ASX Penny Stocks To Watch In July 2025

The Australian market is facing a slight downturn, with the local bourse set to dip following a flat session on Wall Street and ongoing tariff negotiations. Despite these broader challenges, penny stocks remain an intriguing investment area, offering opportunities for growth at lower price points. While the term may seem outdated, these smaller or newer companies can still present significant potential when backed by strong financials and sound fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.41 | A$117.5M | ✅ 3 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.20 | A$103.78M | ✅ 4 ⚠️ 3 View Analysis > |

| GTN (ASX:GTN) | A$0.595 | A$113.45M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.95 | A$454.84M | ✅ 4 ⚠️ 2 View Analysis > |

| Duratec (ASX:DUR) | A$1.43 | A$360.92M | ✅ 3 ⚠️ 1 View Analysis > |

| West African Resources (ASX:WAF) | A$2.29 | A$2.61B | ✅ 5 ⚠️ 1 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.755 | A$464.04M | ✅ 4 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$3.02 | A$1.02B | ✅ 4 ⚠️ 2 View Analysis > |

| Austco Healthcare (ASX:AHC) | A$0.36 | A$131.15M | ✅ 4 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.86 | A$149.81M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 464 stocks from our ASX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Alpha HPA (ASX:A4N)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Alpha HPA Limited is a specialty metals and technology company with a market capitalization of A$1.07 billion.

Operations: The company's revenue is primarily derived from its HPA First Project, contributing A$0.07 million.

Market Cap: A$1.07B

Alpha HPA, with a market capitalization of A$1.07 billion, is currently pre-revenue, generating only A$0.07 million primarily from its HPA First Project. Despite forecasts suggesting substantial revenue growth of over 140% annually, the company remains unprofitable and is not expected to achieve profitability in the near term. Financially, Alpha HPA has more cash than debt and its short-term assets exceed both short-term and long-term liabilities; however, it faces less than a year of cash runway if historical free cash flow reductions persist. The management team lacks experience with an average tenure of 0.4 years.

- Navigate through the intricacies of Alpha HPA with our comprehensive balance sheet health report here.

- Examine Alpha HPA's earnings growth report to understand how analysts expect it to perform.

