Earnings Tell The Story For China East Education Holdings Limited (HKG:667) As Its Stock Soars 26%

Despite an already strong run, China East Education Holdings Limited (HKG:667) shares have been powering on, with a gain of 26% in the last thirty days. The last month tops off a massive increase of 234% in the last year.

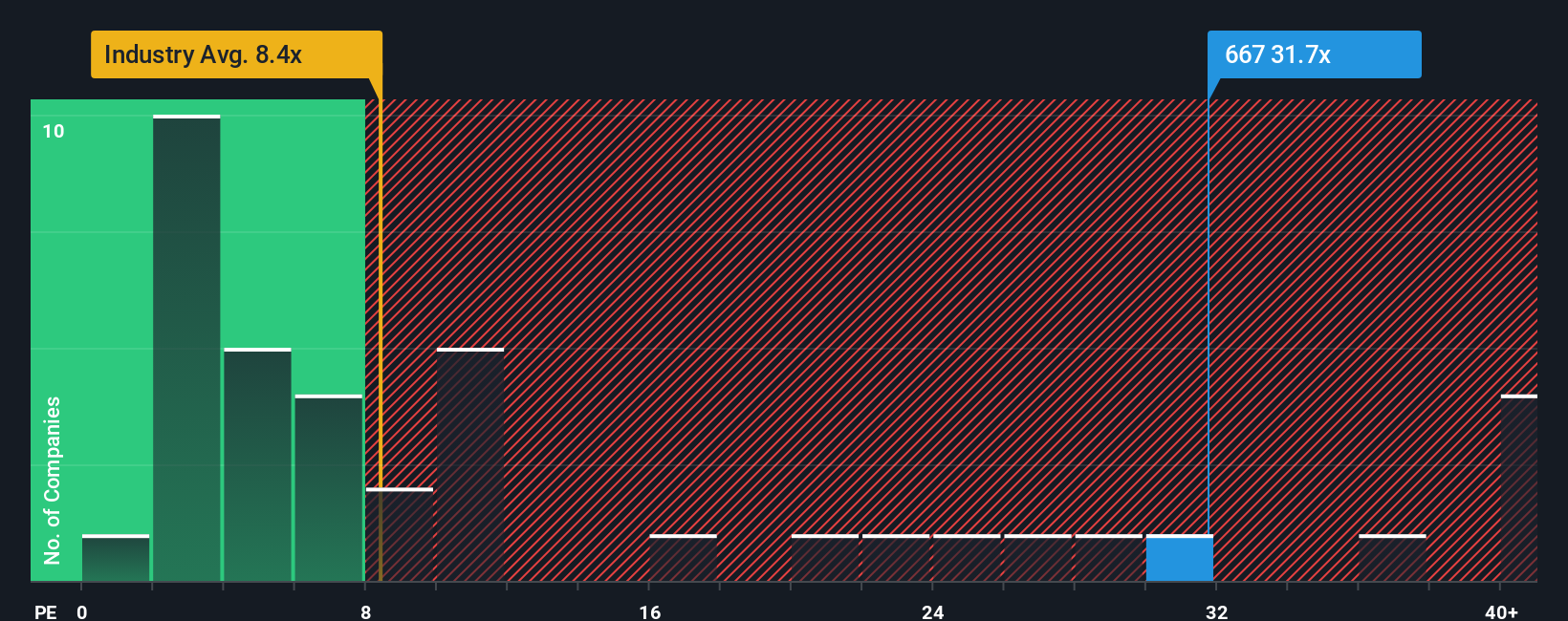

Since its price has surged higher, China East Education Holdings' price-to-earnings (or "P/E") ratio of 31.7x might make it look like a strong sell right now compared to the market in Hong Kong, where around half of the companies have P/E ratios below 11x and even P/E's below 7x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

This technology could replace computers: discover the 20 stocks are working to make quantum computing a reality.

With earnings growth that's superior to most other companies of late, China East Education Holdings has been doing relatively well. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for China East Education Holdings

Does Growth Match The High P/E?

China East Education Holdings' P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered an exceptional 88% gain to the company's bottom line. Pleasingly, EPS has also lifted 69% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the eleven analysts covering the company suggest earnings should grow by 18% per year over the next three years. Meanwhile, the rest of the market is forecast to only expand by 15% each year, which is noticeably less attractive.

In light of this, it's understandable that China East Education Holdings' P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

China East Education Holdings' P/E is flying high just like its stock has during the last month. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that China East Education Holdings maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 1 warning sign for China East Education Holdings that you should be aware of.

If these risks are making you reconsider your opinion on China East Education Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10