3 ASX Growth Companies With Insider Ownership Up To 26%

As the ASX200 remained mostly flat in Tuesday's session, with Utilities and Energy sectors showing strength while Financials lagged, investors continue to navigate a complex landscape of sector-specific performances. In such an environment, growth companies with substantial insider ownership can be appealing, as they often indicate confidence from those closest to the business and may offer resilience amid market fluctuations.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| Meteoric Resources (ASX:MEI) | 19.9% | 82.1% |

| Image Resources (ASX:IMA) | 22.3% | 79.9% |

| Findi (ASX:FND) | 33.6% | 91.2% |

| Fenix Resources (ASX:FEX) | 21.1% | 53.9% |

| Echo IQ (ASX:EIQ) | 18% | 51.4% |

| Cyclopharm (ASX:CYC) | 11.3% | 97.8% |

| Brightstar Resources (ASX:BTR) | 11.2% | 115.1% |

| Alfabs Australia (ASX:AAL) | 10.8% | 41.3% |

| Adveritas (ASX:AV1) | 18.1% | 88.3% |

Click here to see the full list of 98 stocks from our Fast Growing ASX Companies With High Insider Ownership screener.

Here we highlight a subset of our preferred stocks from the screener.

Chrysos (ASX:C79)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chrysos Corporation Limited develops and supplies mining technology, with a market cap of A$595.51 million.

Operations: The company generates revenue primarily from its Mining Services segment, which amounts to A$55.51 million.

