Discovering US Market's Undiscovered Gems in August 2025

In August 2025, the U.S. market is experiencing volatility as investors react to President Trump's tariff announcements and a weaker-than-expected jobs report, causing significant declines in major indices like the Dow Jones and S&P 500. Despite this turbulence, small-cap stocks within the S&P 600 may present unique opportunities for investors seeking potential growth in overlooked sectors, especially when evaluating companies with strong fundamentals and resilience in challenging economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Southern Michigan Bancorp | 117.38% | 8.87% | 4.89% | ★★★★★★ |

| Oakworth Capital | 87.50% | 15.82% | 9.79% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 12.79% | -0.59% | ★★★★★★ |

| Sound Financial Bancorp | 34.70% | 2.11% | -11.08% | ★★★★★★ |

| Wilson Bank Holding | 0.00% | 7.88% | 8.09% | ★★★★★★ |

| FineMark Holdings | 115.14% | 2.22% | -28.34% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| Gulf Island Fabrication | 19.65% | -2.17% | 42.26% | ★★★★★☆ |

| Rich Sparkle Holdings | 26.73% | -6.13% | 1.75% | ★★★★★☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

Click here to see the full list of 297 stocks from our US Undiscovered Gems With Strong Fundamentals screener.

Let's dive into some prime choices out of from the screener.

NVE (NVEC)

Simply Wall St Value Rating: ★★★★★★

Overview: NVE Corporation specializes in developing and selling spintronics-based devices for information acquisition, storage, and transmission, with a market capitalization of $307.50 million.

Operations: The company generates revenue primarily from its electronic components and parts segment, which reported $25.20 million in sales.

