Will FactSet’s (FDS) New ESOP Share Plan Reshape Its Long-Term Incentives and Capital Strategy?

- On July 31, 2025, FactSet Research Systems filed a shelf registration to potentially issue up to 500,000 shares of its common stock, a transaction valued at approximately US$204.58 million and specifically related to its Employee Stock Ownership Plan (ESOP).

- This move highlights the company's ongoing commitment to employee ownership while giving it flexibility to raise capital or support compensation initiatives as needed.

- We'll explore how this shelf registration, supporting employee ownership, may alter FactSet's existing investment story and future growth outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

FactSet Research Systems Investment Narrative Recap

To be a shareholder in FactSet Research Systems, you must believe in the company’s ability to drive revenue and earnings growth by advancing its financial technology platform, expanding its customer base, and monetizing new product innovations like GenAI offerings, despite pressure from a challenging environment for the asset management and banking sectors. The recent ESOP-linked shelf registration offers little immediate effect on FactSet’s primary short-term catalyst, which remains the successful integration and monetization of acquisitions such as Irwin and LiquidityBook, while cost pressures from technology investments are the standout risk at this stage.

Among recent announcements, the new US$400 million share buyback program stands out for its relevance. While the shelf registration could modestly increase FactSet’s share count through employee ownership, the ongoing buyback initiative provides a counterbalance, signaling capital discipline and potentially helping offset any dilution, thereby supporting the focus on earnings per share, still a key investor focus amid a rising technology cost base.

By contrast, investors should also be alert to persistent margin risks if technology expenses continue rising and productivity gains fall short...

Read the full narrative on FactSet Research Systems (it's free!)

FactSet Research Systems' outlook points to $2.7 billion in revenue and $724.3 million in earnings by 2028. This is based on a projected 5.7% annual revenue growth rate and an earnings increase of $191.4 million from the current $532.9 million.

Uncover how FactSet Research Systems' forecasts yield a $445.38 fair value, a 12% upside to its current price.

Exploring Other Perspectives

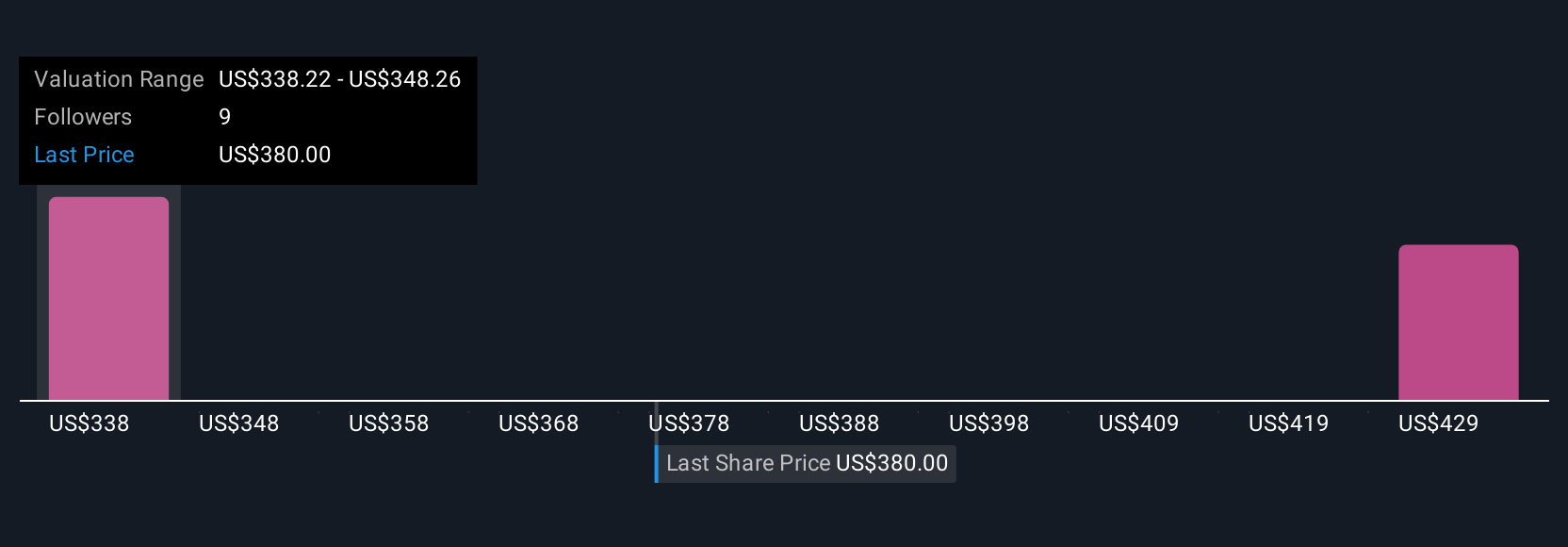

Simply Wall St Community members provided two fair value estimates for FactSet stock, spanning from US$363.48 to US$445.38. These private assessments bookend a wide range and invite you to weigh them against the revenue opportunities and technology cost risks confronting the business today.

Explore 2 other fair value estimates on FactSet Research Systems - why the stock might be worth as much as 12% more than the current price!

Build Your Own FactSet Research Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FactSet Research Systems research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free FactSet Research Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FactSet Research Systems' overall financial health at a glance.

No Opportunity In FactSet Research Systems?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10