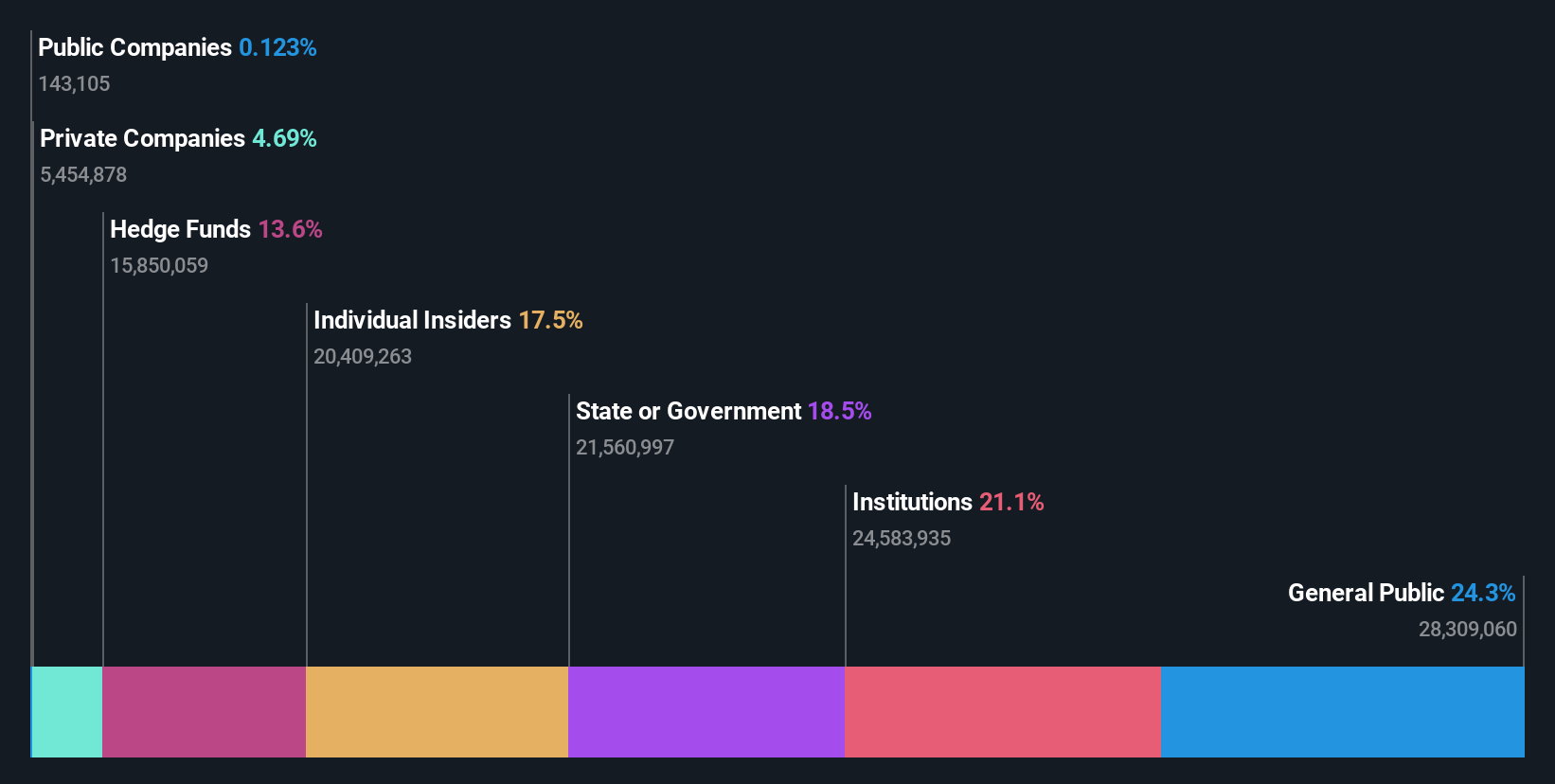

Insider Ownership: 17.5%

Chrysos, with high insider ownership, is poised for significant growth. The company is expected to achieve profitability within three years, with earnings forecasted to grow at 60.27% annually and revenue projected to increase by 28.4% per year—outpacing the Australian market average. Despite a limited cash runway of less than one year and a low forecasted return on equity of 7%, Chrysos remains in a promising position for growth-focused investors.

- Dive into the specifics of Chrysos here with our thorough growth forecast report.

- Our valuation report unveils the possibility Chrysos' shares may be trading at a premium.

Energy One (ASX:EOL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Energy One Limited offers software products, outsourced operations, and advisory services to wholesale energy, environmental, and carbon trading markets in Australasia and Europe with a market cap of A$418.57 million.

