Top Growth Companies With Significant Insider Ownership August 2025

The U.S. stock market is experiencing a notable rebound, with major indices like the Dow Jones and S&P 500 climbing after a recent sell-off driven by concerns over tariffs and economic health. In such fluctuating conditions, stocks of growth companies with significant insider ownership can offer unique insights into potential resilience and long-term value, as insiders often have confidence in their company's future prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Victory Capital Holdings (VCTR) | 10.1% | 32.4% |

| Super Micro Computer (SMCI) | 13.9% | 36.3% |

| Prairie Operating (PROP) | 34.4% | 80.8% |

| Niu Technologies (NIU) | 37.2% | 88.1% |

| FTC Solar (FTCI) | 23.1% | 62.5% |

| Enovix (ENVX) | 10.5% | 47.5% |

| Credo Technology Group Holding (CRDO) | 11.7% | 36.4% |

| Cloudflare (NET) | 10.6% | 46.2% |

| Atour Lifestyle Holdings (ATAT) | 22.6% | 23.5% |

| Astera Labs (ALAB) | 12.8% | 45.6% |

Click here to see the full list of 184 stocks from our Fast Growing US Companies With High Insider Ownership screener.

Below we spotlight a couple of our favorites from our exclusive screener.

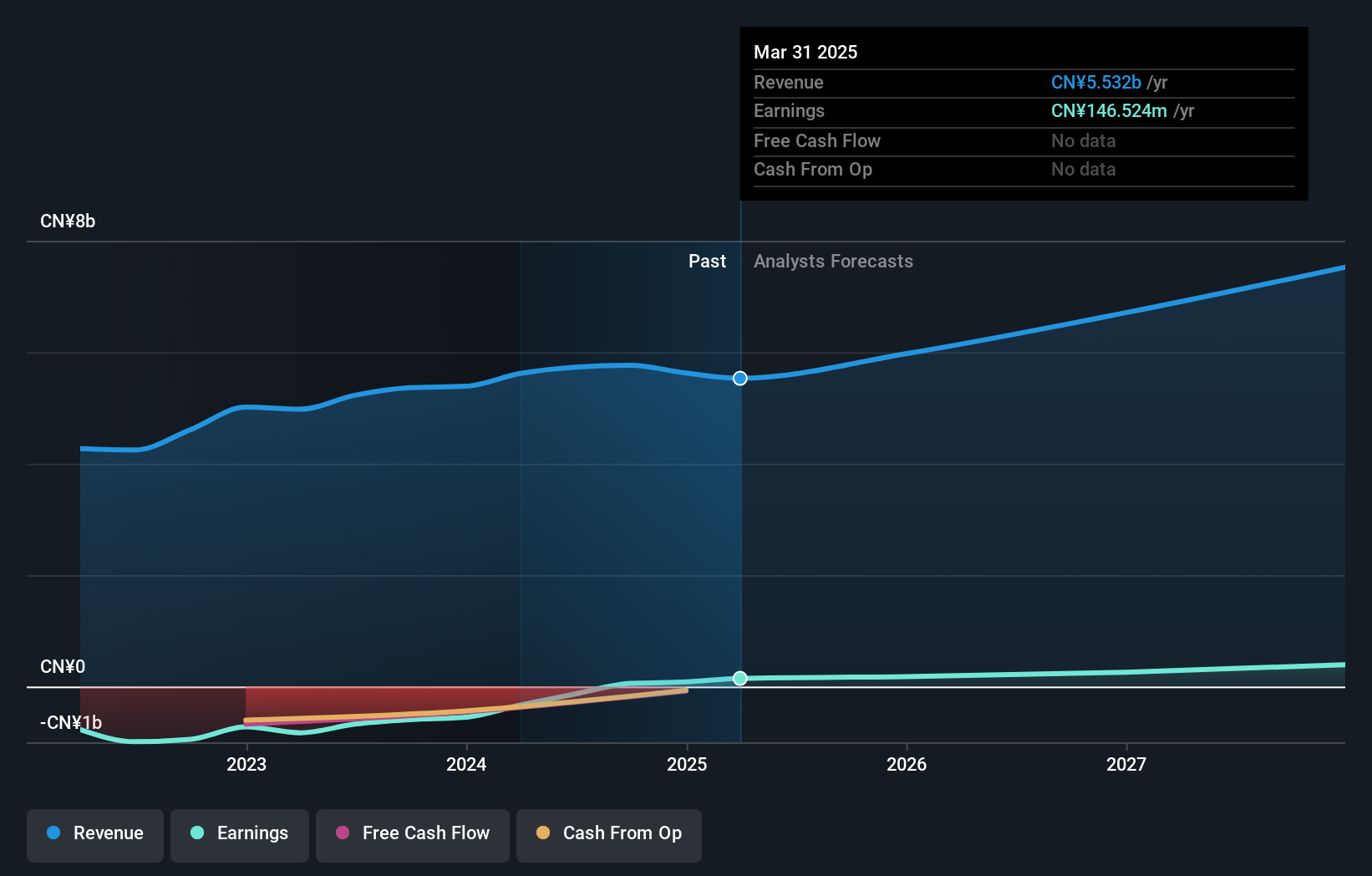

Youdao (DAO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Youdao, Inc. is an internet technology company offering online services in content, community, communication, and commerce in China with a market cap of approximately $1.04 billion.

