3 ASX Penny Stocks With Over A$700M Market Cap

Australian shares recently made a strong push past the 8,800 level, marking a year-to-date increase of about 7%, though recent trading has seen some cautious selling. In this context, penny stocks—despite their somewhat outdated name—remain an intriguing area for investors seeking opportunities in smaller or newer companies. These stocks can offer surprising value and potential returns when backed by solid financial foundations, making them worth exploring for those interested in uncovering hidden gems within the market.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.40 | A$114.64M | ✅ 3 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.36 | A$111.33M | ✅ 4 ⚠️ 3 View Analysis > |

| GTN (ASX:GTN) | A$0.375 | A$71.5M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.90 | A$447.13M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.61 | A$2.98B | ✅ 5 ⚠️ 1 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.82 | A$481.22M | ✅ 4 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$3.05 | A$1.03B | ✅ 4 ⚠️ 2 View Analysis > |

| Austco Healthcare (ASX:AHC) | A$0.385 | A$140.68M | ✅ 4 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.85 | A$149.01M | ✅ 4 ⚠️ 2 View Analysis > |

| Reckon (ASX:RKN) | A$0.61 | A$69.11M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 456 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Djerriwarrh Investments (ASX:DJW)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Djerriwarrh Investments Limited is a publicly owned investment manager with a market cap of A$862.81 million, focusing on managing investment portfolios.

Operations: The company generates revenue primarily from its portfolio of investments, amounting to A$53.07 million.

Market Cap: A$862.81M

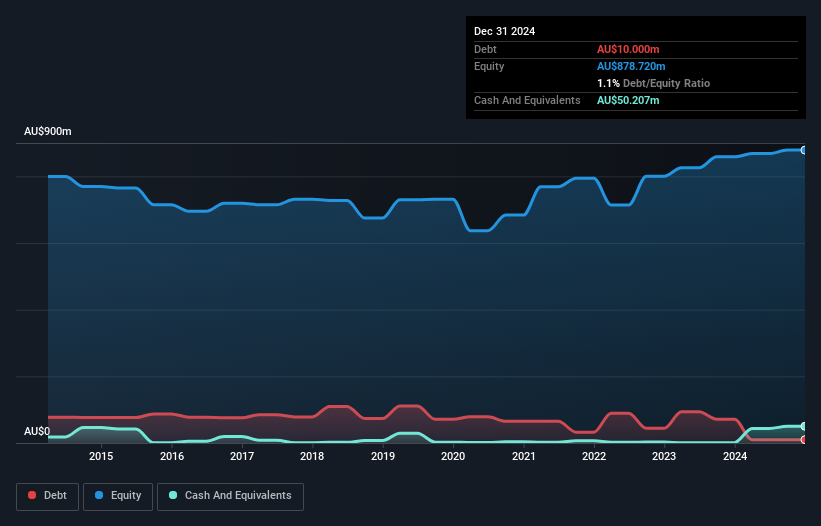

Djerriwarrh Investments Limited, with a market cap of A$862.81 million, is financially robust, as evidenced by its well-covered interest payments and operating cash flow exceeding debt. The company's seasoned management team and board of directors contribute to its stability. Despite earnings growth slowing to 0.6% over the past year compared to a 5-year average of 7.9%, Djerriwarrh maintains high-quality earnings and strong net profit margins at 73.8%. However, its dividend yield of 4.73% is not well covered by earnings or free cash flows, signaling potential sustainability concerns for income-focused investors.

- Get an in-depth perspective on Djerriwarrh Investments' performance by reading our balance sheet health report here.

- Examine Djerriwarrh Investments' past performance report to understand how it has performed in prior years.

Kingsgate Consolidated (ASX:KCN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Kingsgate Consolidated Limited is involved in the exploration, development, and mining of gold and silver mineral properties, with a market cap of A$700.41 million.

Operations: The company generates revenue primarily from its Chatree segment, amounting to A$210.69 million.

