3 Stocks Estimated To Be Trading Up To 30.3% Below Intrinsic Value

As the U.S. stock market faces volatility with recent declines driven by tariff concerns and a weaker-than-expected jobs report, investors are looking for opportunities amidst uncertainty. In such an environment, identifying stocks trading below their intrinsic value can provide a strategic advantage, offering potential upside as market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Valley National Bancorp (VLY) | $9.27 | $18.29 | 49.3% |

| TAL Education Group (TAL) | $10.94 | $21.54 | 49.2% |

| RXO (RXO) | $15.45 | $29.92 | 48.4% |

| Repligen (RGEN) | $117.07 | $228.57 | 48.8% |

| Pennant Group (PNTG) | $22.17 | $44.18 | 49.8% |

| Horizon Bancorp (HBNC) | $15.49 | $29.92 | 48.2% |

| Freshpet (FRPT) | $68.32 | $133.22 | 48.7% |

| Camden National (CAC) | $37.71 | $72.85 | 48.2% |

| BioLife Solutions (BLFS) | $21.26 | $42.20 | 49.6% |

| AGNC Investment (AGNC) | $9.43 | $18.47 | 48.9% |

Click here to see the full list of 175 stocks from our Undervalued US Stocks Based On Cash Flows screener.

Here we highlight a subset of our preferred stocks from the screener.

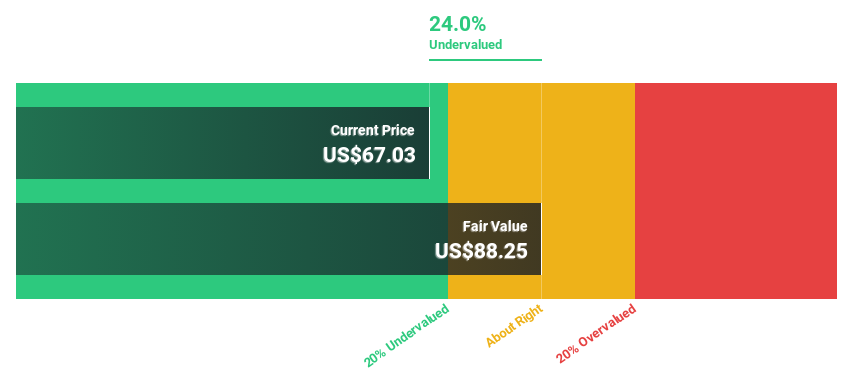

Blackbaud (BLKB)

Overview: Blackbaud, Inc. provides cloud software and services both in the United States and internationally, with a market cap of approximately $3.42 billion.

Operations: The company's revenue is primarily derived from its Software & Programming segment, which generated $1.14 billion.

Estimated Discount To Fair Value: 28.6%

Blackbaud is trading at US$67.42, below its estimated fair value of US$94.37, suggesting it may be undervalued based on cash flows. Despite a high debt level and slower revenue growth forecast (3.6% annually), the company raised its 2025 financial guidance with expected GAAP revenue of up to US$1.13 billion. Recent strategic integrations and product enhancements aim to boost digital engagement in the social impact sector, potentially improving future cash flows and profitability prospects over the next three years.

- In light of our recent growth report, it seems possible that Blackbaud's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Blackbaud's balance sheet health report.

