Are Exelixis’s (EXEL) Share Buybacks a Vote of Confidence or a Shift in Strategy?

- Earlier this week, Exelixis released its second quarter 2025 results, disclosed total revenue of US$568.26 million for the quarter, reaffirmed full-year earnings guidance, and announced the completion of buybacks totaling 5.06% of shares outstanding across two repurchase programs.

- Despite quarterly revenue falling year over year, net income and earnings per share improved for the first half, while the company's buyback activity signals management's commitment to shareholder returns.

- We’ll explore how reaffirmed guidance and the conclusion of sizable share repurchases could influence Exelixis’s long-term investment outlook.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Exelixis Investment Narrative Recap

To hold Exelixis shares, you have to believe in the company’s ability to extend its success beyond dependence on CABOMETYX, particularly as it faces potential market changes and competition. This quarter’s results and reaffirmed guidance do not materially alter the most important short-term catalyst, the continued uptake of CABOMETYX in new oncology indications, nor do they reduce the biggest risk: overreliance on this one drug despite pipeline progress.

The recent completion of share buybacks covering over 5% of outstanding shares is the standout announcement, returning capital to investors while underscoring management’s confidence amid ongoing revenue pressures. However, for those focused on growth, these buybacks may not address concerns around future revenue sources as the product mix remains highly concentrated.

On the other hand, investors should be aware that even as buybacks support per-share metrics, the risk of future revenue pressure from ...

Read the full narrative on Exelixis (it's free!)

Exelixis' outlook forecasts $3.1 billion in revenue and $1.2 billion in earnings by 2028. This scenario implies a 12.0% annual revenue growth rate and an earnings increase of about $598 million from the current $602.3 million.

Uncover how Exelixis' forecasts yield a $45.37 fair value, a 22% upside to its current price.

Exploring Other Perspectives

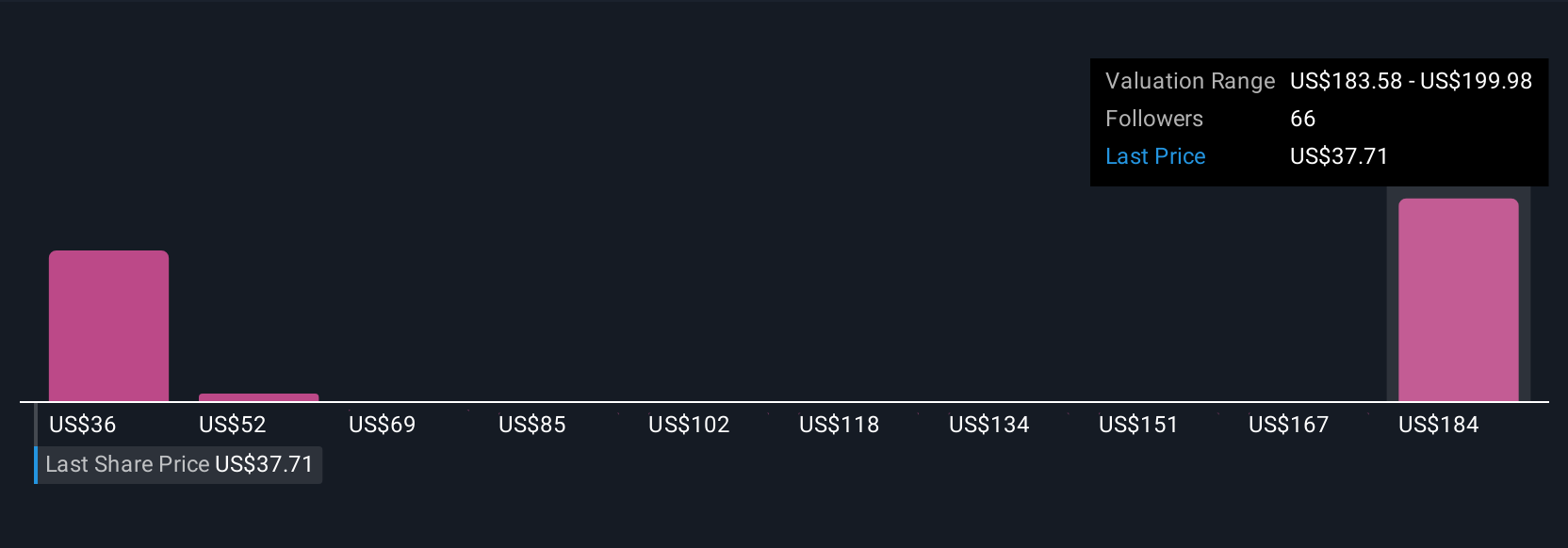

Eight members of the Simply Wall St Community estimate Exelixis’s fair value anywhere from US$36.07 to US$215.68 per share. As debate continues about long-term revenue diversification beyond CABOMETYX, consider how varied outlooks can influence your own expectations and research.

Explore 8 other fair value estimates on Exelixis - why the stock might be worth just $36.07!

Build Your Own Exelixis Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Exelixis research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Exelixis research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Exelixis' overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 21 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 18 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exelixis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10