3 Prominent Stocks Estimated To Be Up To 37.9% Below Intrinsic Value

The United States market has shown a robust performance, climbing by 1.4% over the past week and rising 17% over the past year, with earnings forecasted to grow by 15% annually. In such an environment, identifying stocks that are estimated to be significantly below their intrinsic value can present compelling opportunities for investors seeking potential growth and value.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| TowneBank (TOWN) | $35.61 | $69.58 | 48.8% |

| Sotera Health (SHC) | $12.30 | $24.38 | 49.5% |

| Semrush Holdings (SEMR) | $9.74 | $19.09 | 49% |

| Roku (ROKU) | $90.12 | $174.54 | 48.4% |

| Hims & Hers Health (HIMS) | $57.65 | $114.17 | 49.5% |

| Grindr (GRND) | $18.29 | $36.42 | 49.8% |

| Gold Royalty (GROY) | $2.72 | $5.42 | 49.8% |

| Globalstar (GSAT) | $24.57 | $47.68 | 48.5% |

| Carter Bankshares (CARE) | $18.10 | $35.83 | 49.5% |

| Acadia Realty Trust (AKR) | $18.77 | $36.63 | 48.8% |

Click here to see the full list of 168 stocks from our Undervalued US Stocks Based On Cash Flows screener.

Let's uncover some gems from our specialized screener.

Duolingo (DUOL)

Overview: Duolingo, Inc. operates as a mobile learning platform in the United States, the United Kingdom, and internationally, with a market cap of approximately $16.55 billion.

Operations: The company generates revenue primarily from its educational software segment, amounting to $811.21 million.

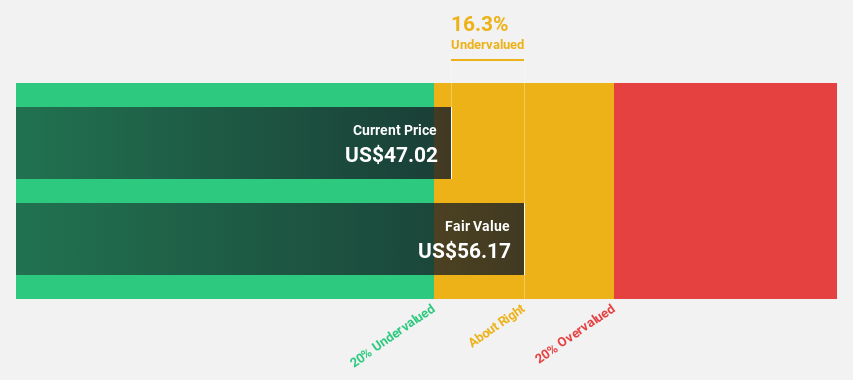

Estimated Discount To Fair Value: 37.9%

Duolingo is trading at US$364.09, significantly below its estimated fair value of US$586.06, making it undervalued based on discounted cash flow analysis. Despite recent insider selling, the company has demonstrated robust growth with earnings up 112.2% last year and projected to grow 39.7% annually over the next three years—outpacing market averages. Recent developments include a major expansion of language courses, potentially enhancing future revenue streams as they meet global demand for language learning options.

- Our growth report here indicates Duolingo may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Duolingo's balance sheet health report.

Calix (CALX)

Overview: Calix, Inc. offers cloud and software platforms, systems, and services across various regions including the United States, the rest of the Americas, Europe, the Middle East, Africa, and Asia Pacific with a market cap of $3.61 billion.

Operations: The company generates revenue of $869.19 million from developing, marketing, and selling communications access systems and software across multiple regions.

