3 Promising Penny Stocks With Market Caps Under $300M

The U.S. stock market has recently seen major indices like the S&P 500 and Nasdaq Composite reach new highs, buoyed by strong corporate earnings and easing trade tensions. In this context, penny stocks continue to attract interest due to their potential for growth at a lower entry cost. While the term "penny stocks" may seem outdated, these investments in smaller or newer companies can still offer significant opportunities when backed by solid financials.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $2.04 | $737.79M | ✅ 3 ⚠️ 0 View Analysis > |

| CuriosityStream (CURI) | $4.77 | $275.27M | ✅ 3 ⚠️ 3 View Analysis > |

| WM Technology (MAPS) | $0.9712 | $163.33M | ✅ 4 ⚠️ 1 View Analysis > |

| Puma Biotechnology (PBYI) | $3.28 | $162.81M | ✅ 2 ⚠️ 1 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $99.33M | ✅ 3 ⚠️ 2 View Analysis > |

| Cardno (COLD.F) | $0.1701 | $6.64M | ✅ 2 ⚠️ 4 View Analysis > |

| Flexible Solutions International (FSI) | $4.78 | $60.46M | ✅ 1 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.87 | $6.32M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.85 | $108.71M | ✅ 3 ⚠️ 2 View Analysis > |

| Tandy Leather Factory (TLF) | $3.46 | $29.45M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 415 stocks from our US Penny Stocks screener.

Let's review some notable picks from our screened stocks.

AirJoule Technologies (AIRJ)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: AirJoule Technologies Corporation specializes in atmospheric renewable energy and water harvesting technology, with a market cap of $276.48 million.

Operations: AirJoule Technologies does not have any reported revenue segments at this time.

Market Cap: $276.48M

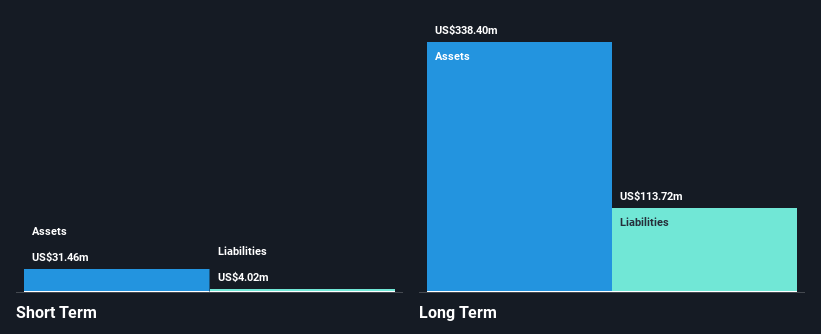

AirJoule Technologies, with a market cap of US$276.48 million, is pre-revenue but has been gaining attention for its atmospheric renewable energy and water harvesting technology. Despite negative earnings growth of 71.3% over the past year, it remains debt-free and has been added to multiple Russell indices, highlighting its growing market presence. The company's short-term assets exceed short-term liabilities by US$22.7 million but fall short against long-term liabilities of US$93.8 million. Recent board changes and a collaboration with data center developers indicate strategic moves towards operational resilience and innovation in sustainable water solutions.

- Unlock comprehensive insights into our analysis of AirJoule Technologies stock in this financial health report.

- Assess AirJoule Technologies' previous results with our detailed historical performance reports.

Apyx Medical (APYX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Apyx Medical Corporation is an energy technology company that designs, develops, manufactures, and sells electrosurgical equipment and medical devices both in the United States and internationally, with a market cap of $95.99 million.

