3 Asian Penny Stocks With Market Caps Over US$100M

Amid favorable trade deal news, Asian markets have been buoyant, reflecting optimism across various indices. Penny stocks, a term that may seem outdated but remains relevant, often represent smaller or newer companies with potential for growth. By focusing on those with strong financials and clear growth trajectories, investors can find opportunities in this niche market segment.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB4.02 | THB3.97B | ✅ 4 ⚠️ 0 View Analysis > |

| JBM (Healthcare) (SEHK:2161) | HK$2.95 | HK$2.4B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.46 | HK$921.19M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.51 | HK$2.09B | ✅ 3 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.485 | SGD196.57M | ✅ 4 ⚠️ 1 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.20 | HK$2B | ✅ 4 ⚠️ 1 View Analysis > |

| China Sunsine Chemical Holdings (SGX:QES) | SGD0.70 | SGD667.37M | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.54 | SGD10B | ✅ 5 ⚠️ 0 View Analysis > |

| Ekarat Engineering (SET:AKR) | THB0.95 | THB1.4B | ✅ 2 ⚠️ 2 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.95 | NZ$135.23M | ✅ 2 ⚠️ 5 View Analysis > |

Click here to see the full list of 970 stocks from our Asian Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Midland Holdings (SEHK:1200)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Midland Holdings Limited is an investment holding company that offers property agency services in Hong Kong, Macau, and Mainland China, with a market cap of HK$1.32 billion.

Operations: The company's revenue is primarily derived from its property agency services, with HK$6.02 billion generated from residential properties and HK$46.57 million from commercial, industrial properties, and shops.

Market Cap: HK$1.32B

Midland Holdings, with a market cap of HK$1.32 billion, primarily earns revenue from property agency services in Hong Kong, Macau, and Mainland China. The company has become profitable over the past year and is trading at 89.6% below its estimated fair value, indicating potential undervaluation compared to peers. Midland is debt-free with high-quality earnings and a strong Return on Equity of 32.2%. Recent developments include entering into a new Cross Referral Services Framework Agreement with Legend Upstar Holdings Limited for three years starting January 2025, reflecting stronger-than-expected performance in its estate agency business.

- Navigate through the intricacies of Midland Holdings with our comprehensive balance sheet health report here.

- Explore Midland Holdings' analyst forecasts in our growth report.

SenseTime Group (SEHK:20)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SenseTime Group Inc. is an investment holding company that researches, develops, and sells artificial intelligence software platforms across Mainland China, Northeast Asia, Southeast Asia, and internationally with a market cap of HK$64.76 billion.

Operations: The company's revenue is primarily generated from its Software & Programming segment, which accounted for CN¥3.77 billion.

