, dividend stocks can offer a compelling option for those seeking steady income streams and potential stability against market fluctuations.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Super Retail Group (ASX:SUL) | 7.51% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 8.12% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 3.09% | ★★★★★☆ |

| New Hope (ASX:NHC) | 9.34% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.53% | ★★★★★☆ |

| Lycopodium (ASX:LYL) | 6.68% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 6.80% | ★★★★★☆ |

| IPH (ASX:IPH) | 6.62% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 3.87% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 6.76% | ★★★★★☆ |

Click here to see the full list of 30 stocks from our Top ASX Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

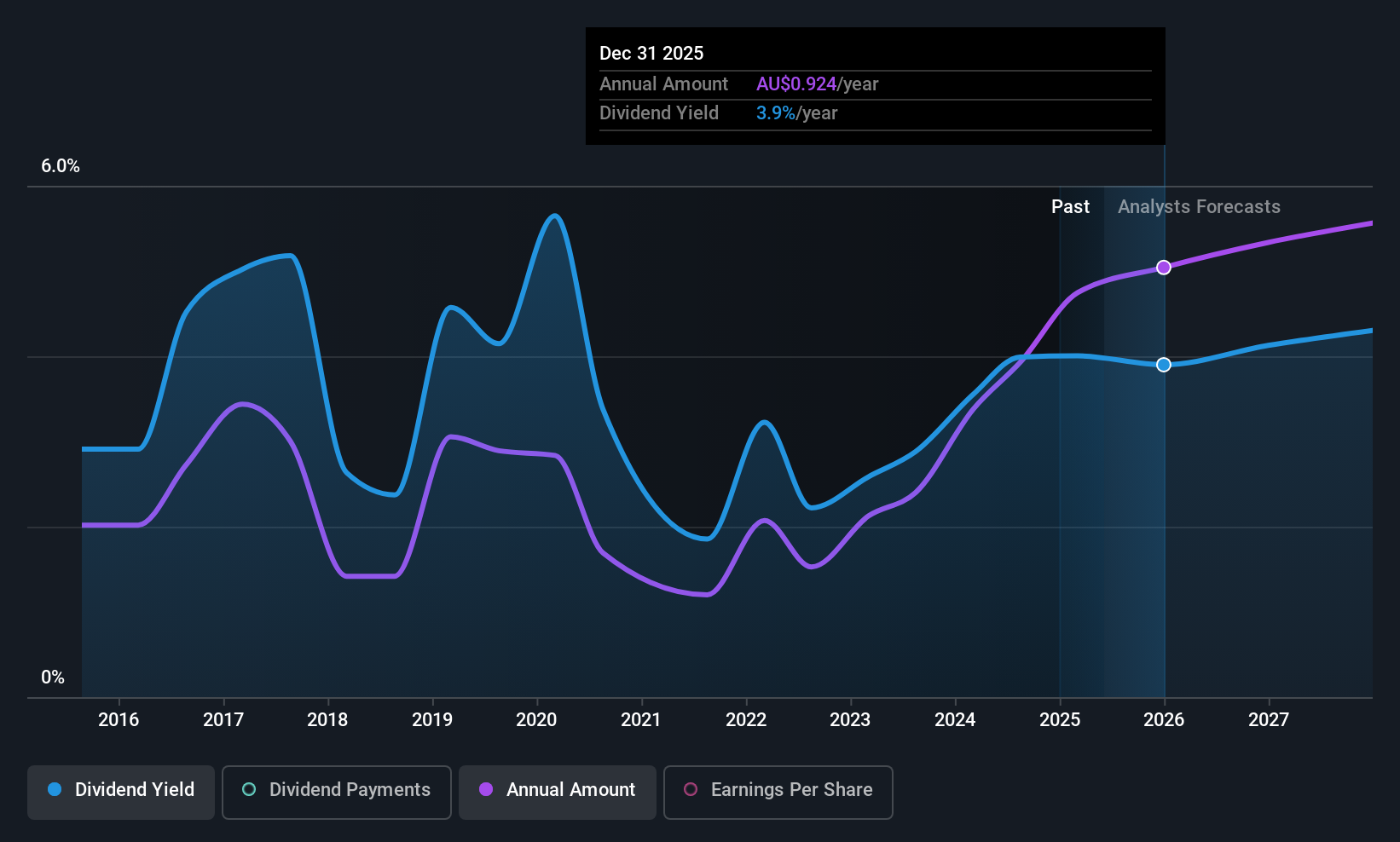

Nick Scali (ASX:NCK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nick Scali Limited, with a market cap of A$1.66 billion, operates in the sourcing and retailing of household furniture and related accessories across Australia, the United Kingdom, and New Zealand.

Operations: The company's revenue primarily comes from its furniture retailing segment, which generated A$492.63 million.

Dividend Yield: 3.1%

Nick Scali's dividend payments have shown stability and growth over the past decade, supported by a payout ratio of 78.2% from earnings and 63.7% from cash flows. While its dividend yield of 3.09% is lower than the top quartile in Australia, inclusion in the S&P/ASX 200 Index may enhance investor confidence. Recent executive changes, including new joint company secretaries, suggest a focus on governance that could impact future performance positively or negatively.

