With EPS Growth And More, EZZ Life Science Holdings (ASX:EZZ) Makes An Interesting Case

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like EZZ Life Science Holdings (ASX:EZZ), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide EZZ Life Science Holdings with the means to add long-term value to shareholders.

Trump has pledged to "unleash" American oil and gas and these 15 US stocks have developments that are poised to benefit.

How Fast Is EZZ Life Science Holdings Growing Its Earnings Per Share?

In the last three years EZZ Life Science Holdings' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. Impressively, EZZ Life Science Holdings' EPS catapulted from AU$0.081 to AU$0.19, over the last year. It's a rarity to see 135% year-on-year growth like that. Shareholders will be hopeful that this is a sign of the company reaching an inflection point.

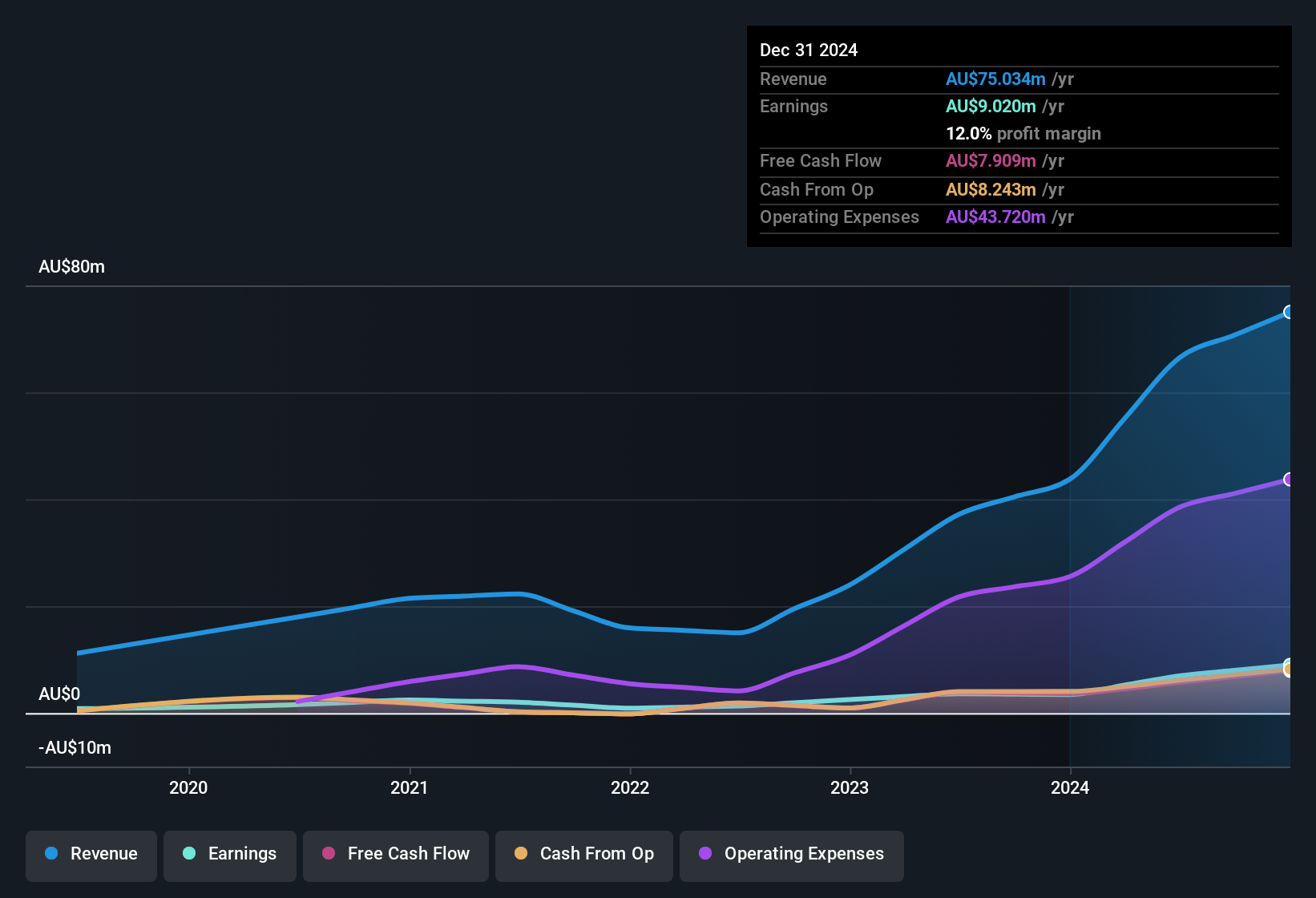

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The music to the ears of EZZ Life Science Holdings shareholders is that EBIT margins have grown from 9.9% to 17% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

See our latest analysis for EZZ Life Science Holdings

Since EZZ Life Science Holdings is no giant, with a market capitalisation of AU$111m, you should definitely check its cash and debt before getting too excited about its prospects.

Are EZZ Life Science Holdings Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

With strong conviction, EZZ Life Science Holdings insiders have stood united by refusing to sell shares over the last year. But the bigger deal is that the Co-founder, Mark Qin, paid AU$246k to buy shares at an average price of AU$2.71. Strong buying like that could be a sign of opportunity.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for EZZ Life Science Holdings will reveal that insiders own a significant piece of the pie. Owning 36% of the company, insiders have plenty riding on the performance of the the share price. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. To give you an idea, the value of insiders' holdings in the business are valued at AU$40m at the current share price. So there's plenty there to keep them focused!

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because EZZ Life Science Holdings' CEO, Qizhou Qin, is paid at a relatively modest level when compared to other CEOs for companies of this size. For companies with market capitalisations under AU$306m, like EZZ Life Science Holdings, the median CEO pay is around AU$444k.

The CEO of EZZ Life Science Holdings only received AU$211k in total compensation for the year ending June 2024. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is EZZ Life Science Holdings Worth Keeping An Eye On?

EZZ Life Science Holdings' earnings per share growth have been climbing higher at an appreciable rate. The icing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest EZZ Life Science Holdings belongs near the top of your watchlist. What about risks? Every company has them, and we've spotted 3 warning signs for EZZ Life Science Holdings (of which 1 doesn't sit too well with us!) you should know about.

The good news is that EZZ Life Science Holdings is not the only stock with insider buying. Here's a list of small cap, undervalued companies in AU with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if EZZ Life Science Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10