Market Cap: HK$64.76B

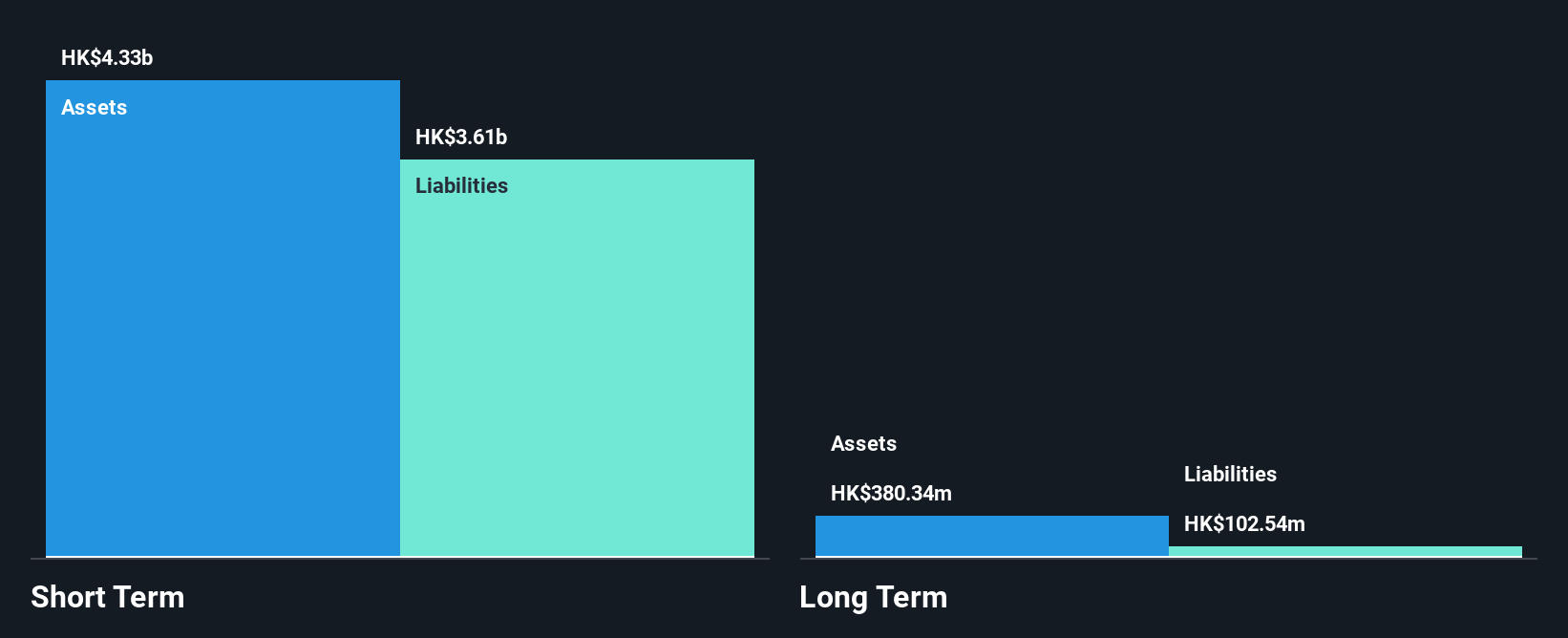

SenseTime Group, with a market cap of HK$64.76 billion, generates significant revenue from its Software & Programming segment, totaling CN¥3.77 billion. The company remains unprofitable and is not expected to achieve profitability in the next three years; however, it has reduced losses by 17.8% annually over the past five years. SenseTime's financial position is bolstered by short-term assets exceeding both short and long-term liabilities, and it maintains more cash than total debt. Recent developments include a HKD 2.5 billion follow-on equity offering and board changes with new executive directors appointed to strengthen governance structures.

- Unlock comprehensive insights into our analysis of SenseTime Group stock in this financial health report.

- Understand SenseTime Group's earnings outlook by examining our growth report.

Zhuzhou Tianqiao Crane (SZSE:002523)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhuzhou Tianqiao Crane Co., Ltd. manufactures and sells material handling equipment for industries such as electrolytic aluminum, steel, construction machinery, and non-ferrous sectors in China and internationally, with a market cap of CN¥5.69 billion.

Operations: Zhuzhou Tianqiao Crane Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥5.69B

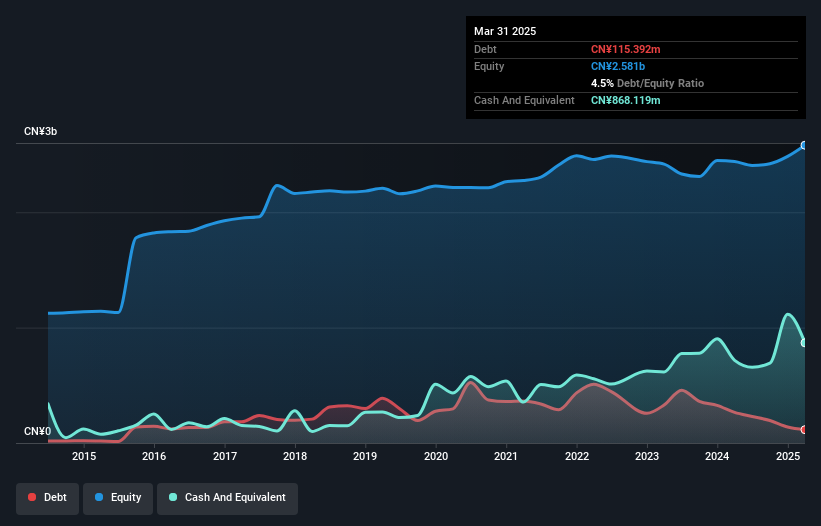

Zhuzhou Tianqiao Crane Co., Ltd., with a market cap of CN¥5.69 billion, has shown impressive earnings growth of 87.9% over the past year, surpassing industry averages, although its five-year trend shows a decline of 7.1% annually. The company's financial health is robust, with short-term assets significantly exceeding both long and short-term liabilities and more cash than total debt. Despite low return on equity at 1.6%, it effectively manages interest payments and has reduced its debt-to-equity ratio from 13.4% to 4.5%. Recent dividend affirmations highlight shareholder returns amidst stable weekly volatility at 4%.

- Click to explore a detailed breakdown of our findings in Zhuzhou Tianqiao Crane's financial health report.

- Explore historical data to track Zhuzhou Tianqiao Crane's performance over time in our past results report.

Next Steps

- Unlock more gems! Our Asian Penny Stocks screener has unearthed 967 more companies for you to explore.Click here to unveil our expertly curated list of 970 Asian Penny Stocks.

- Want To Explore Some Alternatives? We've found 17 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10