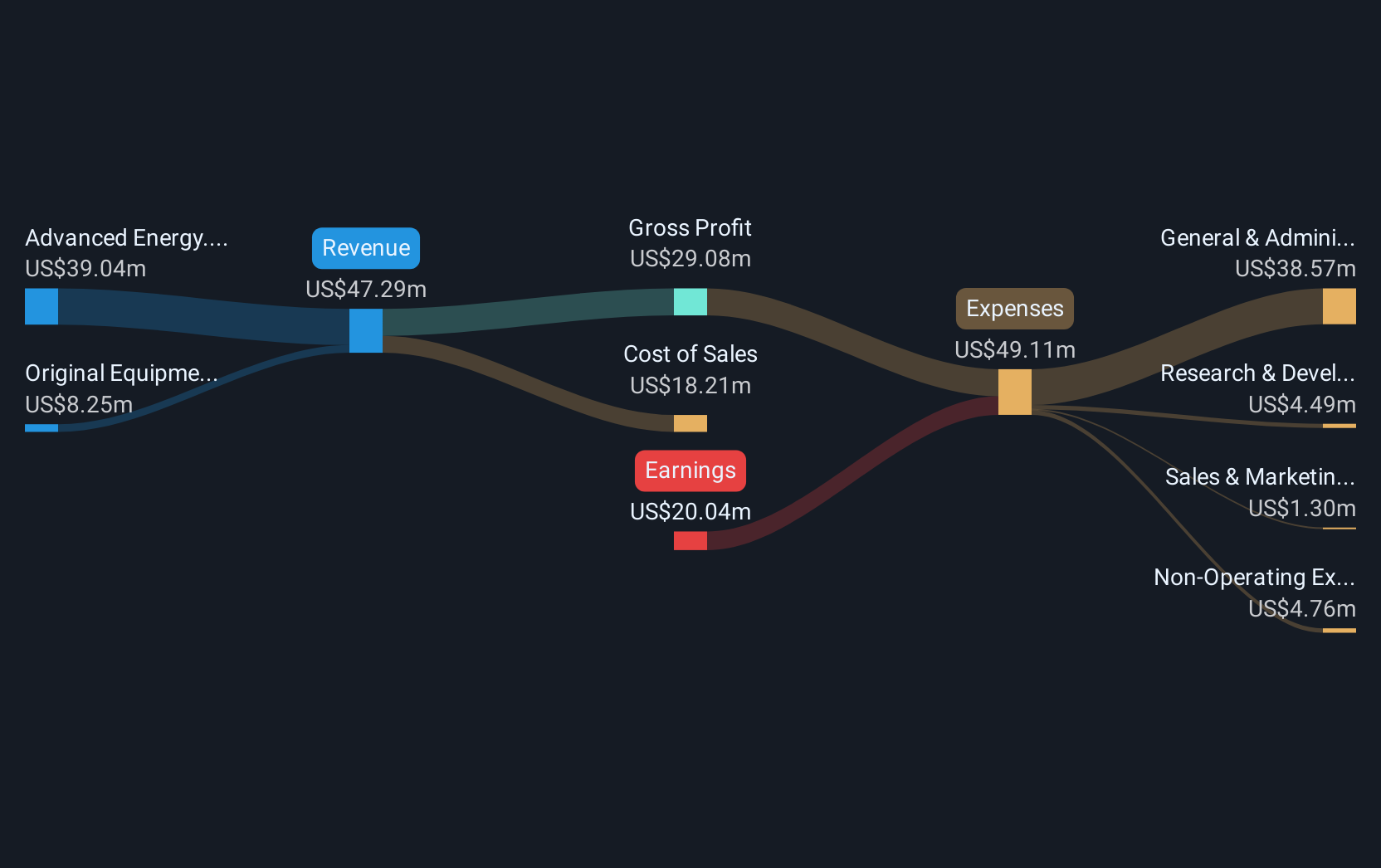

Operations: Apyx Medical generates revenue through its Advanced Energy segment, which accounts for $39.04 million, and its Original Equipment Manufacturing (OEM) segment, contributing $8.25 million.

Market Cap: $96M

Apyx Medical Corporation, with a market cap of US$95.99 million, is navigating the penny stock landscape with recent FDA clearance for its AYON Body Contouring System™, poised for launch later in 2025. Despite reporting a net loss of US$4.15 million in Q1 2025, the company maintains robust short-term assets (US$51.9M) exceeding both short and long-term liabilities, indicating financial stability amidst volatility. The company's debt to equity ratio has surged significantly over five years, yet it trades at a significant discount to estimated fair value while anticipating revenue growth driven by its Advanced Energy segment and strategic product innovations.

- Get an in-depth perspective on Apyx Medical's performance by reading our balance sheet health report here.

- Explore Apyx Medical's analyst forecasts in our growth report.

trivago (TRVG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: trivago N.V. operates a hotel and accommodation search platform across various countries including the United States, Germany, and Japan, with a market cap of approximately $268.13 million.