Market Cap: A$700.41M

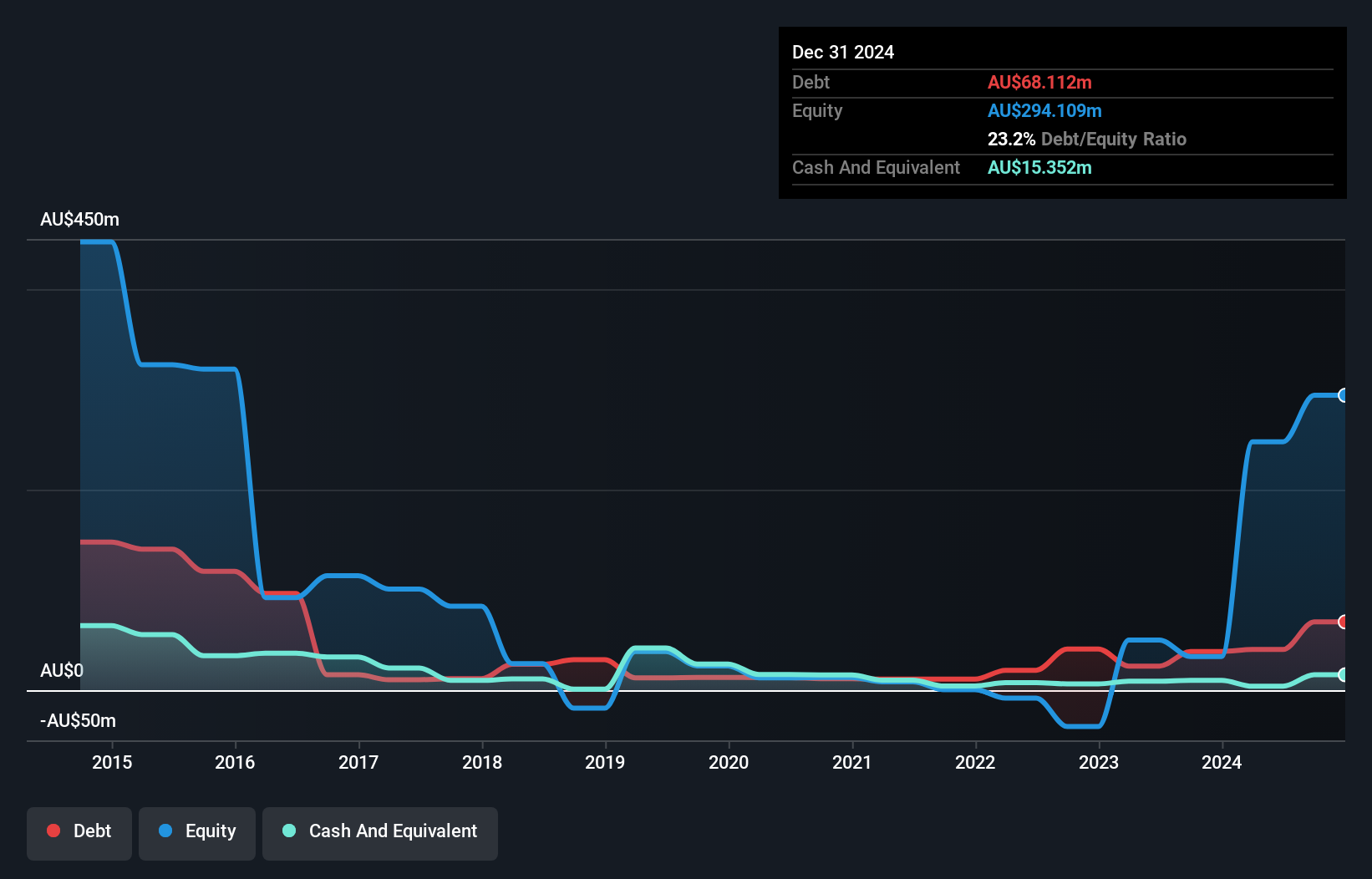

Kingsgate Consolidated Limited, with a market cap of A$700.41 million, has demonstrated significant earnings growth of 1203% over the past year, far outpacing its industry peers. Despite this impressive growth and a strong return on equity of 74.4%, the company faces challenges such as short-term assets not covering long-term liabilities and recent executive changes with Mischa Mutavdzic appointed as CFO. While trading at a substantial discount to its estimated fair value, Kingsgate's debt management is commendable with well-covered interest payments and reduced net debt to equity ratio over time.

- Click here to discover the nuances of Kingsgate Consolidated with our detailed analytical financial health report.

- Gain insights into Kingsgate Consolidated's outlook and expected performance with our report on the company's earnings estimates.

Regal Partners (ASX:RPL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Regal Partners Limited is a privately owned hedge fund sponsor with a market cap of A$1.03 billion.

Operations: The company generates revenue of A$257.55 million from its investment management services segment.