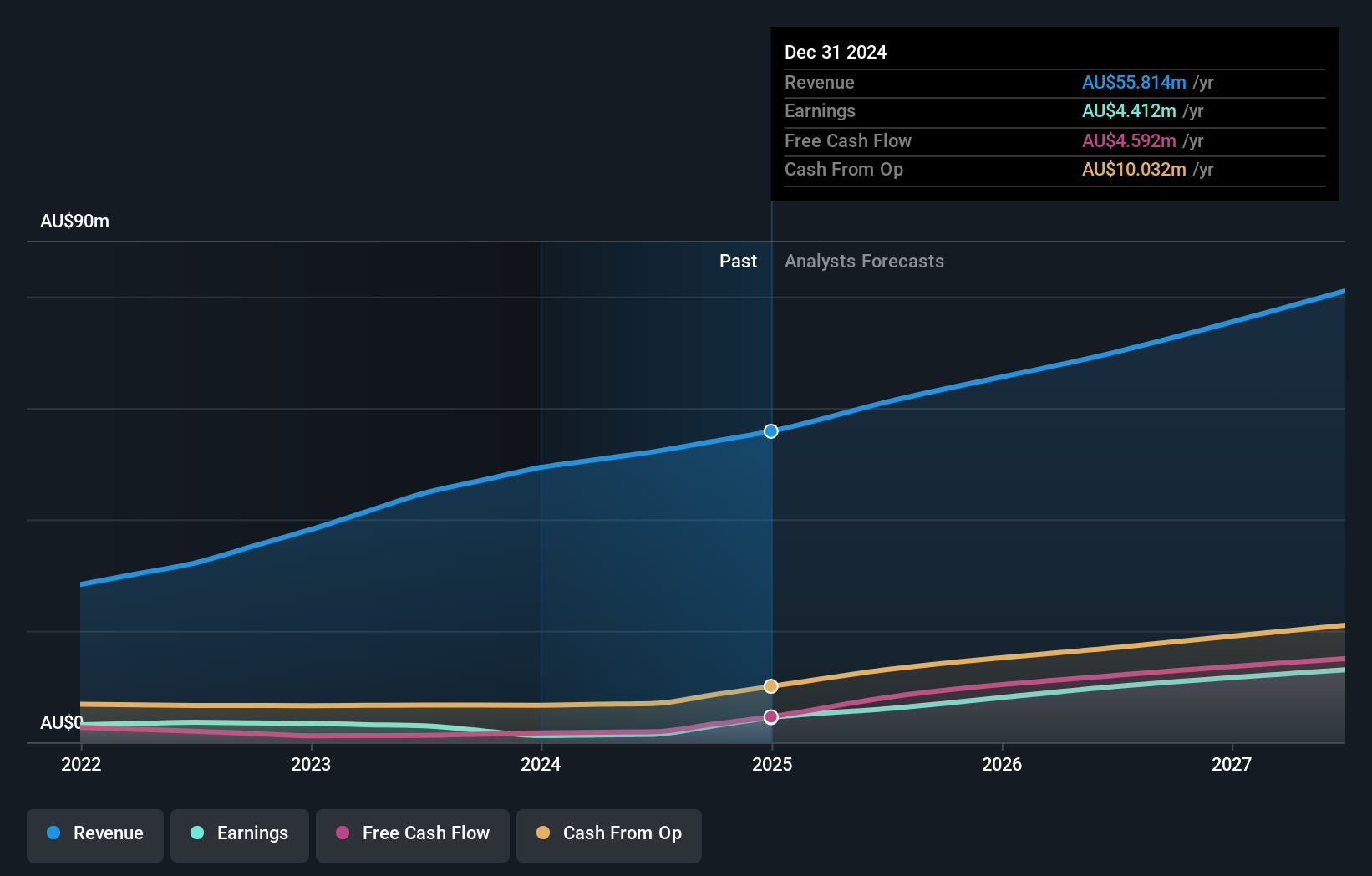

Operations: The company generates revenue of A$55.81 million from its energy software industry segment, serving wholesale energy, environmental, and carbon trading markets in Australasia and Europe.

Insider Ownership: 26.7%

Energy One, with substantial insider ownership, is positioned for growth in the Australian market. Its earnings are forecast to grow significantly at 42% annually, surpassing the market average of 11.1%. Revenue is also expected to increase faster than the market at 14.9% per year. Despite a forecasted low return on equity of 15.5% in three years and no recent insider trading activity, Energy One remains an attractive option for growth-oriented investors seeking strong earnings potential.

- Get an in-depth perspective on Energy One's performance by reading our analyst estimates report here.

- Our valuation report here indicates Energy One may be overvalued.

Universal Store Holdings (ASX:UNI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Universal Store Holdings Limited designs, wholesales, and retails fashion products for men and women in Australia, with a market cap of A$622.97 million.