- Unlock comprehensive insights into our analysis of Nick Scali stock in this dividend report.

- The analysis detailed in our Nick Scali valuation report hints at an inflated share price compared to its estimated value.

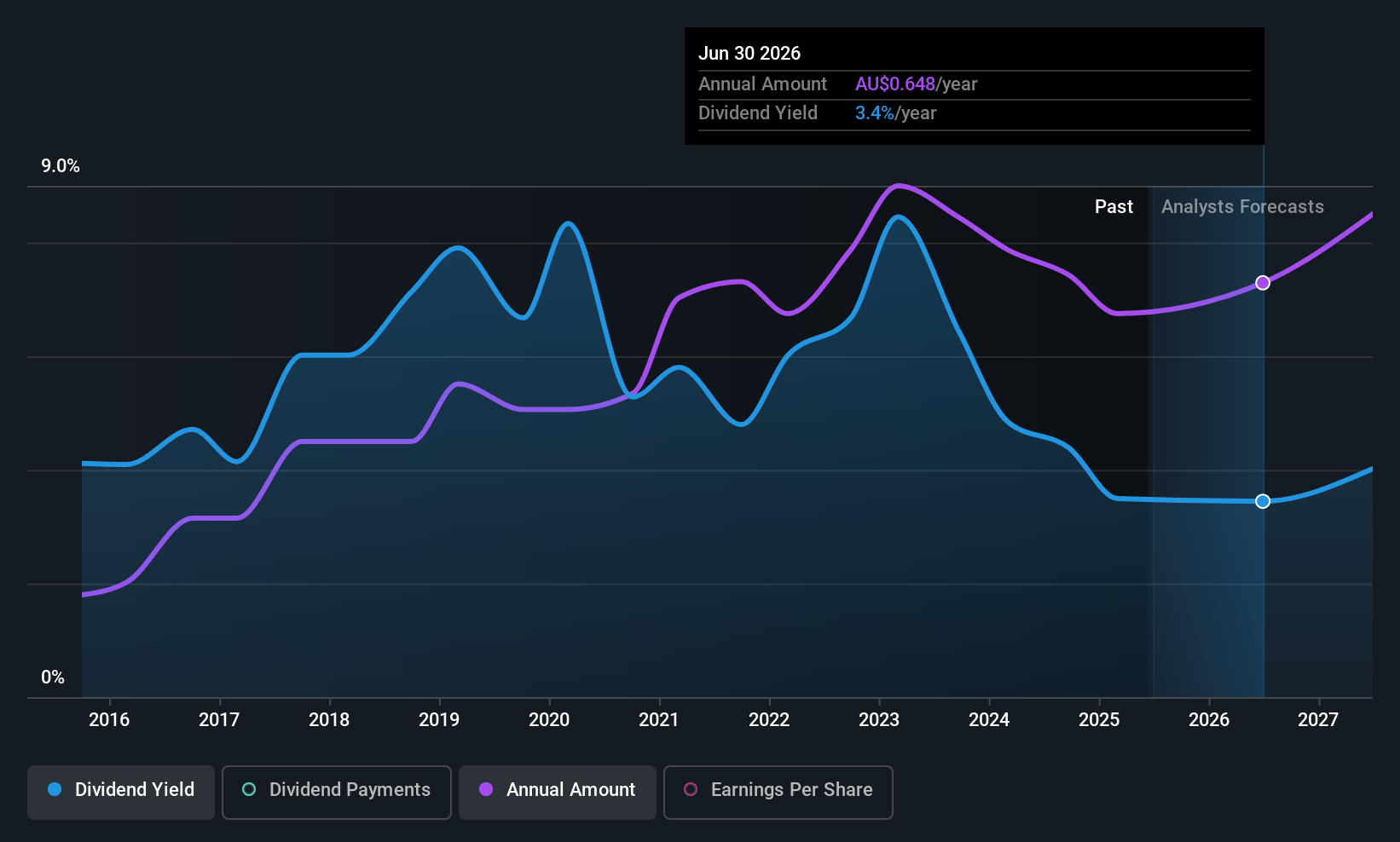

QBE Insurance Group (ASX:QBE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: QBE Insurance Group Limited underwrites general insurance and reinsurance risks across the Australia Pacific, North America, and international markets, with a market cap of A$35.18 billion.

Operations: QBE Insurance Group Limited's revenue is derived from its operations in International markets ($9.82 billion), North America ($7.54 billion), and the Australia Pacific region ($5.96 billion).

Dividend Yield: 3.4%

QBE Insurance Group's dividend payments are well covered by earnings and cash flows, with payout ratios of 46.7% and 32.3%, respectively. Despite a history of volatility, dividends have increased over the past decade. Trading at a significant discount to its estimated fair value, QBE offers potential for capital appreciation alongside its dividend yield of 3.42%, which is below Australia's top quartile payers. Recent constitutional amendments may influence governance practices moving forward.

- Delve into the full analysis dividend report here for a deeper understanding of QBE Insurance Group.

