Asian Growth Companies With High Insider Ownership That Insiders Value

Amid the backdrop of global economic uncertainties and trade tensions, Asian markets are navigating a complex landscape with varying growth prospects. In such an environment, companies with high insider ownership often signal confidence from those closest to the business, suggesting potential resilience and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 60.9% |

| Vuno (KOSDAQ:A338220) | 15.6% | 109.8% |

| Techwing (KOSDAQ:A089030) | 18.8% | 68% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Samyang Foods (KOSE:A003230) | 11.7% | 27.2% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 98.7% |

| Novoray (SHSE:688300) | 23.6% | 28.2% |

| Laopu Gold (SEHK:6181) | 35.5% | 43% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 26.5% |

| Fulin Precision (SZSE:300432) | 13.6% | 43.7% |

Click here to see the full list of 587 stocks from our Fast Growing Asian Companies With High Insider Ownership screener.

We're going to check out a few of the best picks from our screener tool.

Kuaishou Technology (SEHK:1024)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kuaishou Technology is an investment holding company offering live streaming, online marketing, and other services in the People’s Republic of China, with a market cap of HK$340.90 billion.

Operations: The company's revenue segments consist of Domestic operations generating CN¥125.08 billion and Overseas operations contributing CN¥5.02 billion.

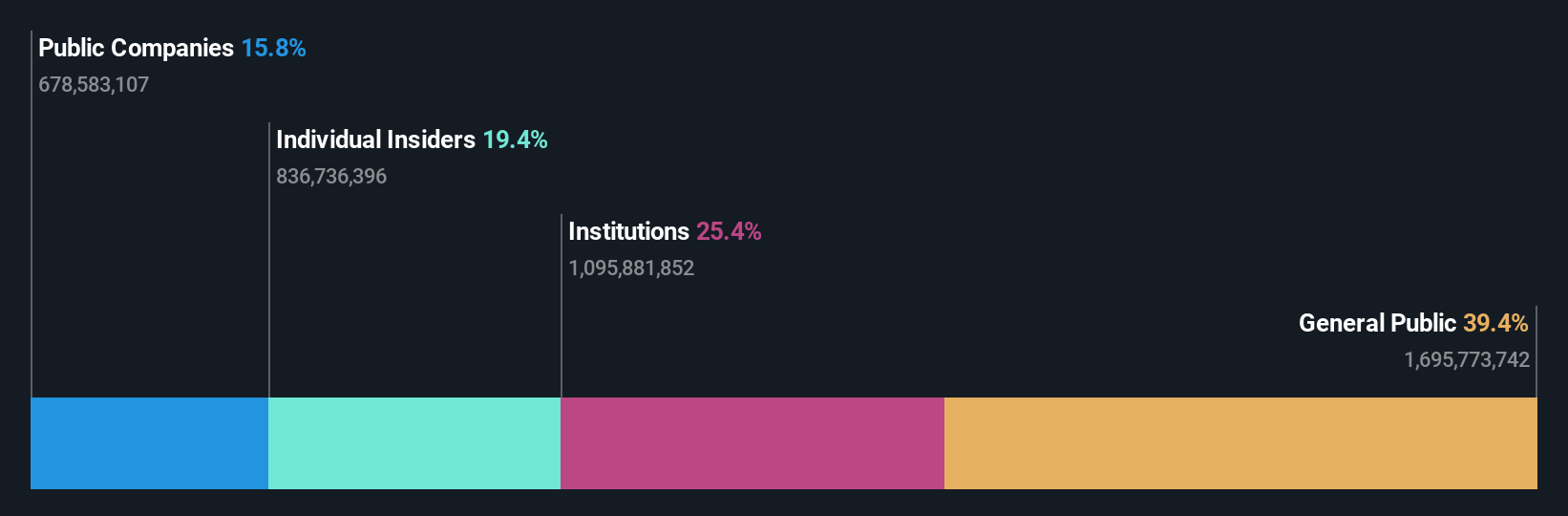

Insider Ownership: 19.4%

Earnings Growth Forecast: 16.7% p.a.