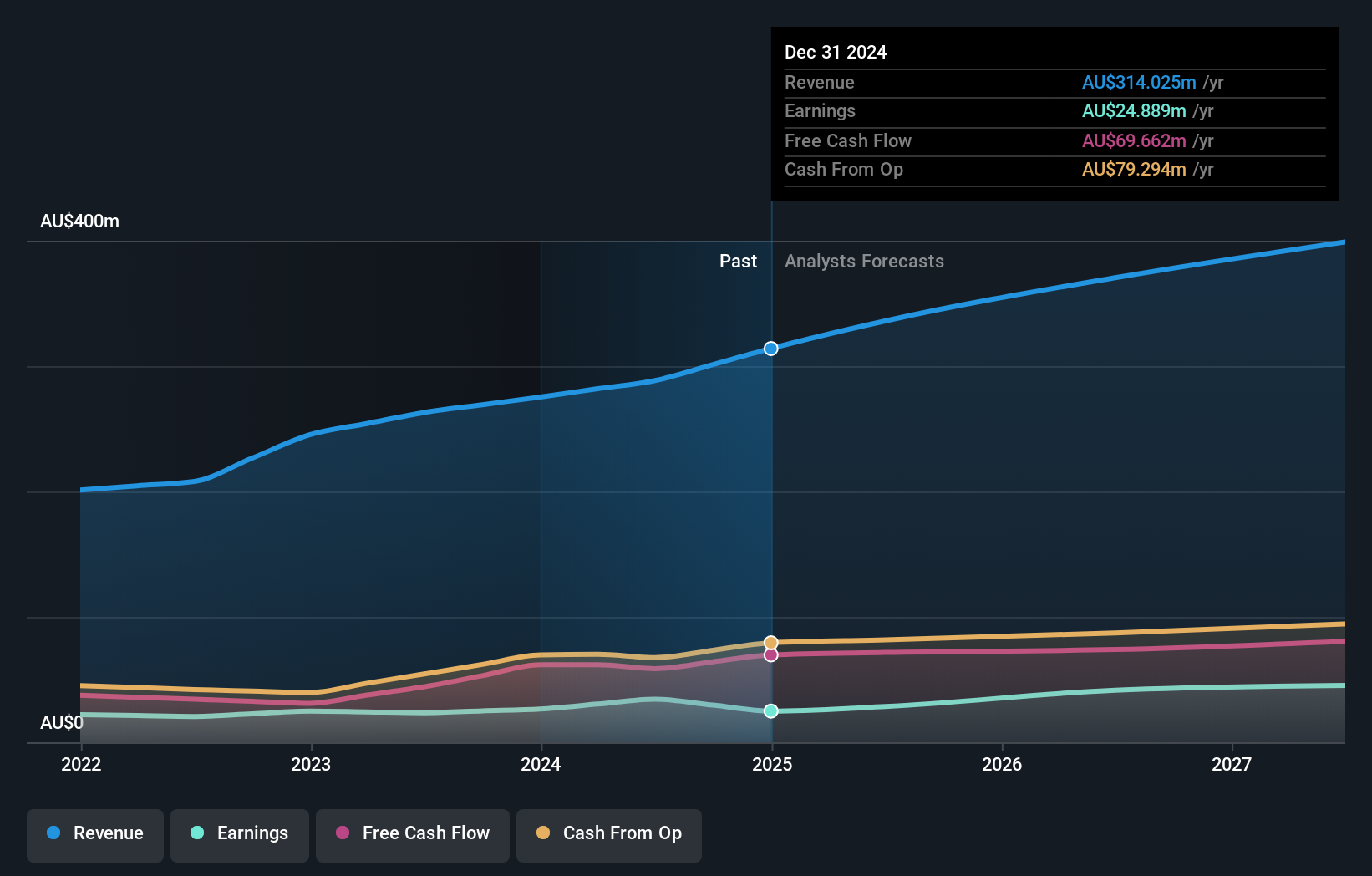

Operations: The company generates revenue primarily through its Universal Store segment with A$287.13 million and CTC contributing A$41.29 million.

Insider Ownership: 14.1%

Universal Store Holdings, with high insider ownership, shows promising growth potential in Australia. Its earnings are forecast to grow at 16.23% annually, outpacing the market average of 11.1%. However, revenue growth is expected to be moderate at 8.5% per year. Despite trading significantly below its estimated fair value and analysts predicting a price rise of 22.2%, recent significant insider selling may raise concerns for some investors about future prospects and confidence levels within the company.

- Delve into the full analysis future growth report here for a deeper understanding of Universal Store Holdings.

- Our valuation report unveils the possibility Universal Store Holdings' shares may be trading at a discount.

Make It Happen

- Access the full spectrum of 98 Fast Growing ASX Companies With High Insider Ownership by clicking on this link.

- Ready For A Different Approach? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10