How Weaker Results and Leadership Shifts at Healthcare Realty Trust (HR) May Alter Its Investment Story

- Earlier this week, Healthcare Realty Trust reported financial results for the half year ended June 30, 2025, revealing weaker sales of US$287.07 million, net losses of US$157.85 million, and a basic loss per share of US$0.45 from continuing operations, along with lowered full-year earnings guidance, increased real estate asset impairments, extended debt maturities, and a board-approved dividend of US$0.24 per share.

- The addition of two senior asset management executives and the company’s effort to reduce near-term debt maturities mark responses to operational and leadership challenges during a period of increased losses and revised guidance.

- We'll examine how the lowered earnings outlook and operational changes could influence Healthcare Realty Trust’s longer-term investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Healthcare Realty Trust Investment Narrative Recap

To be a long-term shareholder in Healthcare Realty Trust, you need confidence in the company’s ability to manage debt and stabilize net operating income as it faces sector headwinds and recent operational setbacks. The latest results, featuring lowered earnings guidance and growing impairments, intensify focus on execution, and although short-term catalysts like capital recycling and occupancy improvements remain core, the outlook downgrade is material and amplifies earnings risks in the near term.

Among the recent announcements, the extension of the US$1.5 billion revolving credit facility and the reduction of near-term loan maturities stand out as particularly relevant. This move eases immediate refinancing pressures and could give management more time to prioritize operational recovery, which is highly pertinent as cost of capital concerns weigh on future earnings and the company’s ability to support distributions.

Yet, despite these steps, investors must contrast that with the rising risk that continued asset sales or tenant troubles could put further pressure on cash flows and occupancy...

Read the full narrative on Healthcare Realty Trust (it's free!)

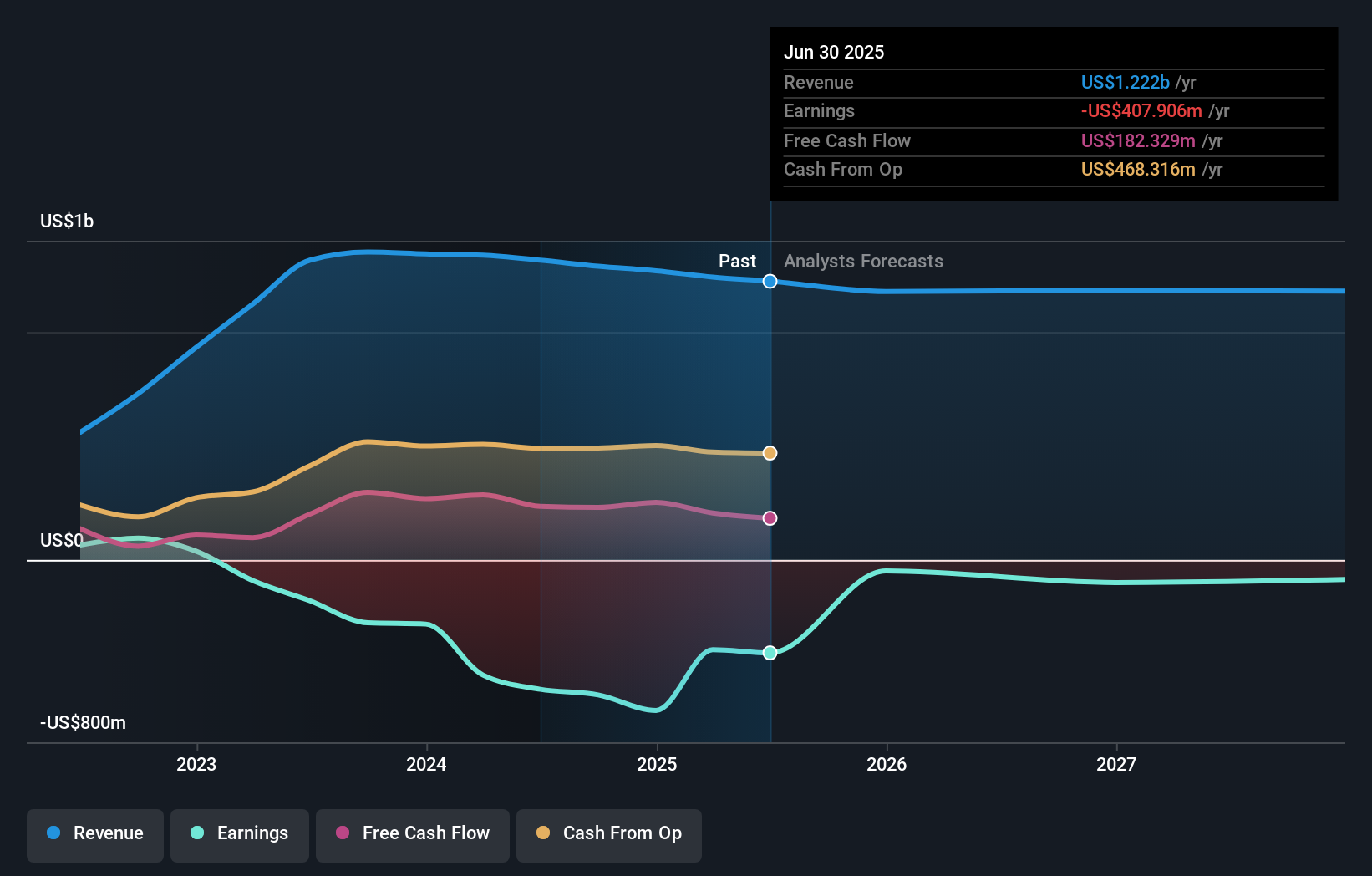

Healthcare Realty Trust's outlook points to $1.2 billion in revenue and $261.1 million in earnings by 2028. This is based on analysts' expectations for revenue to decline by 1.5% per year and a swing from current earnings of -$394.4 million to $261.1 million, a $655.5 million increase.

Uncover how Healthcare Realty Trust's forecasts yield a $16.88 fair value, in line with its current price.

Exploring Other Perspectives

Fair value estimates from two Simply Wall St Community members range widely between US$16.88 and US$42.39 per share. Even as some see deeper value, the company’s revised earnings guidance reminds you that short-term profitability remains uncertain, encouraging you to consider multiple viewpoints before making decisions.

Explore 2 other fair value estimates on Healthcare Realty Trust - why the stock might be worth over 2x more than the current price!

Build Your Own Healthcare Realty Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Healthcare Realty Trust research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Healthcare Realty Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Healthcare Realty Trust's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 21 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Healthcare Realty Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10