Three Growth Stocks With Strong Insider Confidence

The United States market has shown positive momentum, climbing by 1.4% over the past week and up 17% over the last 12 months, with earnings forecast to grow by 15% annually. In this environment, growth stocks with strong insider ownership can be particularly appealing as they often signal confidence from those who know the company best.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Zapp Electric Vehicles Group (ZAPP.F) | 16.1% | 170.8% |

| Wallbox (WBX) | 24.6% | 75.8% |

| Super Micro Computer (SMCI) | 13.9% | 38.2% |

| Prairie Operating (PROP) | 34.4% | 80.8% |

| Niu Technologies (NIU) | 37.2% | 88.1% |

| FTC Solar (FTCI) | 23.1% | 62.5% |

| Credo Technology Group Holding (CRDO) | 11.7% | 36.9% |

| Atour Lifestyle Holdings (ATAT) | 22.9% | 23.6% |

| Astera Labs (ALAB) | 12.8% | 45.4% |

| ARS Pharmaceuticals (SPRY) | 14.3% | 63.1% |

Click here to see the full list of 185 stocks from our Fast Growing US Companies With High Insider Ownership screener.

Let's dive into some prime choices out of the screener.

Aebi Schmidt Holding (AEBI)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aebi Schmidt Holding AG develops and manufactures special-purpose vehicles and attachments, with a market cap of $758.92 million.

Operations: The company's revenue is derived from two main segments: North America, contributing $595.77 million, and Europe and the Rest of the World (RoW), adding $480.58 million.

Insider Ownership: 14.0%

Revenue Growth Forecast: 37.2% p.a.

Aebi Schmidt Holding AG, recently added to the NASDAQ Composite and Transportation Indexes, is trading significantly below its estimated fair value. Despite limited financial data and high illiquidity, the company shows promising growth prospects with forecasted annual earnings growth of 54.18% and revenue growth of 37.2%, both outpacing the US market averages. However, recent earnings revealed a decline in net income to US$2.08 million from US$8.75 million year-over-year, indicating potential financial challenges ahead.

- Click to explore a detailed breakdown of our findings in Aebi Schmidt Holding's earnings growth report.

- Our valuation report here indicates Aebi Schmidt Holding may be overvalued.

Duolingo (DUOL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Duolingo, Inc. operates as a mobile learning platform in the United States, the United Kingdom, and internationally with a market cap of approximately $16.55 billion.

Operations: The company generates revenue primarily from its educational software segment, totaling $811.21 million.

Insider Ownership: 14.2%

Revenue Growth Forecast: 23.7% p.a.

Duolingo's strong growth trajectory is underscored by a significant earnings increase of 112.2% over the past year and forecasted annual profit growth of 39.7%, surpassing the US market average. Despite recent substantial insider selling, the company's revenue is expected to grow by 23.7% annually, driven by strategic expansions like launching 148 new language courses using advanced AI tools. Trading at a notable discount to its fair value, analysts anticipate further stock price appreciation.

- Delve into the full analysis future growth report here for a deeper understanding of Duolingo.

- Our valuation report here indicates Duolingo may be undervalued.

Marcus & Millichap (MMI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Marcus & Millichap, Inc. is an investment brokerage company offering real estate investment brokerage and financing services to commercial real estate buyers and sellers in the United States and Canada, with a market cap of approximately $1.24 billion.

