Discover LifeMD And 2 Other High Growth Stocks With Strong Insider Ownership

As the S&P 500 and Nasdaq Composite hit new highs, investors are closely watching for trade developments and major tech earnings that could influence market trends. In this climate of heightened anticipation, stocks with strong insider ownership can be particularly appealing, as they often signal confidence from those closest to the company.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Wallbox (WBX) | 24.6% | 75.8% |

| Super Micro Computer (SMCI) | 13.9% | 38.2% |

| Prairie Operating (PROP) | 34.4% | 80.8% |

| On Holding (ONON) | 17.4% | 22.7% |

| Niu Technologies (NIU) | 37.2% | 88.1% |

| FTC Solar (FTCI) | 23.1% | 62.5% |

| Credo Technology Group Holding (CRDO) | 11.7% | 36.9% |

| Atour Lifestyle Holdings (ATAT) | 22.9% | 23.6% |

| Astera Labs (ALAB) | 12.8% | 45.4% |

| ARS Pharmaceuticals (SPRY) | 14.3% | 63.1% |

Click here to see the full list of 185 stocks from our Fast Growing US Companies With High Insider Ownership screener.

Let's take a closer look at a couple of our picks from the screened companies.

LifeMD (LFMD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: LifeMD, Inc. is a direct-to-patient telehealth company in the United States that connects consumers with healthcare professionals for medical care, with a market cap of $485.83 million.

Operations: The company's revenue is derived from two main segments: Telehealth, contributing $180.05 million, and Worksimpli, adding $53.95 million.

Insider Ownership: 14.8%

Earnings Growth Forecast: 108.9% p.a.

LifeMD has seen significant insider selling over the past three months, yet it remains a growth-oriented company with a forecasted annual profit growth above market average. The company's revenue is expected to grow at 18.2% annually, surpassing the broader US market's 9% growth rate. Recent initiatives include expanded telehealth collaborations and discounted access to prescription treatments, supporting its vertically integrated platform in delivering comprehensive healthcare solutions efficiently across the U.S.

- Delve into the full analysis future growth report here for a deeper understanding of LifeMD.

- Our comprehensive valuation report raises the possibility that LifeMD is priced lower than what may be justified by its financials.

SES AI (SES)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SES AI Corporation focuses on developing and producing AI-enhanced lithium metal and lithium-ion rechargeable battery technologies for various applications, including electric vehicles and robotics, with a market cap of approximately $432.89 million.

Operations: SES AI Corporation's revenue segments include the development and production of advanced rechargeable battery technologies for electric vehicles, urban air mobility, drones, robotics, and battery energy storage systems in the U.S. and Asia Pacific.

Insider Ownership: 12.3%

Earnings Growth Forecast: 64.1% p.a.

SES AI is positioned for robust growth, with revenue forecasted to expand by 51% annually, outpacing the US market. The company anticipates becoming profitable within three years, driven by its innovative Molecular Universe platform. Recent developments include the launch of Deep Space, a feature designed to expedite battery R&D significantly. However, SES faces volatility and risks associated with emerging markets like EVs and UAMs, alongside challenges in achieving profitability and integrating its technology into commercial applications.

- Get an in-depth perspective on SES AI's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of SES AI shares in the market.

VTEX (VTEX)