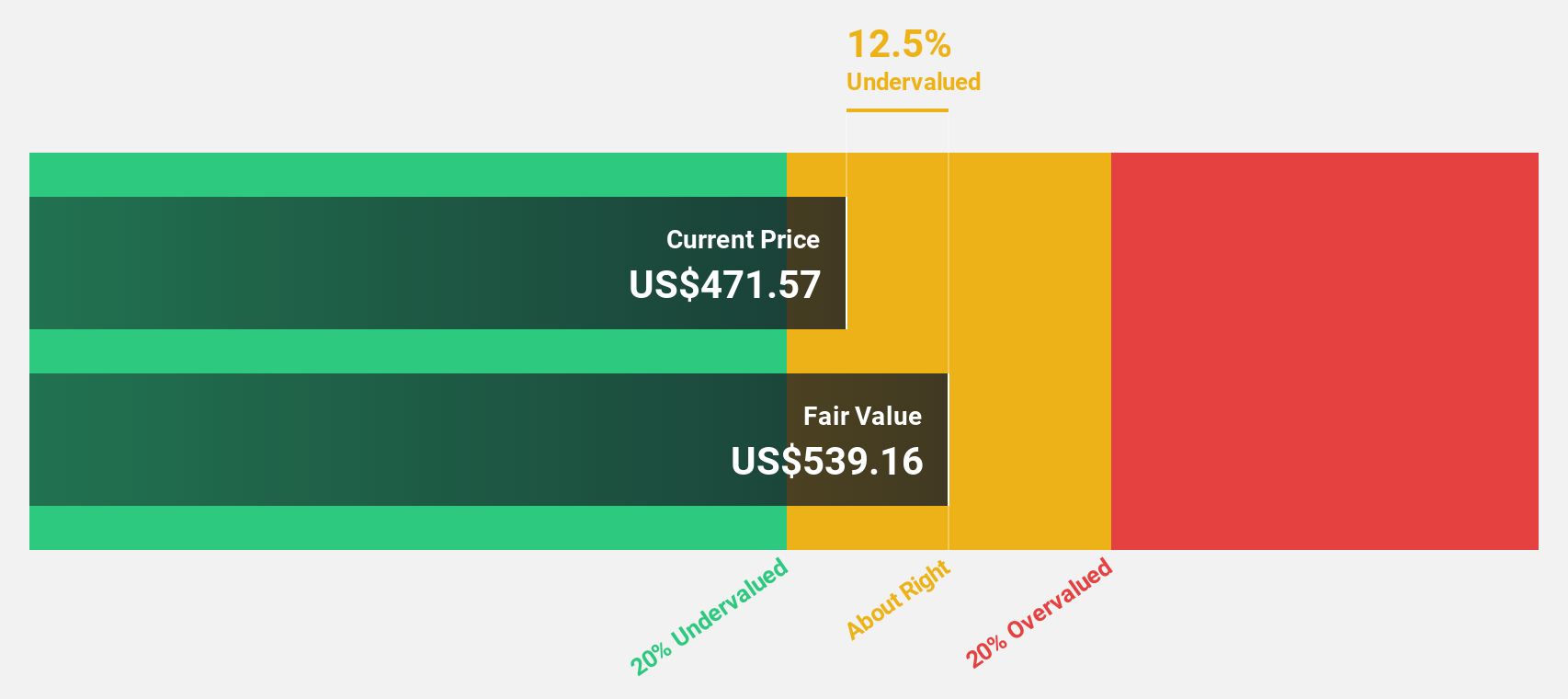

Estimated Discount To Fair Value: 14.7%

Calix, trading at US$55.29, is undervalued relative to its fair value of US$64.79 based on discounted cash flow analysis. The company recently reported improved earnings with a net loss reduction from US$7.96 million to US$0.199 million year-over-year for Q2 2025, alongside increased sales of US$241.88 million from the previous year's US$198.14 million, signaling positive cash flow trends despite slower revenue growth compared to market expectations and recent index exclusions.

- The analysis detailed in our Calix growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Calix.

Owens Corning (OC)

Overview: Owens Corning is a company that supplies residential and commercial building products across the United States, Europe, the Asia Pacific, and internationally, with a market cap of approximately $12.41 billion.

Operations: The company's revenue is derived from its Roofing segment at $4.07 billion and Insulation segment at $3.64 billion.