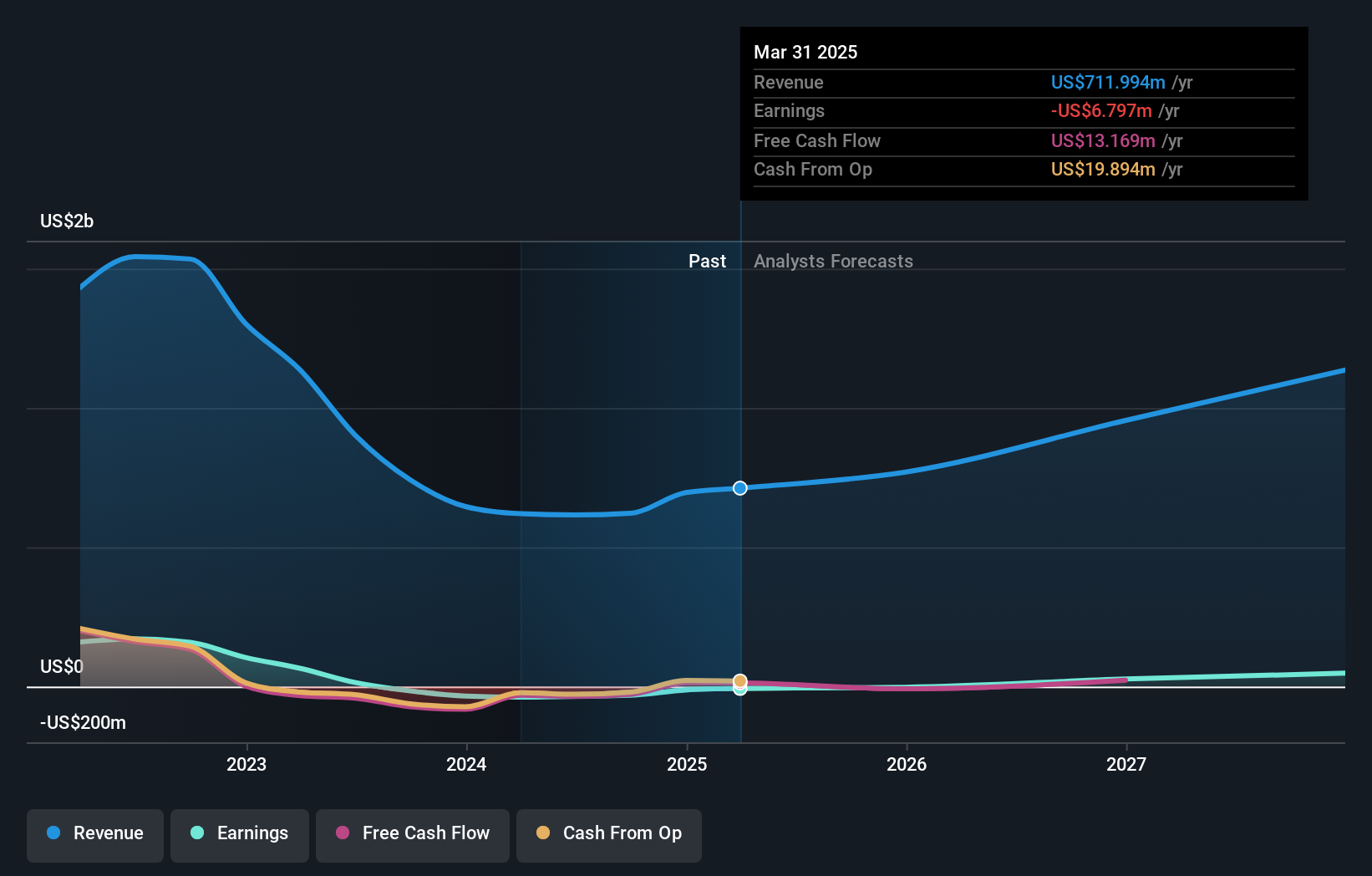

Operations: The company generates revenue primarily from the delivery of commercial real estate services, amounting to $711.99 million.

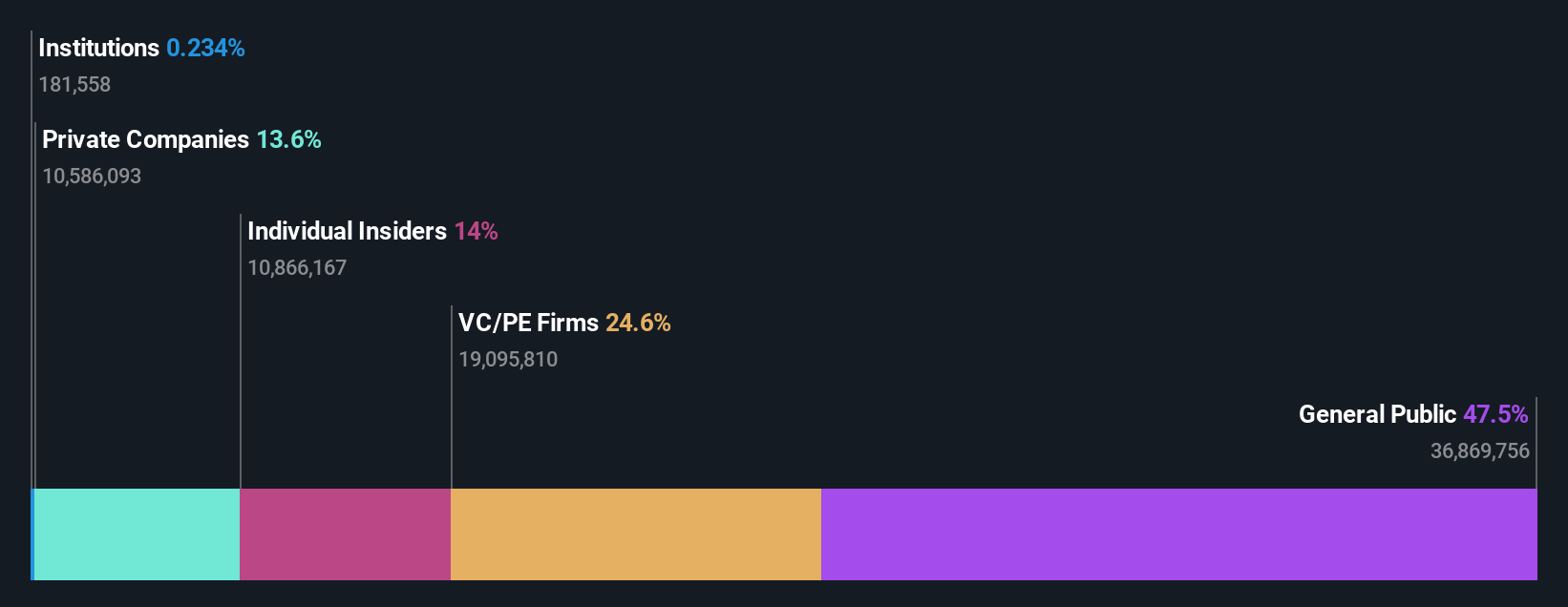

Insider Ownership: 37.5%

Revenue Growth Forecast: 16.6% p.a.

Marcus & Millichap, despite being dropped from the Russell 2000 Dynamic Index, shows promising growth potential with earnings expected to grow substantially at 100.68% annually and a forecasted revenue increase of 16.6% per year, outpacing the US market average. The company is actively pursuing strategic acquisitions and investments while maintaining cost controls. Recent management reorganization aims to enhance growth initiatives, although its dividend remains unsustainable due to insufficient earnings coverage.

- Take a closer look at Marcus & Millichap's potential here in our earnings growth report.

- Our valuation report unveils the possibility Marcus & Millichap's shares may be trading at a discount.

Where To Now?

- Delve into our full catalog of 185 Fast Growing US Companies With High Insider Ownership here.

- Looking For Alternative Opportunities? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10