Market Cap: A$1.03B

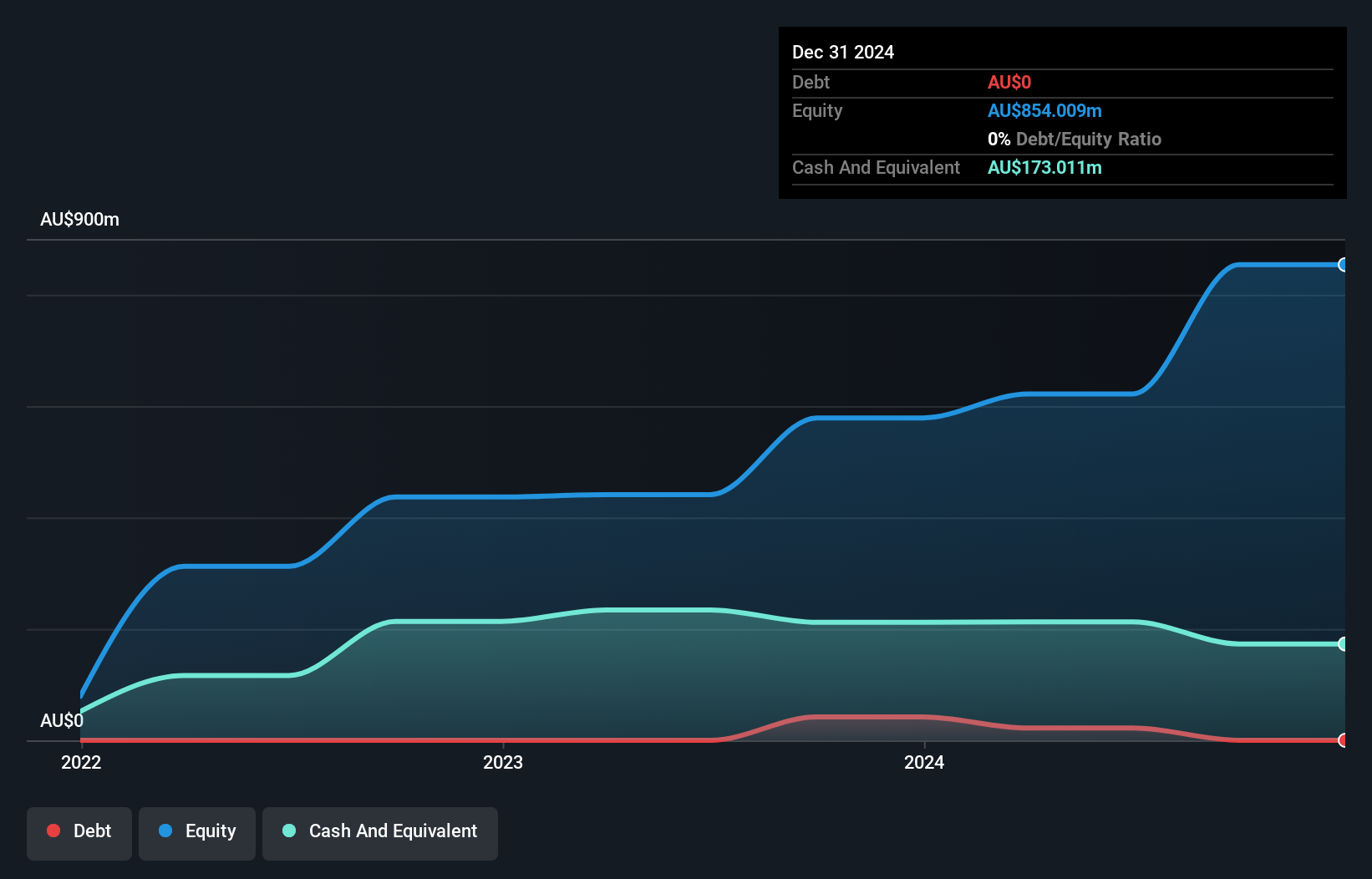

Regal Partners Limited, with a market cap of A$1.03 billion, has shown remarkable earnings growth of 4050.4% over the past year, surpassing industry averages. The company is debt-free and trades below its estimated fair value by 25.2%, suggesting potential undervaluation compared to peers. Despite low return on equity at 7.8%, Regal maintains high-quality earnings and improved net profit margins from the previous year. Recent insider selling raises concerns; however, strong asset coverage for both short- and long-term liabilities provides financial stability. The company seeks strategic acquisitions to enhance shareholder value while maintaining disciplined M&A practices.

- Click to explore a detailed breakdown of our findings in Regal Partners' financial health report.

- Explore Regal Partners' analyst forecasts in our growth report.

Seize The Opportunity

- Get an in-depth perspective on all 456 ASX Penny Stocks by using our screener here.

- Ready For A Different Approach? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10