Judo Capital Holdings And 2 Other ASX Penny Stocks To Monitor

Amidst the backdrop of global tariff tensions and a subdued Australian market, investors are exploring diverse opportunities to navigate these uncertain times. Penny stocks, though often associated with smaller or newer companies, continue to hold relevance for those seeking potential growth outside the mainstream. This article will examine three such stocks that combine financial strength with promising prospects, offering intriguing possibilities for investors looking beyond conventional options.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.40 | A$114.64M | ✅ 3 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.03 | A$95.76M | ✅ 4 ⚠️ 3 View Analysis > |

| GTN (ASX:GTN) | A$0.365 | A$69.59M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.91 | A$448.67M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.26 | A$2.58B | ✅ 5 ⚠️ 1 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.77 | A$468M | ✅ 4 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.95 | A$991.86M | ✅ 4 ⚠️ 2 View Analysis > |

| Sugar Terminals (NSX:SUG) | A$0.99 | A$360M | ✅ 2 ⚠️ 2 View Analysis > |

| Austco Healthcare (ASX:AHC) | A$0.385 | A$140.26M | ✅ 4 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.855 | A$149.41M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 459 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Judo Capital Holdings (ASX:JDO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Judo Capital Holdings Limited, with a market cap of A$1.74 billion, provides a range of banking products and services specifically tailored for small and medium businesses in Australia through its subsidiaries.

Operations: The company generates revenue of A$325.5 million from its banking operations, focusing on products and services for small and medium enterprises in Australia.

Market Cap: A$1.74B

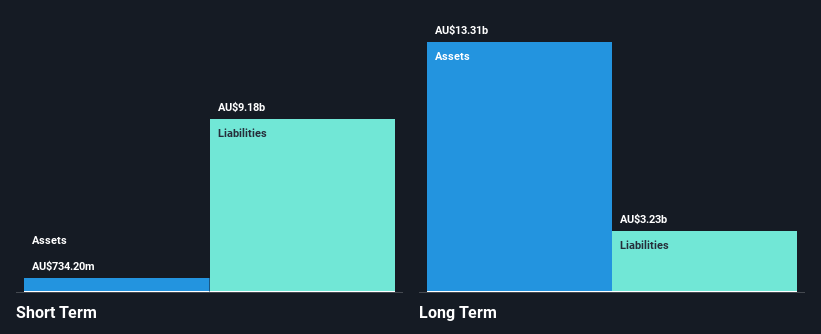

Judo Capital Holdings Limited, with a market cap of A$1.74 billion, focuses on banking services for small and medium enterprises in Australia. The company has a robust allowance for bad loans at 111% and maintains an appropriate Loans to Assets ratio of 82%. However, its Return on Equity is low at 4%, and earnings growth has been negative over the past year despite having high-quality earnings. The management team and board are experienced with average tenures of 3.5 years and 4.8 years respectively. Judo's shares trade at a discount to estimated fair value by approximately 25.8%.

- Click to explore a detailed breakdown of our findings in Judo Capital Holdings' financial health report.

- Review our growth performance report to gain insights into Judo Capital Holdings' future.

LGI (ASX:LGI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: LGI Limited specializes in carbon abatement and renewable energy solutions using biogas from landfill, with a market cap of A$310.83 million.

Operations: The company's revenue is derived from Carbon Abatement (A$17.03 million), Renewable Energy (A$15.05 million), and Infrastructure Construction and Management (A$2.21 million).

Market Cap: A$310.83M

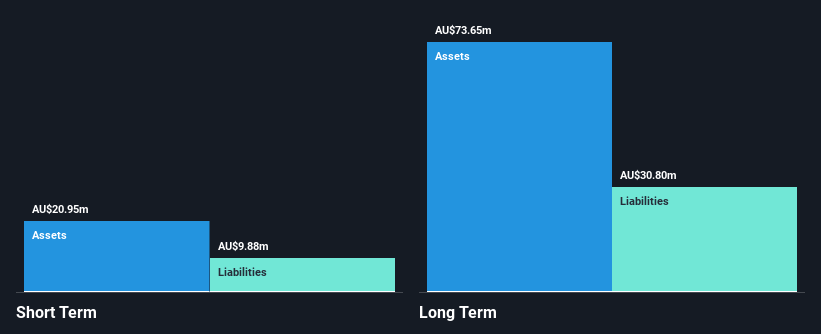

LGI Limited, with a market cap of A$310.83 million, derives revenue from carbon abatement and renewable energy solutions. Despite significant earnings growth over the past five years, recent negative earnings growth (-15.3%) poses challenges against industry averages. The company's short-term assets (A$20.9M) comfortably cover its short-term liabilities (A$9.9M), but not its long-term obligations (A$30.8M). Debt management is prudent, evidenced by a reduced debt-to-equity ratio now at 46.2% and satisfactory net debt to equity of 14.9%. However, the management team's inexperience could be a concern for potential investors evaluating stability and strategic direction.

- Jump into the full analysis health report here for a deeper understanding of LGI.

- Explore LGI's analyst forecasts in our growth report.