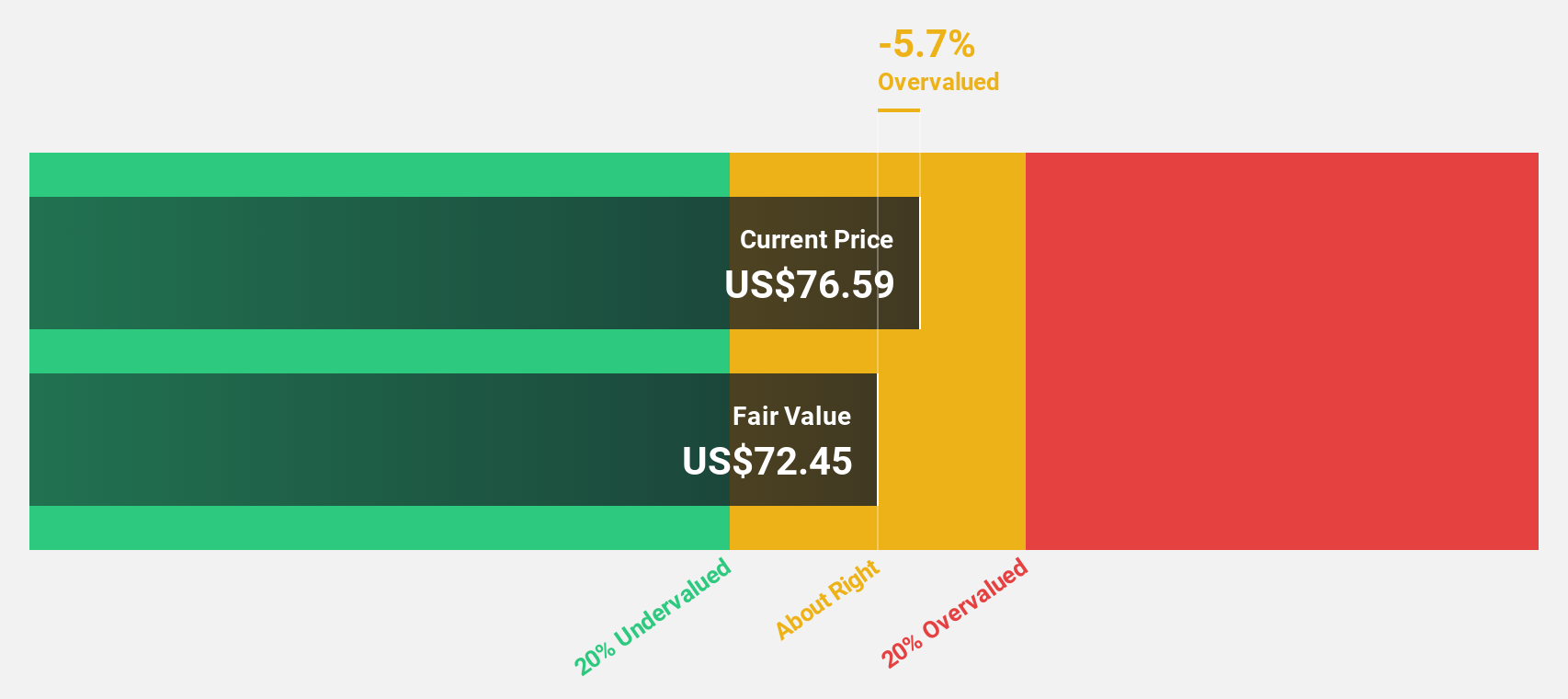

Silicon Motion Technology (SIMO)

Overview: Silicon Motion Technology Corporation designs, develops, and markets NAND flash controllers for solid-state storage devices globally, with a market cap of $2.60 billion.

Operations: Silicon Motion Technology Corporation generates revenue from designing and marketing NAND flash controllers used in solid-state storage devices across various international markets, including Taiwan, the United States, Korea, China, Malaysia, and Singapore.

Estimated Discount To Fair Value: 25.4%

Silicon Motion Technology, trading at US$76.54, is below its fair value estimate of US$102.62, reflecting potential undervaluation based on cash flows. Despite a dip in recent earnings and sales compared to last year, revenue is projected to grow faster than the US market at 13.4% annually with significant earnings growth expected over the next three years. Recent strategic leadership additions and product innovations in AI smart cockpits may enhance long-term business prospects despite current dividend coverage concerns.

- Upon reviewing our latest growth report, Silicon Motion Technology's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Silicon Motion Technology with our detailed financial health report.

