After Leaping 31% Ocular Therapeutix, Inc. (NASDAQ:OCUL) Shares Are Not Flying Under The Radar

Ocular Therapeutix, Inc. (NASDAQ:OCUL) shares have continued their recent momentum with a 31% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 48%.

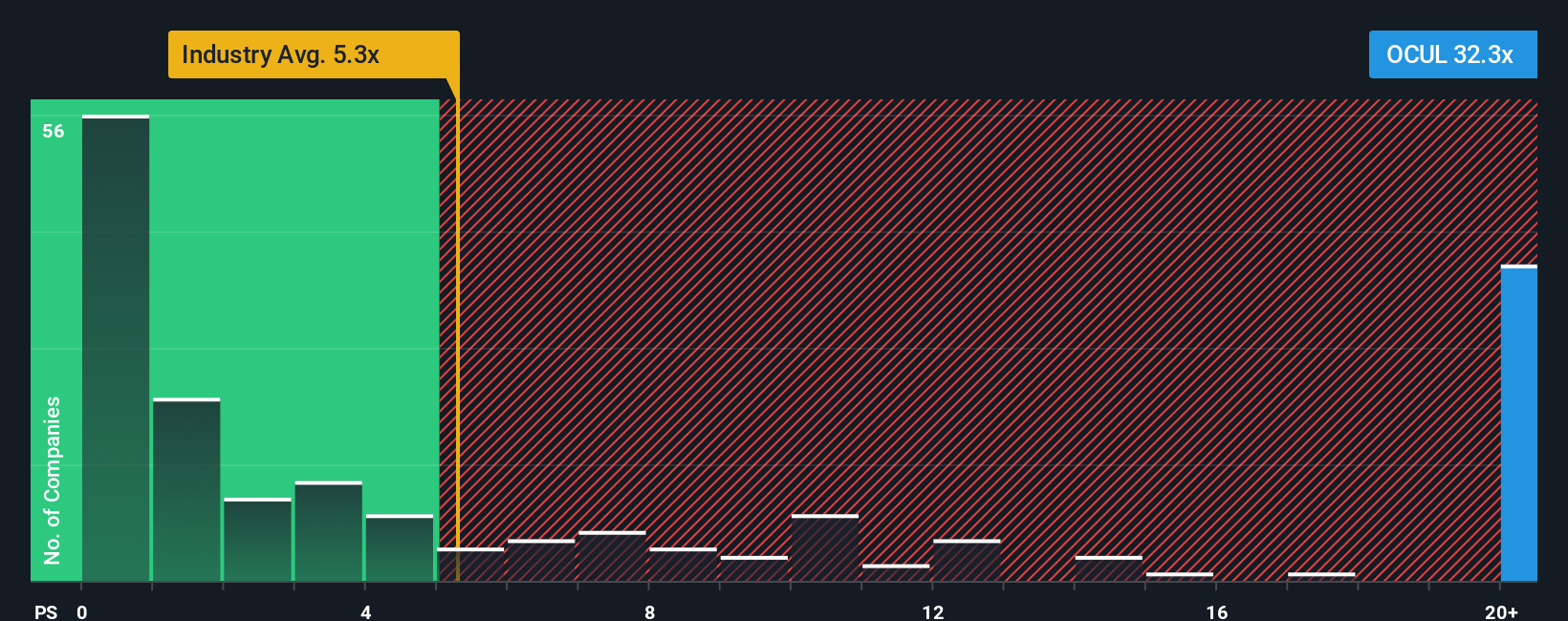

After such a large jump in price, Ocular Therapeutix's price-to-sales (or "P/S") ratio of 32.3x might make it look like a strong sell right now compared to other companies in the Pharmaceuticals industry in the United States, where around half of the companies have P/S ratios below 5.3x and even P/S below 1.4x are quite common. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Trump has pledged to "unleash" American oil and gas and these 15 US stocks have developments that are poised to benefit.

See our latest analysis for Ocular Therapeutix

How Has Ocular Therapeutix Performed Recently?

Ocular Therapeutix hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ocular Therapeutix.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Ocular Therapeutix would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period was better as it's delivered a decent 21% overall rise in revenue. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, revenue is anticipated to climb by 41% each year during the coming three years according to the twelve analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 18% each year, which is noticeably less attractive.

With this in mind, it's not hard to understand why Ocular Therapeutix's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Ocular Therapeutix's P/S

Ocular Therapeutix's P/S has grown nicely over the last month thanks to a handy boost in the share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Ocular Therapeutix maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Pharmaceuticals industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 2 warning signs for Ocular Therapeutix that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10