Michael Hill International (ASX:MHJ)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Michael Hill International Limited operates jewelry stores and offers related services across Australia, New Zealand, and Canada, with a market cap of A$161.62 million.

Operations: The company generated revenue of A$644.09 million from its jewelry retail operations in Australia, New Zealand, and Canada.

Market Cap: A$161.62M

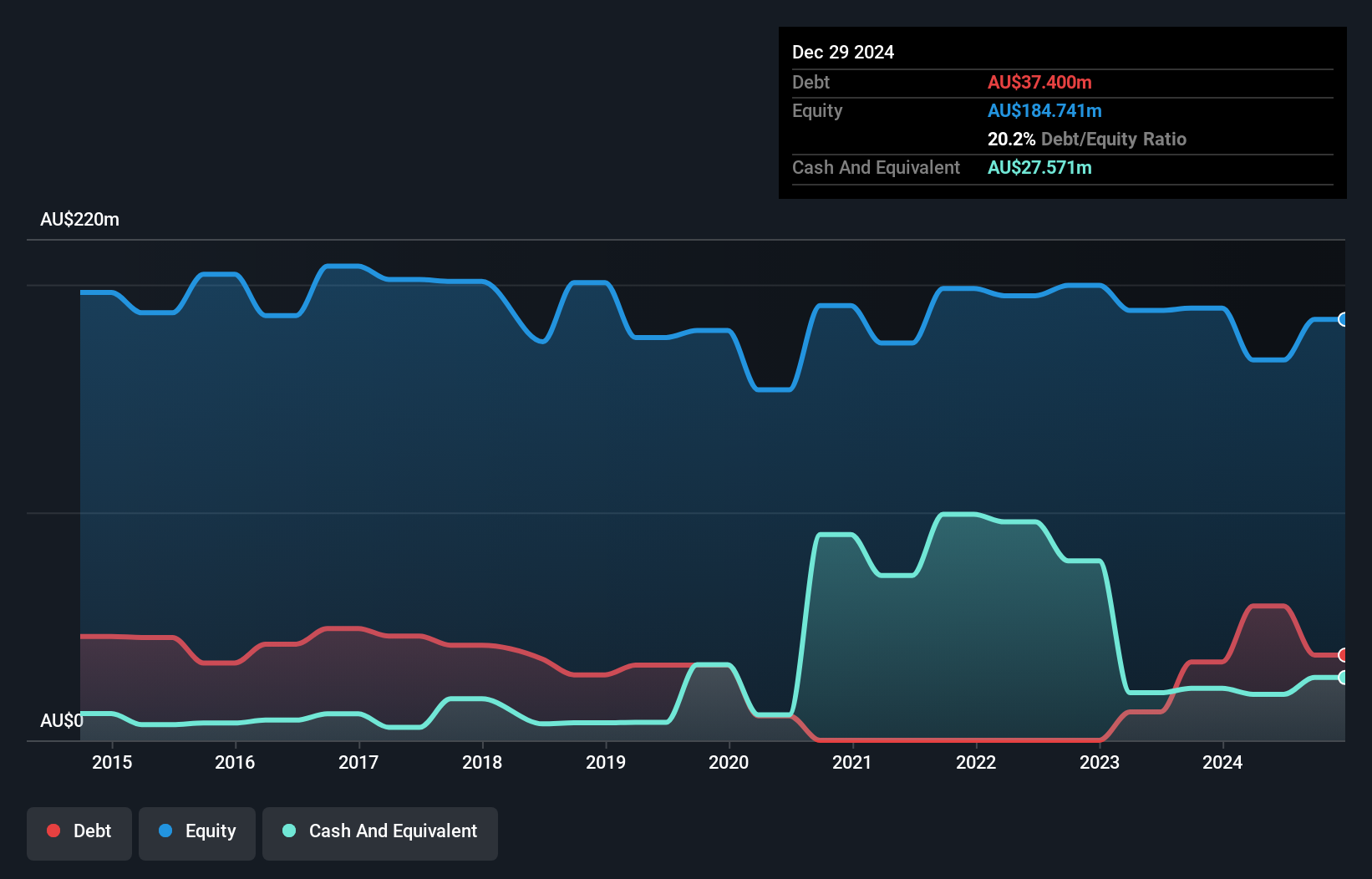

Michael Hill International, with a market cap of A$161.62 million, operates across Australia, New Zealand, and Canada. Despite generating significant revenue of A$644.09 million, the company faces challenges with declining profit margins (currently 0.2%) and negative earnings growth (-92.5%) over the past year. While its short-term assets exceed both short- and long-term liabilities, interest coverage is weak at 1.7 times EBIT. The company's debt is well-covered by operating cash flow (196.3%), but recent leadership changes due to the passing of founder Sir Michael Hill may impact strategic direction moving forward.

- Click here and access our complete financial health analysis report to understand the dynamics of Michael Hill International.

- Gain insights into Michael Hill International's outlook and expected performance with our report on the company's earnings estimates.

Summing It All Up

- Click through to start exploring the rest of the 456 ASX Penny Stocks now.

- Curious About Other Options? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10