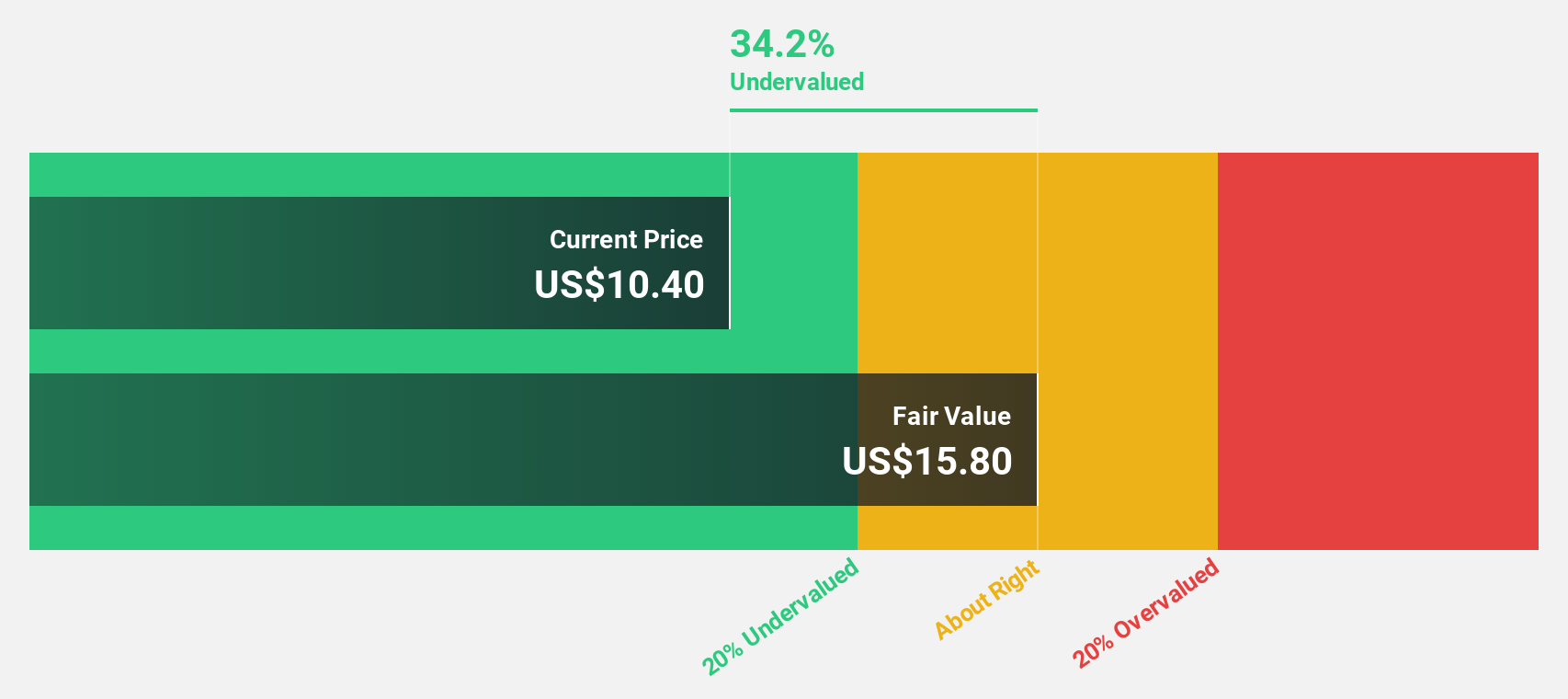

Genius Sports (GENI)

Overview: Genius Sports Limited develops and sells technology-driven products and services for the sports, sports betting, and sports media industries, with a market cap of approximately $2.65 billion.

Operations: The company's revenue is primarily derived from its data processing segment, which generated $535.17 million.

Estimated Discount To Fair Value: 30.3%

Genius Sports, trading at US$11.25, is considered undervalued with a fair value estimate of US$16.13. The company has secured exclusive data rights for European football leagues and extended its NFL partnership, enhancing its strategic position in sports data and betting markets. Revenue is forecast to grow 14.2% annually, outpacing the broader US market growth rate of 9.1%. Despite current losses, Genius Sports is expected to achieve profitability within three years.

- Our comprehensive growth report raises the possibility that Genius Sports is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Genius Sports.

Summing It All Up

- Navigate through the entire inventory of 175 Undervalued US Stocks Based On Cash Flows here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10