Operations: The company's revenue is derived from three main segments: Smart Devices (CN¥912.97 million), Learning Services (CN¥2.63 billion), and Online Marketing Services (CN¥1.99 billion).

Insider Ownership: 20.4%

Earnings Growth Forecast: 36.4% p.a.

Youdao's earnings are forecast to grow significantly at 36.43% per year, outpacing the US market's 14.7%. However, its revenue growth of 11.4% per year is slower than the desired 20%, though still above the US average of 9.2%. The company faces challenges with negative shareholder equity and insufficient operating cash flow to cover debt, while recent insider trading activity remains unreported over the past three months.

- Unlock comprehensive insights into our analysis of Youdao stock in this growth report.

- Our valuation report here indicates Youdao may be overvalued.

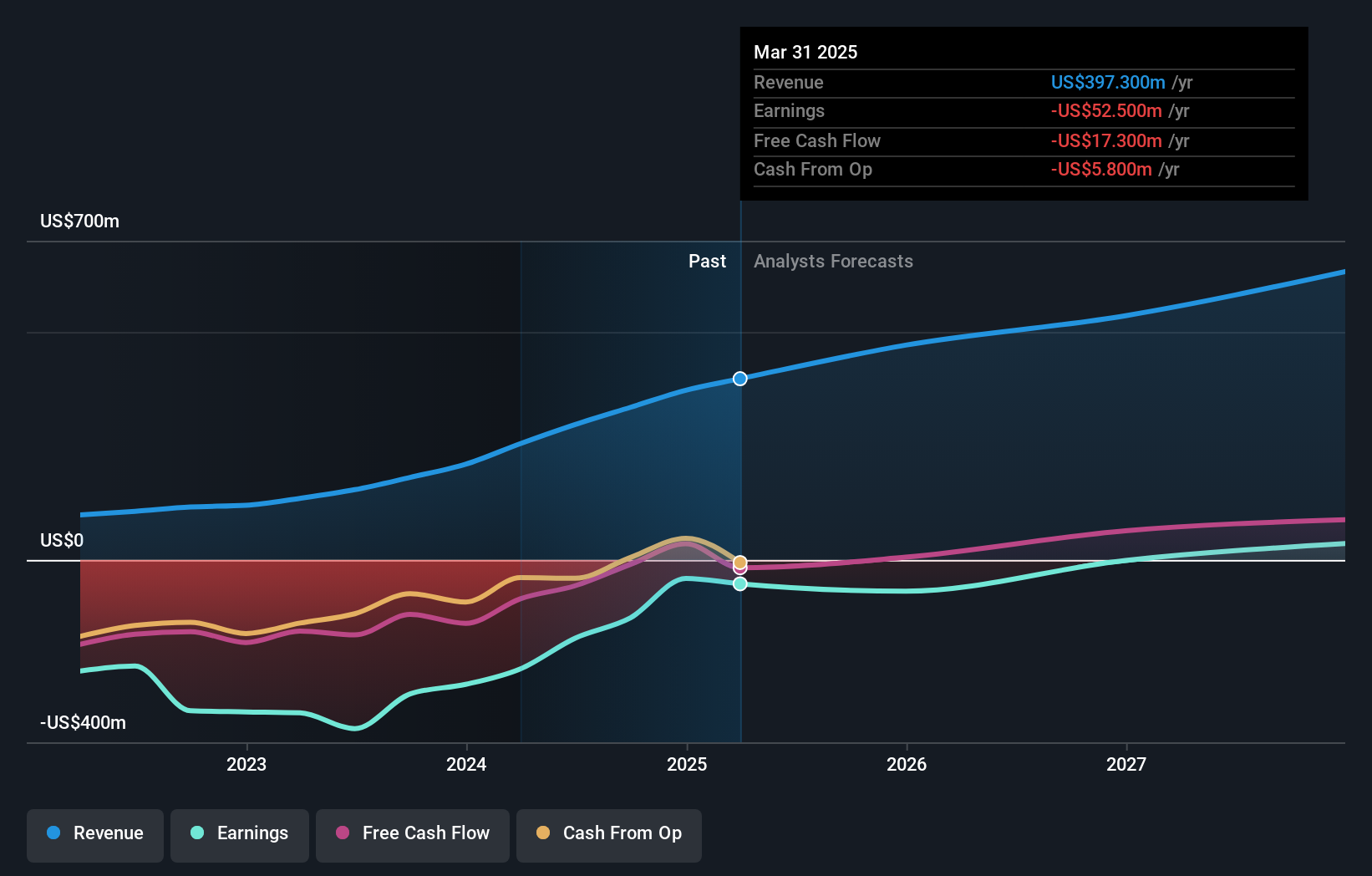

Hippo Holdings (HIPO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hippo Holdings Inc. offers property and casualty insurance products to individuals and businesses in the United States, with a market cap of $637.98 million.