Operations: trivago's revenue is primarily derived from three geographical segments: Developed Europe (€200.46 million), the Americas (€180.46 million), and the Rest of World (€98.45 million).

Market Cap: $268.13M

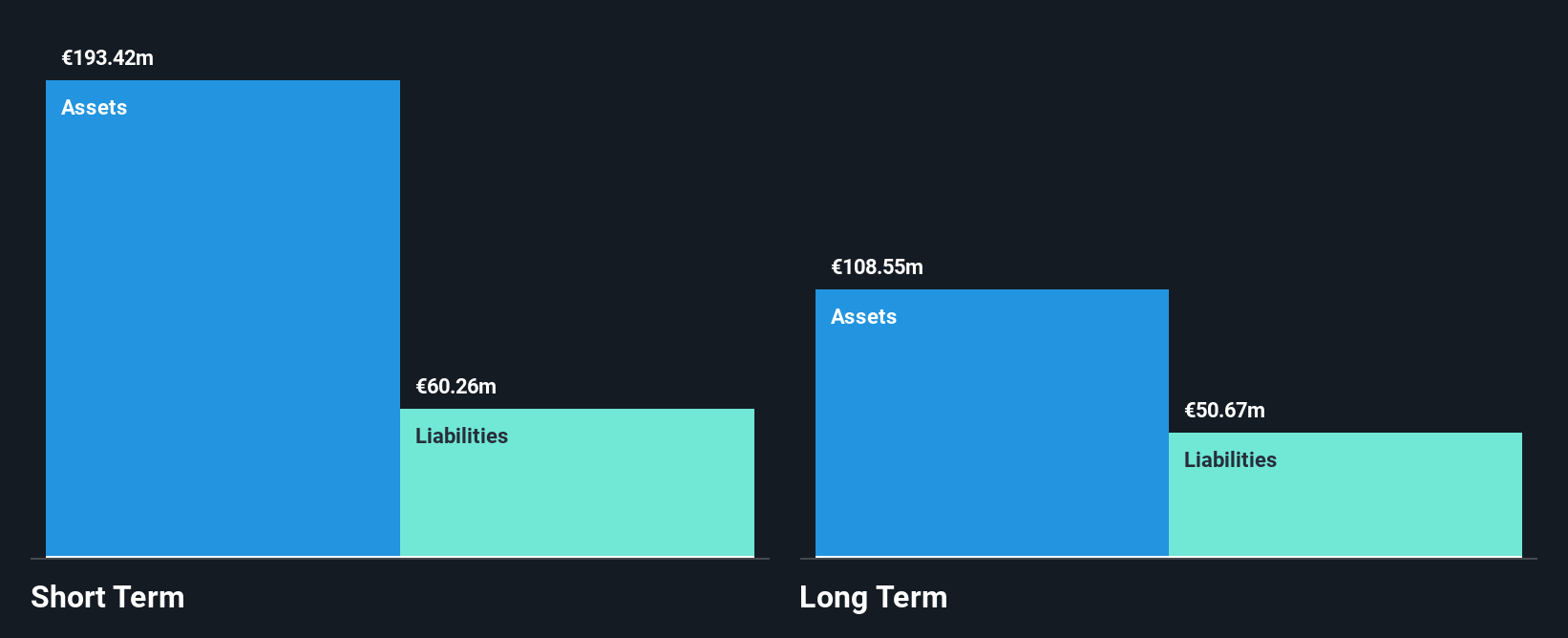

trivago N.V., with a market cap of approximately $268.13 million, is navigating the penny stock arena by leveraging its substantial short-term assets (€193.4M) to cover both short and long-term liabilities, indicating financial resilience despite ongoing unprofitability. The company's recent earnings report showed improved sales of €124.11 million in Q1 2025, up from €101.43 million a year prior, alongside a reduced net loss of €7.8 million. While trivago remains debt-free and has not diluted shareholders recently, its negative return on equity highlights profitability challenges even as revenue growth forecasts remain optimistic for the year ahead.

- Dive into the specifics of trivago here with our thorough balance sheet health report.

- Gain insights into trivago's outlook and expected performance with our report on the company's earnings estimates.

Make It Happen

- Navigate through the entire inventory of 415 US Penny Stocks here.

- Seeking Other Investments? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10