Kuaishou Technology's growth prospects are supported by forecasted earnings growth of 16.7% annually, outpacing the Hong Kong market. Despite a slower revenue growth forecast of 8.5%, its valuation is favorable, trading below fair value and compared to peers. Recent share buybacks totaling HK$5.15 billion suggest confidence in future performance, though recent net income slightly declined year-over-year to CNY 3,978 million from CNY 4,119 million amidst rising sales figures.

- Click here to discover the nuances of Kuaishou Technology with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Kuaishou Technology's share price might be too pessimistic.

Shenzhen Envicool Technology (SZSE:002837)

Simply Wall St Growth Rating: ★★★★★★

Overview: Shenzhen Envicool Technology Co., Ltd. specializes in producing and selling temperature control and energy-saving solutions in China, with a market cap of CN¥39.72 billion.

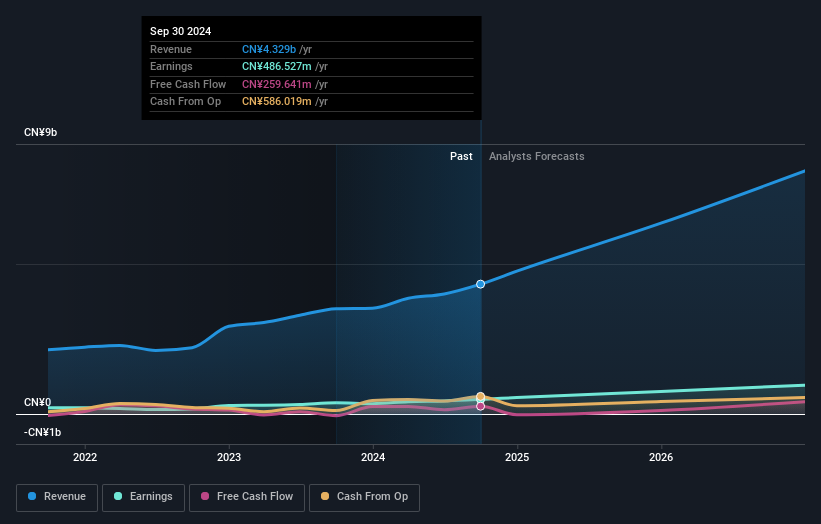

Operations: The company's revenue primarily comes from its Precision Temperature Control Energy Saving Equipment segment, totaling CN¥4.78 billion.

Insider Ownership: 18.3%

Earnings Growth Forecast: 27.7% p.a.

Shenzhen Envicool Technology is poised for significant growth with forecasted earnings and revenue increases of 27.67% and 25.1% per year, respectively, outpacing the Chinese market. Trading at 34.5% below estimated fair value enhances its investment appeal. The company's recent strategic alliance with Green AI to pursue data center infrastructure projects in ASEAN highlights its commitment to innovation in energy-efficient cooling solutions, potentially strengthening its market position and expanding global reach.

- Click to explore a detailed breakdown of our findings in Shenzhen Envicool Technology's earnings growth report.

- Our valuation report here indicates Shenzhen Envicool Technology may be overvalued.

Shenzhen Megmeet Electrical (SZSE:002851)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Megmeet Electrical Co., LTD focuses on the R&D, production, sales, and services of hardware, software, and system solutions for electrical automation in China with a market cap of CN¥34.41 billion.