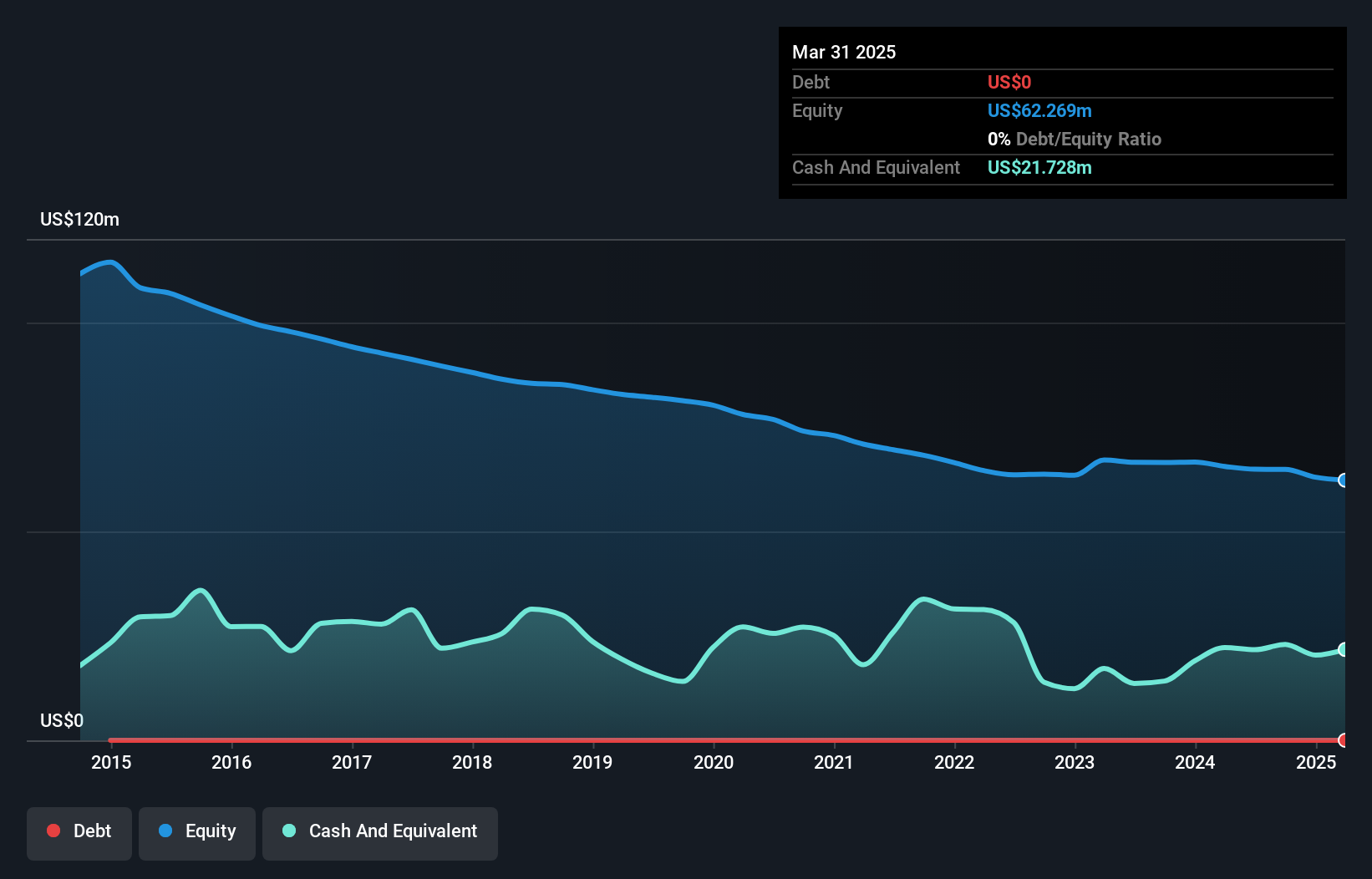

NVE Corporation, a compact yet intriguing player in the semiconductor space, recently reported a revenue of US$6.1 million for Q1 2025, down from US$6.78 million the previous year. Despite this dip and a negative earnings growth of -13.5%, its price-to-earnings ratio stands at 21.1x, which is below the industry average of 29.7x, suggesting potential value for investors seeking opportunities in this sector. The company continues to operate debt-free and boasts high-quality earnings while maintaining positive free cash flow over time, reinforcing its stable financial footing amidst industry challenges.

- Delve into the full analysis health report here for a deeper understanding of NVE.

Learn about NVE's historical performance.

First Bancorp (FNLC)

Simply Wall St Value Rating: ★★★★★★

Overview: The First Bancorp, Inc. is a bank holding company for First National Bank, offering various banking products and services to individual and corporate clients, with a market cap of $283.62 million.

