Quantum Breakthrough and Federal Support Could Be a Game Changer for Rigetti Computing (RGTI)

- Rigetti Computing recently announced a breakthrough with its Ankaa-3 platform, achieving a 99.5% two-qubit gate fidelity, while federal initiatives like DARPA’s Quantum Benchmark Initiative have increased attention on the quantum computing sector.

- This progress highlights the ongoing competition among quantum computing companies, each leveraging different technologies and government-backed research opportunities to advance the field.

- We'll explore how Rigetti's technical milestone and heightened federal support may influence its long-term investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Rigetti Computing's Investment Narrative?

For anyone considering Rigetti Computing, the foundational belief is in a future where quantum hardware breakthroughs finally translate into commercial value. The latest Ankaa-3 milestone and a jump in the share price after boosted analyst enthusiasm both underscore short-term interest tied to technical progress and growing federal support. Yet, it’s clear that despite this excitement, Rigetti remains unprofitable and isn’t expected to break even in the next three years, a major risk remains that fresh milestones may not translate immediately into revenues or sustainable profitability. The company’s recent $350 million equity raise improves its liquidity position, potentially extending its runway, but this comes after significant shareholder dilution. The sector’s volatility and fast-moving competitors mean these technical achievements may only temporarily shift Rigetti’s risk profile and short-term narrative unless backed by real commercial traction. On the other hand, reliance on further funding remains a reality that investors should be aware of.

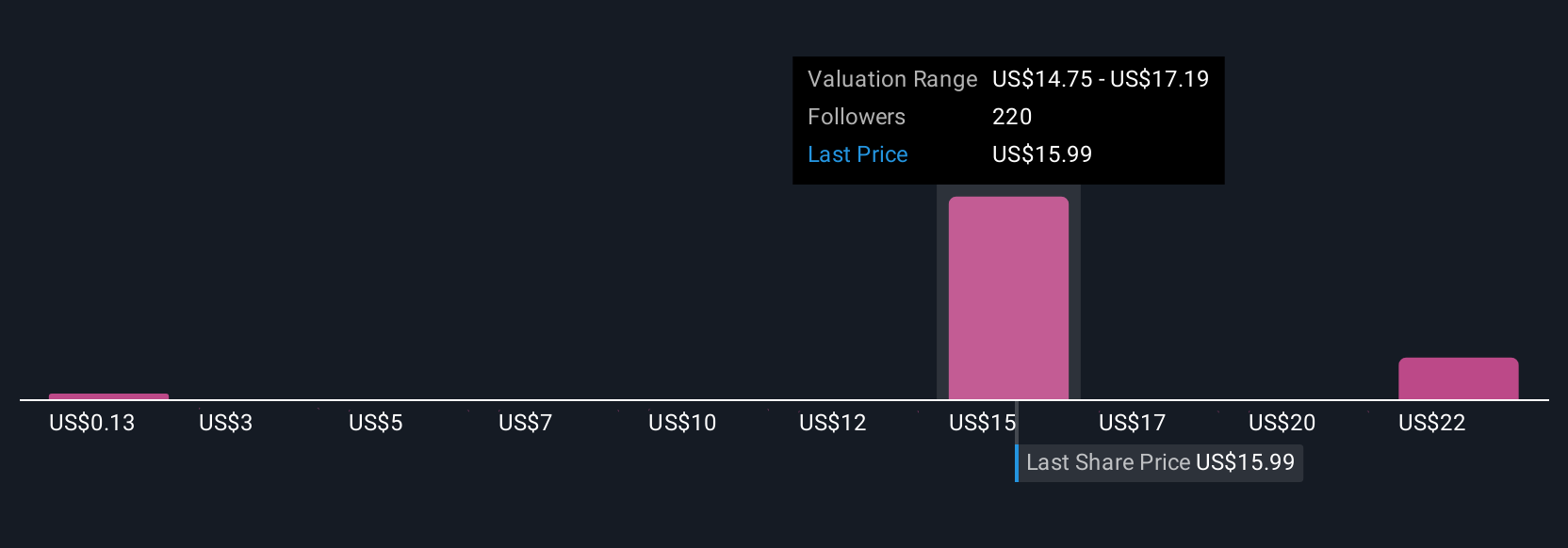

The valuation report we've compiled suggests that Rigetti Computing's current price could be inflated.Exploring Other Perspectives

Explore 31 other fair value estimates on Rigetti Computing - why the stock might be worth less than half the current price!

Build Your Own Rigetti Computing Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rigetti Computing research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Rigetti Computing research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rigetti Computing's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10