Will ConocoPhillips' (COP) Portfolio Streamlining Define Its Capital Allocation Edge?

- In July 2025, ConocoPhillips entered advanced talks to sell its Oklahoma Anadarko Basin assets, totaling roughly 300,000 net acres and producing about 39,000 barrels of oil equivalent per day, to Stone Ridge Energy for approximately US$1.3 billion, while also seeking to cease being a reporting issuer in Canada.

- This asset sale reflects ConocoPhillips’s ongoing focus on portfolio optimization and capital allocation, following its major acquisition of Marathon Oil and expansion into global LNG markets.

- We’ll explore how the potential divestiture of US$1.3 billion in gas and oil assets could affect ConocoPhillips’s investment outlook.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

ConocoPhillips Investment Narrative Recap

For shareholders of ConocoPhillips, the long-term story remains anchored on the company’s ability to drive efficiencies, realize synergies from the Marathon Oil acquisition, and expand its presence in global LNG markets. The potential US$1.3 billion sale of Anadarko Basin assets to Stone Ridge Energy aligns with ongoing portfolio optimization, but given the company’s overall size and asset base, this transaction is not expected to materially impact the key near-term catalyst, successful synergy realization from the Marathon Oil integration, or the primary risk of commodity price volatility.

Among recent announcements, ConocoPhillips’s move to cease being a reporting issuer in Canada is most relevant, reflecting how the company continues to streamline its operations as it shifts focus to core growth and efficiency projects. While this regulatory change will not affect US disclosure practices or investor access to financial information, it underscores management’s intent to prioritize simplicity as the company pursues its major US and international initiatives.

However, investors should note that even as the asset sale supports capital allocation efforts, exposure to swings in oil and gas prices remains a key consideration...

Read the full narrative on ConocoPhillips (it's free!)

ConocoPhillips' outlook anticipates $61.7 billion in revenue and $10.4 billion in earnings by 2028. This is based on a 1.5% annual revenue growth rate and an increase in earnings of $0.9 billion from the current $9.5 billion level.

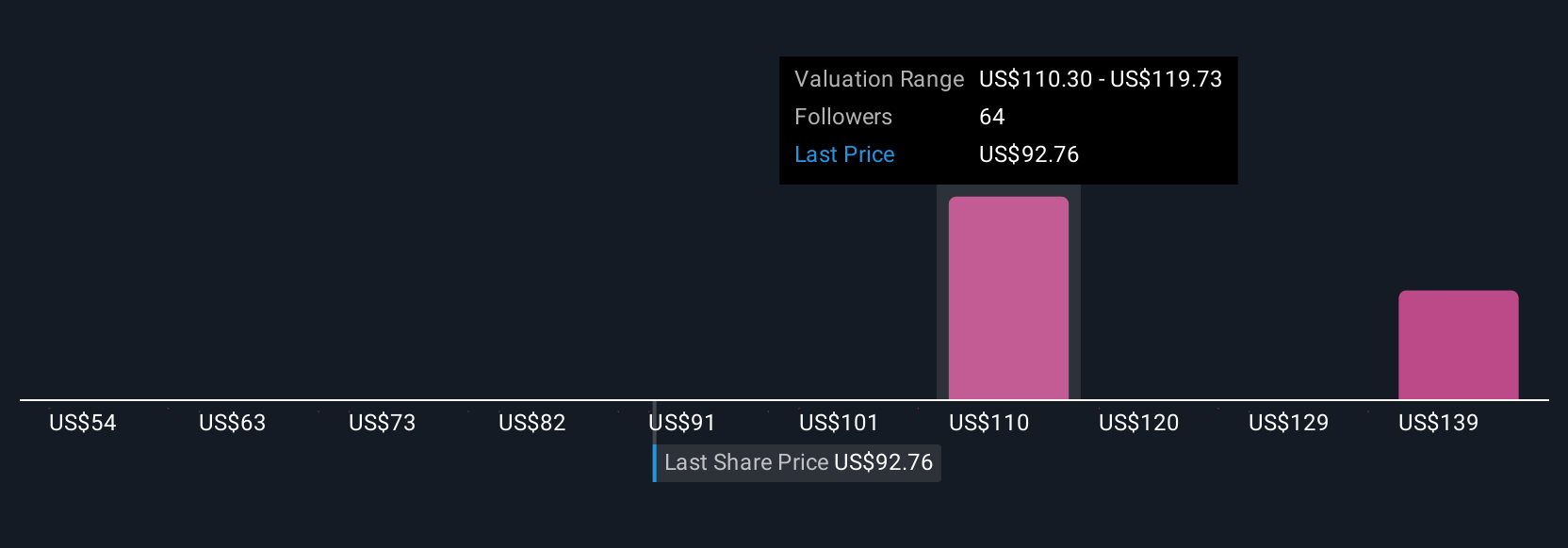

Uncover how ConocoPhillips' forecasts yield a $117.00 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Five community-sourced fair value estimates for ConocoPhillips span from US$53.72 to US$147.82, reflecting widely differing views on the company’s future. Alongside this range, integration risk from the Marathon Oil acquisition could have far-reaching effects, so consider a variety of opinions before making decisions.

Explore 5 other fair value estimates on ConocoPhillips - why the stock might be worth 45% less than the current price!

Build Your Own ConocoPhillips Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ConocoPhillips research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ConocoPhillips research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ConocoPhillips' overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10