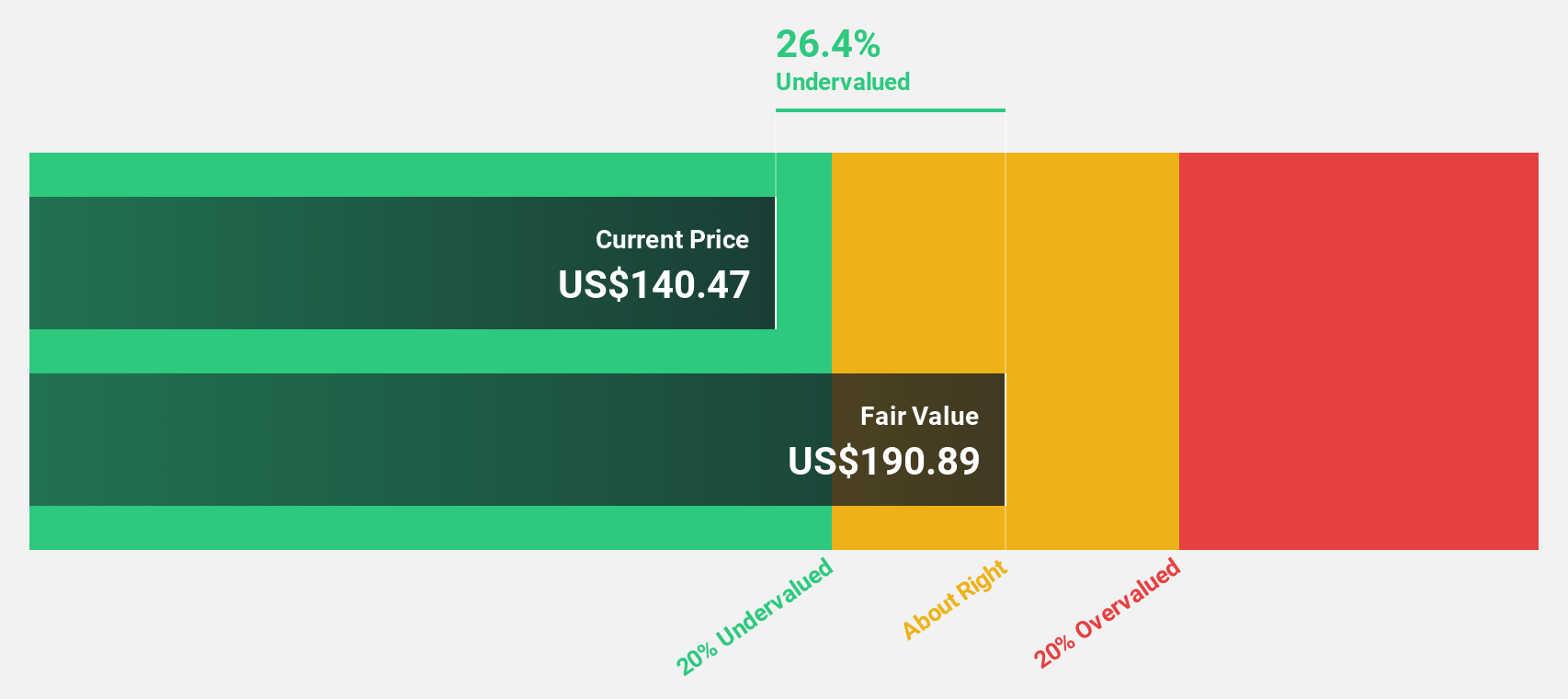

Estimated Discount To Fair Value: 23.6%

Owens Corning, currently trading at US$145.90, is undervalued based on its fair value estimate of US$190.88 using discounted cash flow analysis. Despite a recent net loss of US$93 million for Q1 2025 and declining profit margins, the company maintains strong relative value compared to peers and offers a reliable dividend yield. Owens Corning's earnings are forecast to grow significantly over the next three years, supported by strategic leadership changes in its Roofing and Insulation divisions.

- The growth report we've compiled suggests that Owens Corning's future prospects could be on the up.

- Navigate through the intricacies of Owens Corning with our comprehensive financial health report here.

Next Steps

- Reveal the 168 hidden gems among our Undervalued US Stocks Based On Cash Flows screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10