Operations: The company's revenue segments include $48.50 million from Services, $118 million from Insurance-As-A-Service, and $243.20 million from the Hippo Home Insurance Program.

Insider Ownership: 12.8%

Earnings Growth Forecast: 82.5% p.a.

Hippo Holdings is poised for significant growth, with revenue projected to increase by 21.9% annually, surpassing the US market average. The company is expected to become profitable within three years, reflecting robust earnings growth of 82.53% per year. Despite a low forecasted return on equity of 15.7%, Hippo's inclusion in multiple Russell Growth indices highlights its potential appeal among investors focused on high-growth opportunities. Recent insider trading activity remains unreported over the past three months.

- Click to explore a detailed breakdown of our findings in Hippo Holdings' earnings growth report.

- The valuation report we've compiled suggests that Hippo Holdings' current price could be inflated.

Paymentus Holdings (PAY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Paymentus Holdings, Inc. offers cloud-based bill payment technology and solutions both in the United States and internationally, with a market cap of approximately $3.54 billion.

Operations: The company generates revenue primarily from services to financial companies, amounting to $962.11 million.

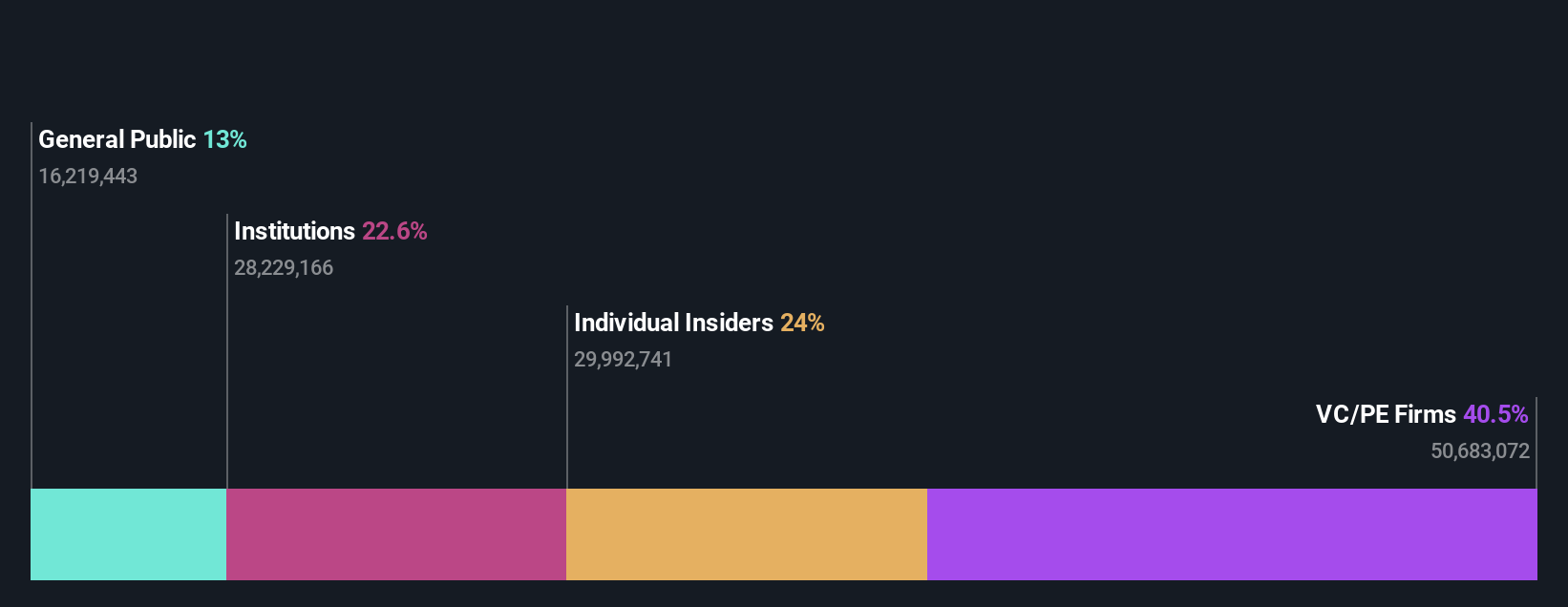

Insider Ownership: 24%

Earnings Growth Forecast: 26.9% p.a.

Paymentus Holdings shows promising growth potential, with earnings expected to grow significantly at 26.95% annually, outpacing the US market average. Despite a low forecasted return on equity of 18.8%, its revenue is anticipated to increase by 18.1% per year. The company reported strong Q1 results, with sales reaching US$275.24 million and net income of US$13.81 million, marking substantial year-over-year growth in both metrics without significant insider trading activity recently noted.

- Take a closer look at Paymentus Holdings' potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Paymentus Holdings is trading beyond its estimated value.

Key Takeaways

- Unlock our comprehensive list of 184 Fast Growing US Companies With High Insider Ownership by clicking here.

- Contemplating Other Strategies? Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10