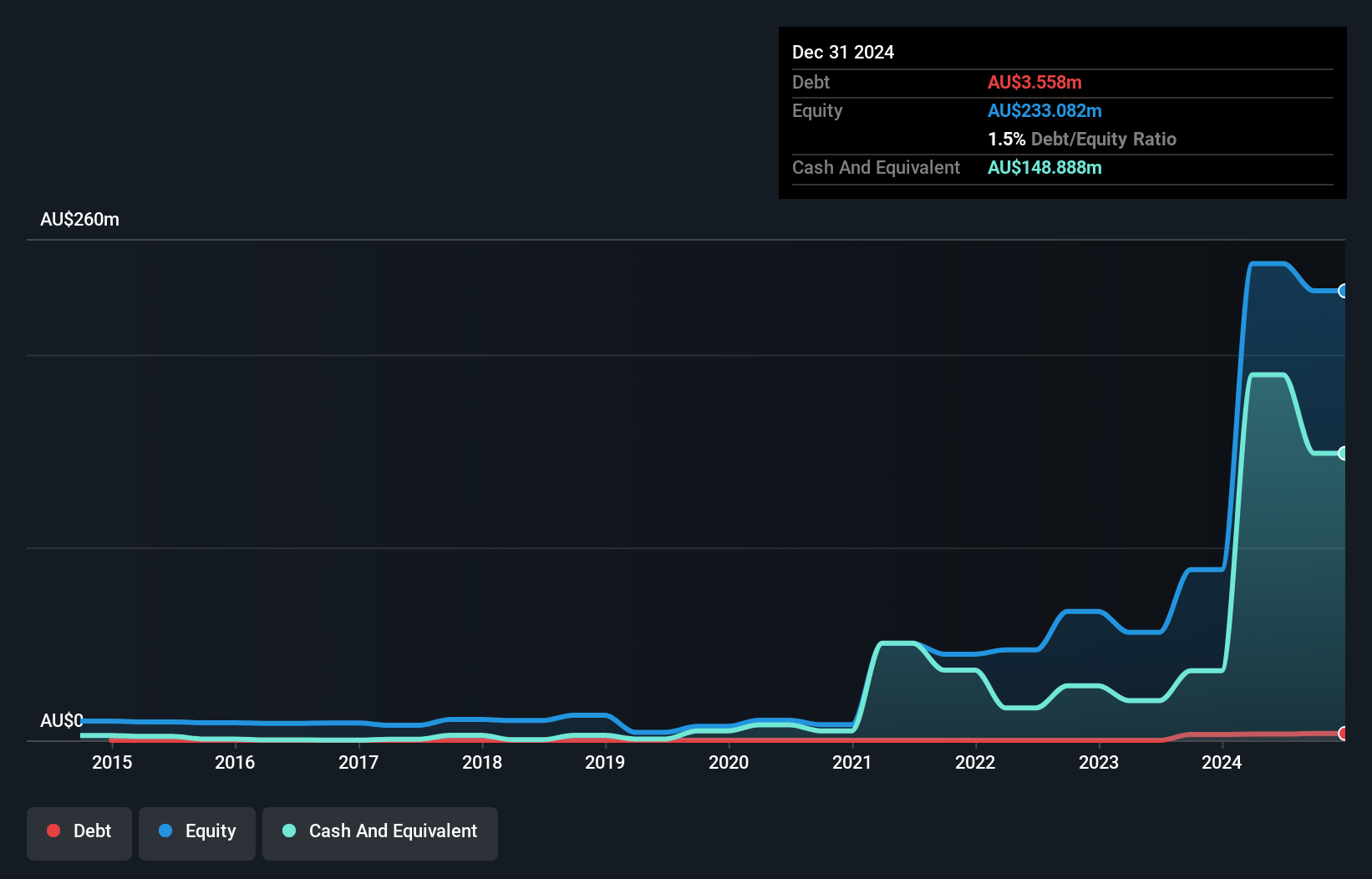

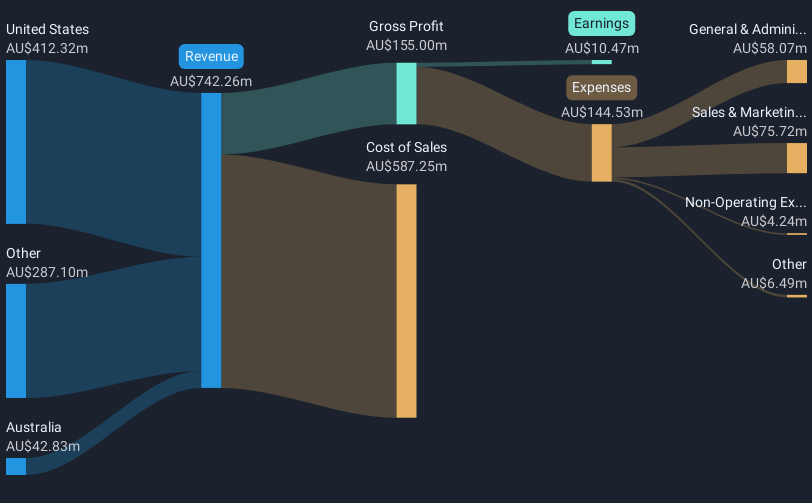

Cettire (ASX:CTT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cettire Limited operates as an online luxury goods retailer in Australia, the United States, and internationally, with a market cap of A$139.15 million.

Operations: The company generates revenue from online retail sales amounting to A$781.98 million.

Market Cap: A$139.15M

Cettire Limited, with a market cap of A$139.15 million, operates debt-free and has short-term assets exceeding liabilities. Despite stable weekly volatility over the past year, its share price remains highly volatile compared to most Australian stocks. Earnings growth has been negative recently, contrasting with significant profit growth over the past five years. The company's net profit margins have declined from 3.6% to 0.3%, impacted by a large one-off gain of A$1.3 million in recent financial results. Recent board changes include Timothy Hume's appointment as Company Secretary following Fiona van Wyk’s retirement after her tenure since Cettire's IPO in 2020.

- Jump into the full analysis health report here for a deeper understanding of Cettire.

- Learn about Cettire's future growth trajectory here.

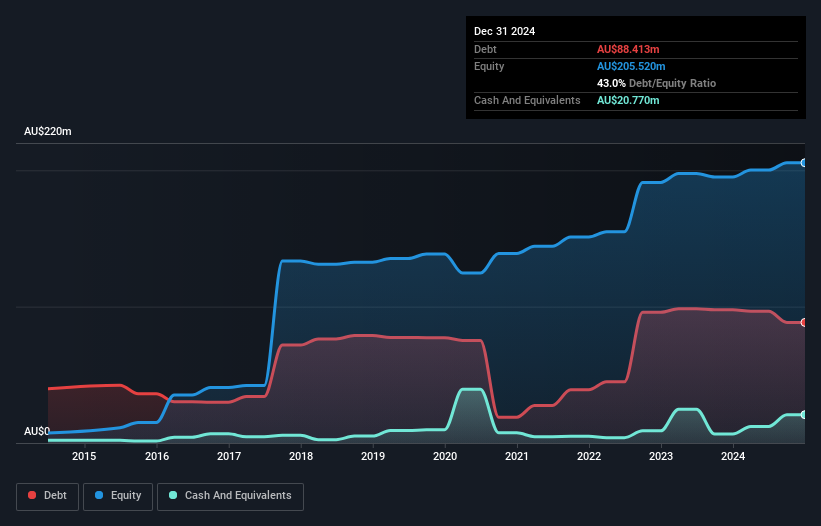

MotorCycle Holdings (ASX:MTO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: MotorCycle Holdings Limited operates motorcycle dealerships across Australia and has a market capitalization of A$247.25 million.

Operations: The company generates revenue through two main segments: Motorcycle Retailing, which accounts for A$446.85 million, and Motorcycle and Accessories Wholesaling, contributing A$180.54 million.

Market Cap: A$247.25M

MotorCycle Holdings Limited, with a market cap of A$247.25 million, shows a mixed financial profile. Its revenue streams from Motorcycle Retailing and Wholesaling are substantial, yet recent negative earnings growth and declining net profit margins suggest challenges. The company's return on equity is low at 8.3%, but it maintains strong liquidity with short-term assets exceeding liabilities and satisfactory debt levels supported by operating cash flow. Despite trading below fair value estimates and having high-quality past earnings, the management team's inexperience may impact strategic direction amidst ongoing business reorganizations and M&A activities involving Peter Stevens Motorcycles Pty Ltd and Harley Heaven Pty Ltd.

- Click here to discover the nuances of MotorCycle Holdings with our detailed analytical financial health report.

- Gain insights into MotorCycle Holdings' outlook and expected performance with our report on the company's earnings estimates.

Next Steps

- Embark on your investment journey to our 464 ASX Penny Stocks selection here.

- Ready To Venture Into Other Investment Styles? Uncover 15 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10