Deckers Outdoor (DECK) Launches HOKA's Mafate 5 With Rocker Integrity Technology

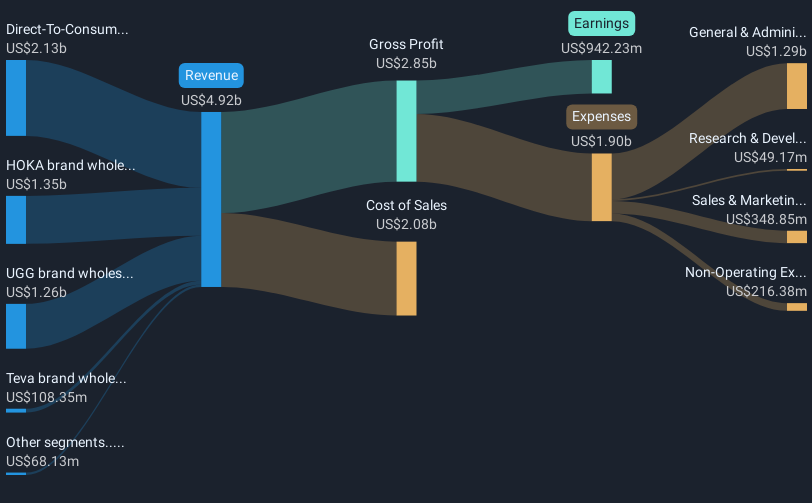

HOKA, a key brand under Deckers Outdoor (DECK), has launched the Mafate 5 trail shoe, featuring innovative Rocker Integrity Technology designed for ultra-runners. This launch, along with the associated Strava challenge, highlights the brand's ongoing commitment to innovation and customer engagement. Over the last week, DECK experienced a 1.17% price move, which can be seen as resilient amid broader market declines driven by global tariff concerns and a weak jobs report. DECK's movement aligned more closely with market fluctuations and may reflect investor confidence in its product strategies despite external economic pressures.

Buy, Hold or Sell Deckers Outdoor? View our complete analysis and fair value estimate and you decide.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The introduction of the Mafate 5 trail shoe by HOKA as a part of Deckers Outdoor's innovative lineup could positively influence the company's narrative by reinforcing its commitment to high-performance running products. Such launches may fuel the brand's reputation and demand in the trail running community, supporting Deckers' strategy to expand revenue through product innovation and engagement. Given HOKA and UGG's global growth ambitions, these developments align with the company's focus on expanding direct-to-consumer channels, potentially enhancing future revenue and earnings forecasts.

Over the past five years, Deckers Outdoor's total shareholder returns reached an impressive 208.47%, indicating robust long-term performance. In contrast, the company's performance over the past year lagged behind the US luxury industry, which returned 5.1%, while the broader US market saw a 16.8% return. This underperformance suggests potential challenges in the short term, although the longer-term success highlights the company's strengths.

Considering the recent 1.17% price movement amidst broader market declines, the introduction of new products like the Mafate 5 might offer resilience and drive future gains. The current US$106.17 share price, trading below the US$129.28 price target, suggests an upside potential based on analysts' consensus. The launch and continued product innovation may positively impact Deckers' revenue and earnings forecasts, given their strategy to capitalize on global expansion and direct sales, although risks such as currency fluctuations and supply chain issues remain.

The analysis detailed in our Deckers Outdoor valuation report hints at an deflated share price compared to its estimated value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10