Did Lowered Earnings Guidance Just Shift PG&E’s (PCG) Near-Term Investment Narrative?

- PG&E Corporation recently reported its second-quarter 2025 results, showing relatively stable year-over-year revenue at US$5.90 billion and net income of US$521 million, but also lowered its full-year GAAP earnings guidance to a range of US$1.26 to US$1.32 per share.

- The reduction in earnings outlook comes despite consistent quarterly earnings, highlighting management’s view of emerging headwinds for the remainder of the year.

- We’ll explore what PG&E’s updated earnings guidance means for its near-term investment case, particularly against earlier analyst expectations for margin improvement.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

PG&E Investment Narrative Recap

To believe in PG&E as a shareholder, you need to have confidence in its ability to execute its large capital investment plan while managing unpredictable regulatory and wildfire-related risks. The recent lowering of full-year earnings guidance, despite steady quarterly results, does not materially shift the near-term catalyst: progress on infrastructure improvements funded by capital investments. However, it keeps the spotlight on wildfire risk, which remains the biggest operational and financial concern for investors in the short run.

Among recent developments, PG&E’s move to extend and expand its credit agreements stands out, reinforcing access to funding critical for its multi-billion dollar investment strategy. This supports the narrative that capital investments in reliability and grid safety remain central, even as near-term earnings expectations moderate. Yet, any disruption to these capital plans could quickly become a catalyst for share price volatility.

In contrast, investors should keep in mind one risk that could quickly reemerge when financial headwinds deepen, such as...

Read the full narrative on PG&E (it's free!)

PG&E's narrative projects $27.4 billion in revenue and $3.9 billion in earnings by 2028. This requires 3.8% yearly revenue growth and a $1.5 billion earnings increase from the current $2.4 billion in earnings.

Uncover how PG&E's forecasts yield a $20.60 fair value, a 46% upside to its current price.

Exploring Other Perspectives

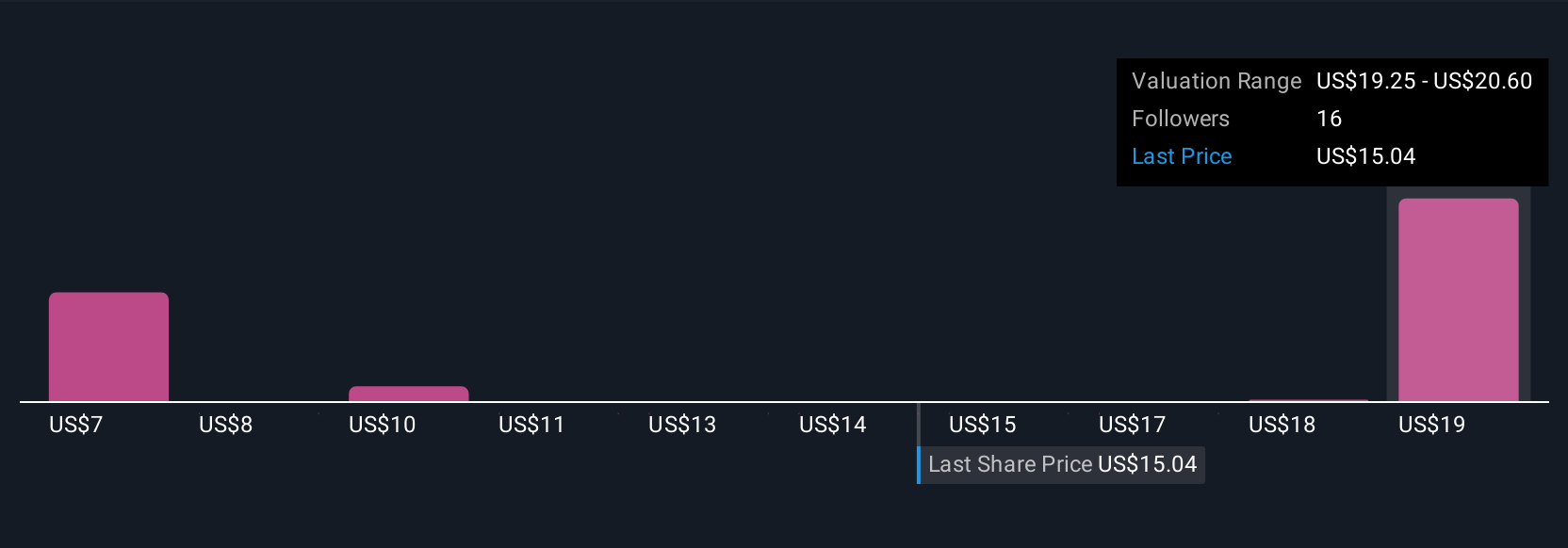

Five members of the Simply Wall St Community peg PG&E’s fair value between US$7.33 and US$20.60 per share. While some focus on infrastructure-led growth, the ongoing challenge of wildfire risk may color broader expectations about future profitability and stability.

Explore 5 other fair value estimates on PG&E - why the stock might be worth as much as 46% more than the current price!

Build Your Own PG&E Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PG&E research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free PG&E research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PG&E's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10