- Our expertly prepared valuation report QBE Insurance Group implies its share price may be lower than expected.

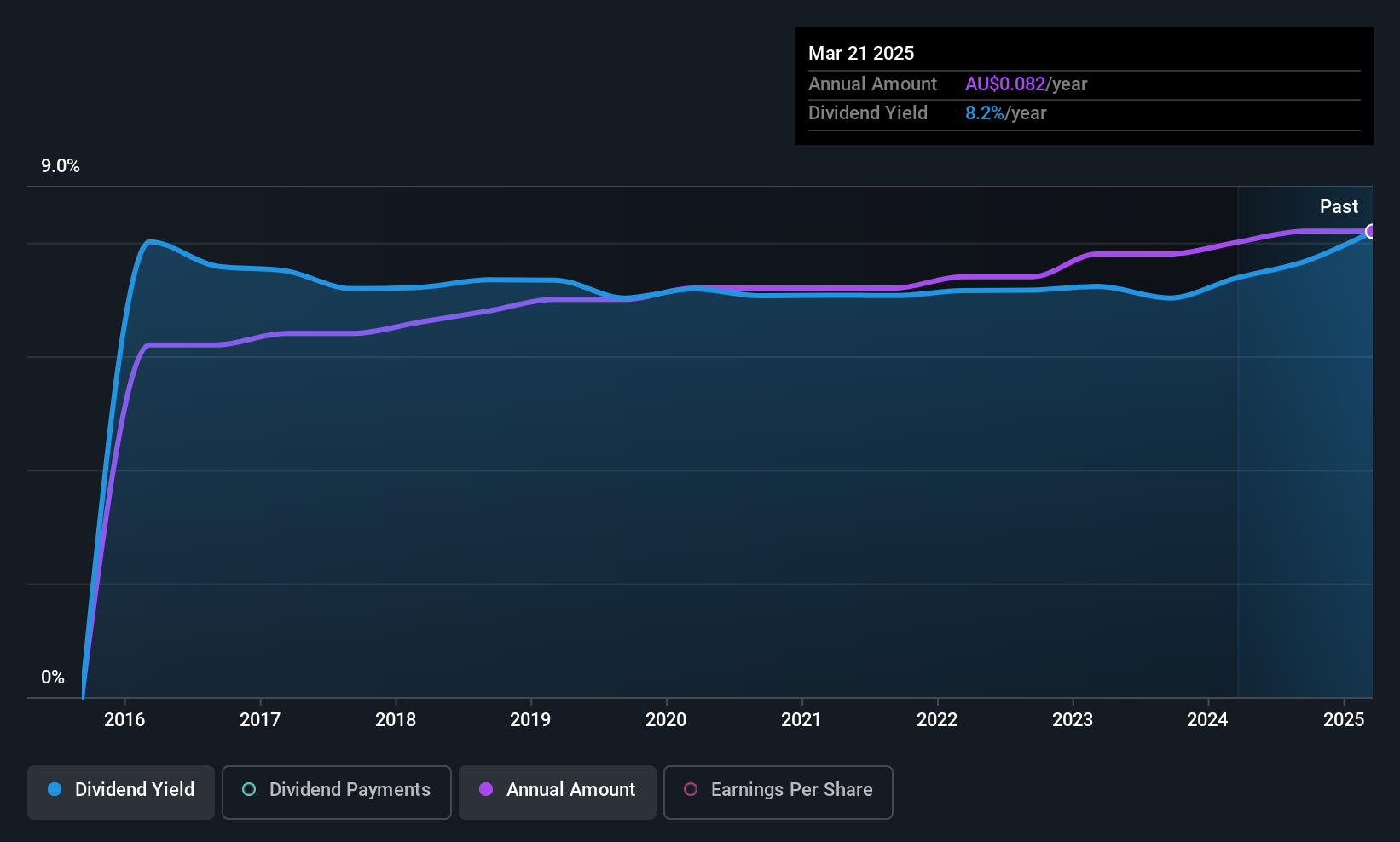

Sugar Terminals (NSX:SUG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sugar Terminals Limited offers storage and handling solutions for bulk sugar and other commodities in Australia, with a market cap of A$363.60 million.

Operations: Sugar Terminals Limited generates revenue primarily from the sugar industry, amounting to A$115.01 million.

Dividend Yield: 8.1%

Sugar Terminals Limited has a dividend yield of 8.12%, placing it among the top 25% of Australian dividend payers, though not well covered by earnings. Recent agreements with customers, including Bundaberg Sugar Ltd., aim to maintain stable returns and potentially impact future dividends positively. The company's dividends have grown steadily over the past decade with minimal volatility but are not fully supported by cash flows or earnings, raising sustainability concerns despite its significant undervaluation at A$0.67 billion below fair value estimates.

- Click here and access our complete dividend analysis report to understand the dynamics of Sugar Terminals.

- The analysis detailed in our Sugar Terminals valuation report hints at an deflated share price compared to its estimated value.

Make It Happen

- Click this link to deep-dive into the 30 companies within our Top ASX Dividend Stocks screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10