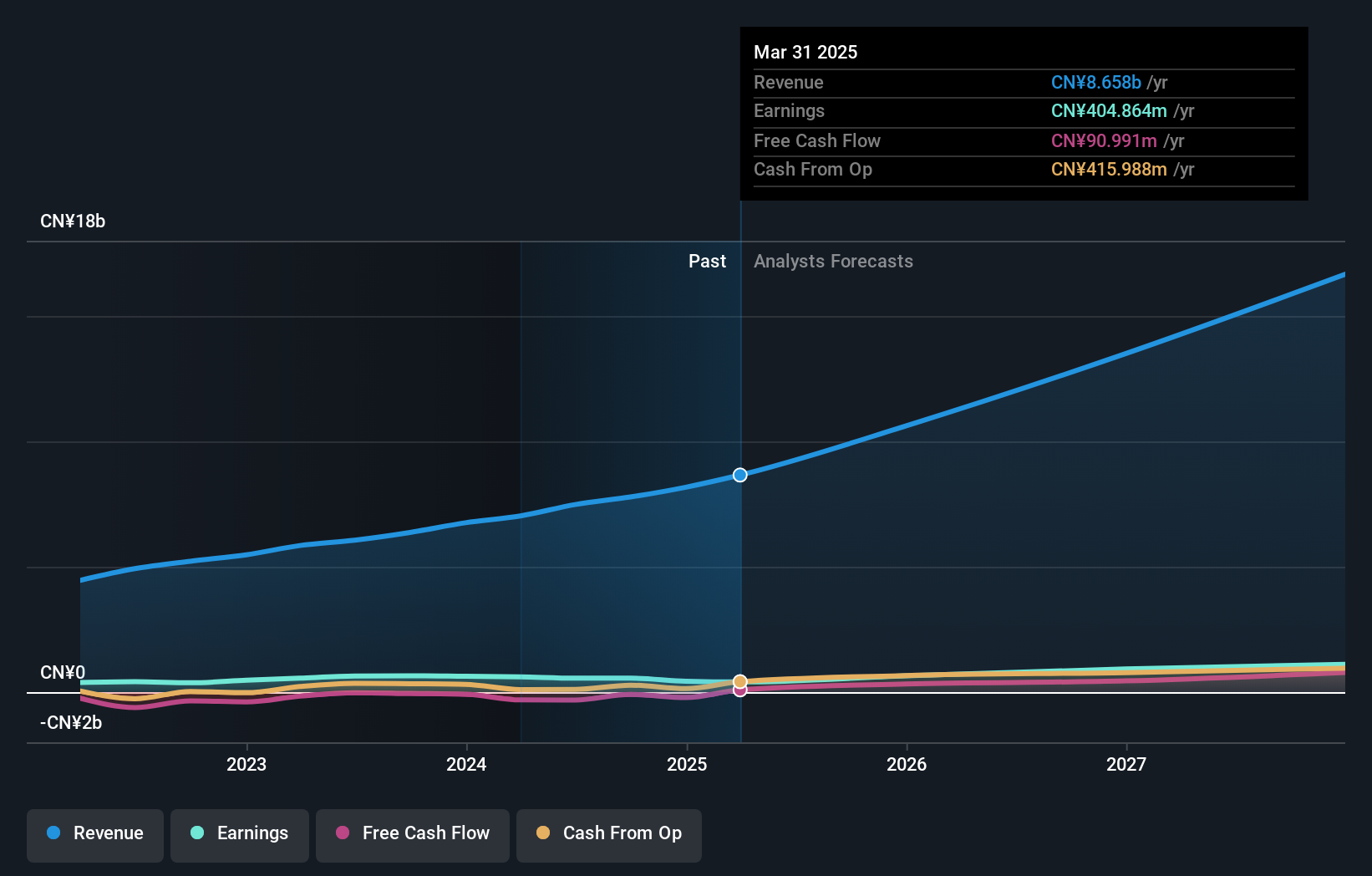

Operations: Shenzhen Megmeet Electrical Co., LTD's revenue is derived from its involvement in the research, development, production, sales, and service of hardware, software, and system solutions for electrical automation in China.

Insider Ownership: 33.2%

Earnings Growth Forecast: 33.7% p.a.

Shenzhen Megmeet Electrical is set for robust growth with earnings and revenue projected to rise by 33.7% and 23.4% annually, surpassing the Chinese market averages. Despite recent profit margin declines from 8.6% to 4.7%, the company's focus on a restricted stock incentive plan suggests an emphasis on aligning management interests with shareholders'. Recent changes in bylaws indicate governance adaptation, while dividend adjustments reflect a strategic allocation of resources amid volatile share price movements.

- Unlock comprehensive insights into our analysis of Shenzhen Megmeet Electrical stock in this growth report.

- Our comprehensive valuation report raises the possibility that Shenzhen Megmeet Electrical is priced higher than what may be justified by its financials.

Where To Now?

- Reveal the 587 hidden gems among our Fast Growing Asian Companies With High Insider Ownership screener with a single click here.

- Curious About Other Options? Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Kuaishou Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10