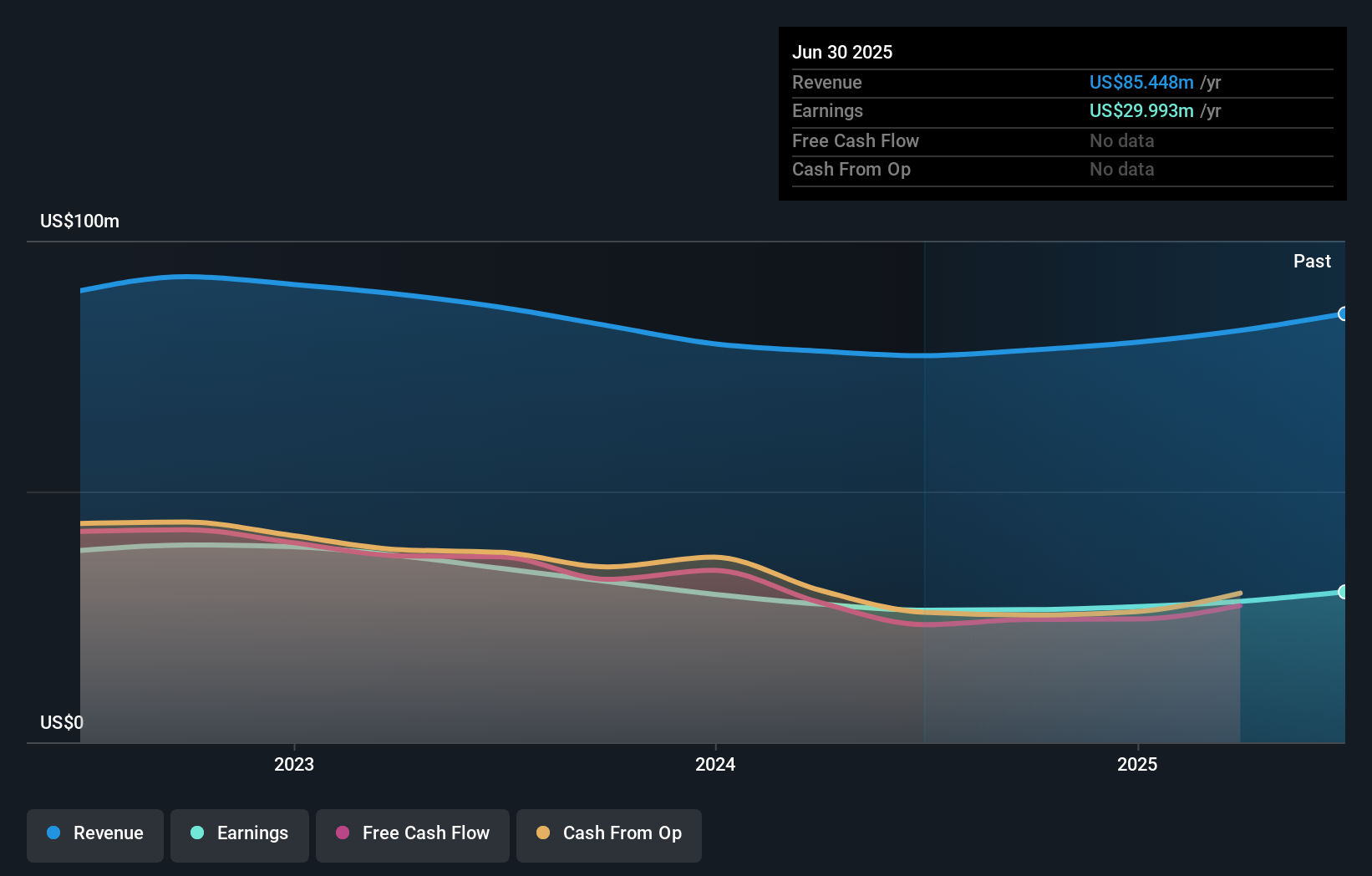

Operations: First Bancorp generates revenue primarily from its banking operations, amounting to $85.45 million. The company's net profit margin reflects its profitability dynamics over time.

First Bancorp, with its total assets of US$3.2 billion and equity of US$265.5 million, stands out for its solid financial footing. The bank's deposits amount to US$2.7 billion, while loans tally up to US$2.4 billion, indicating a robust lending operation backed by a net interest margin of 2.3%. Its allowance for bad loans is sufficient at 0.3% of total loans, reflecting prudent risk management practices in place. Recent earnings reports show net income rose to US$8 million from last year's US$6 million in the second quarter, highlighting improved profitability alongside a dividend increase to 37 cents per share this quarter.

- Dive into the specifics of First Bancorp here with our thorough health report.

Review our historical performance report to gain insights into First Bancorp's's past performance.

Genie Energy (GNE)

Simply Wall St Value Rating: ★★★★★★

Overview: Genie Energy Ltd., with a market cap of $540.67 million, operates through its subsidiaries to provide energy services both in the United States and internationally.

Operations: Genie Energy's revenue primarily comes from its Genie Retail Energy segment, generating $423.35 million, while Genie Renewables contributes $18.97 million.

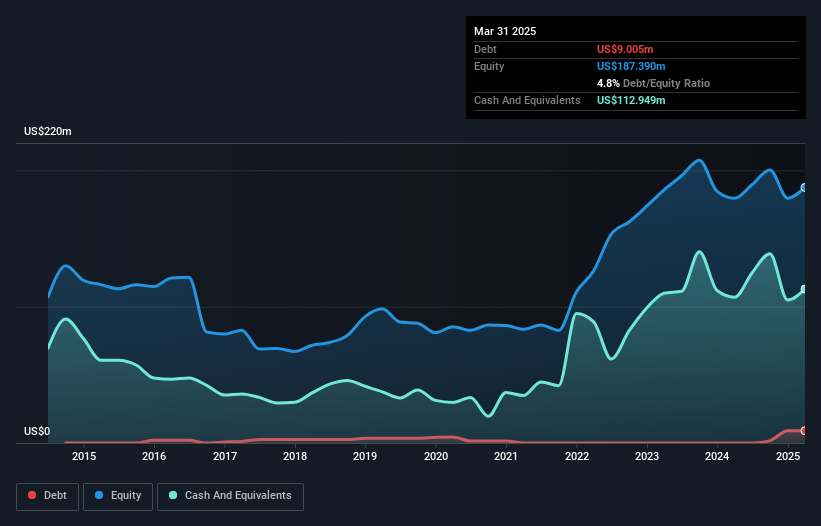

Genie Energy, a dynamic player in the energy sector, has demonstrated impressive financial resilience. With cash exceeding total debt and high-quality earnings, its interest payments are well-covered. Over the past year, Genie reported an earnings growth of 79%, significantly outpacing the Electric Utilities industry's 6.7% growth rate. The company is trading at a substantial discount of 67% below its estimated fair value. Despite being dropped from the Russell 2000 Dynamic Index recently and undergoing auditor changes, Genie continues to focus on strategic expansions and renewable investments to drive future opportunities in California and Kentucky.

- Genie Energy's strategic expansion into new markets and diversified energy portfolio aim to foster sustainable growth—click here to explore the full narrative.

Summing It All Up

- Access the full spectrum of 297 US Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10