Simply Wall St Growth Rating: ★★★★☆☆

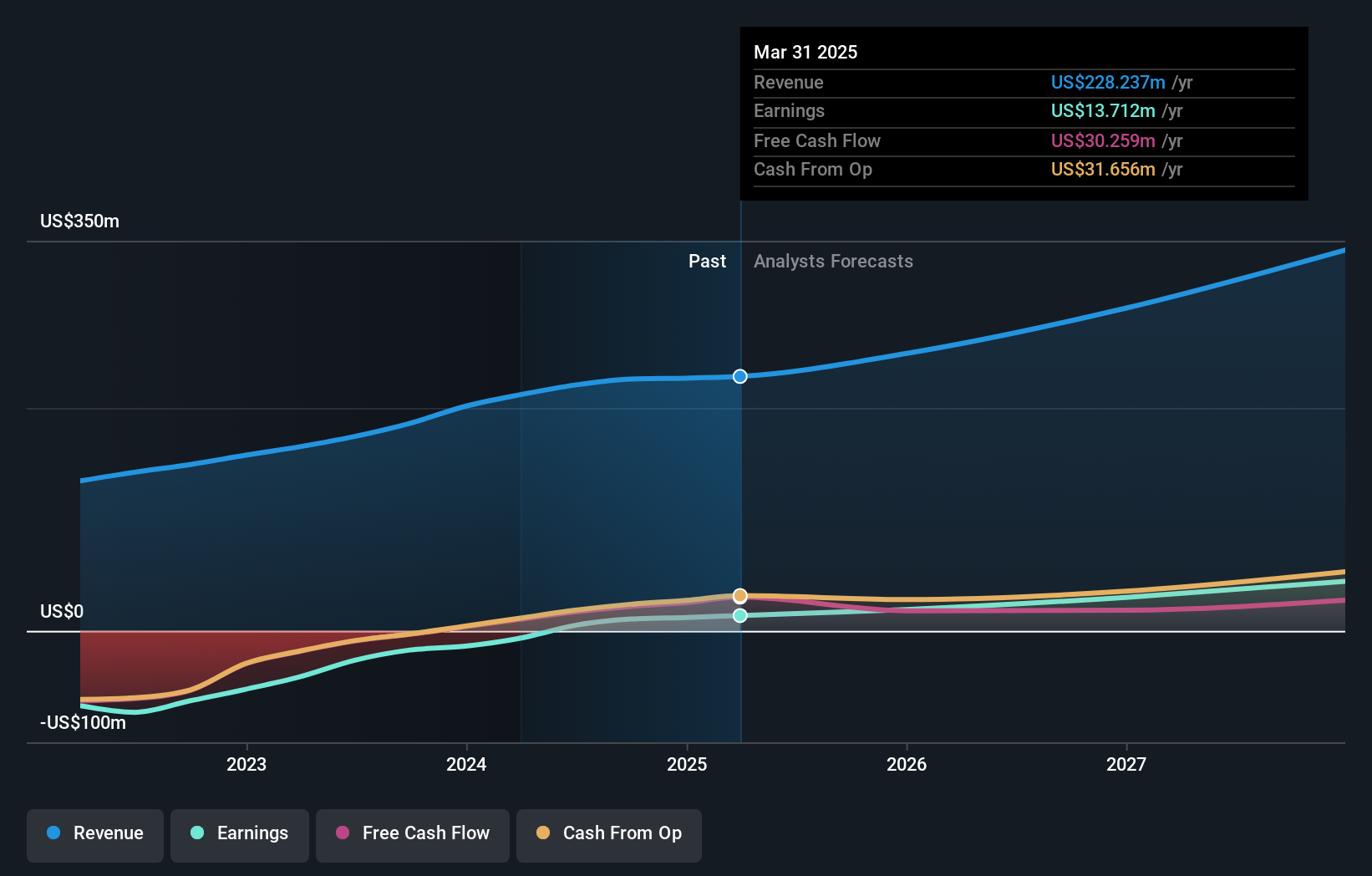

Overview: VTEX, along with its subsidiaries, offers a software-as-a-service digital commerce platform for enterprise brands and retailers, with a market cap of $1.15 billion.

Operations: The company's revenue is primarily derived from its Internet Software & Services segment, totaling $228.24 million.

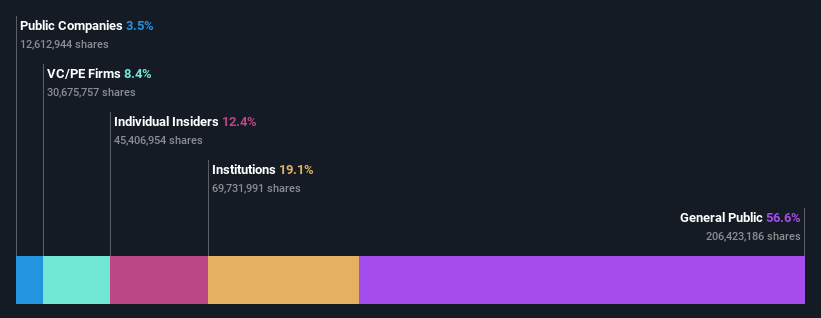

Insider Ownership: 39.6%

Earnings Growth Forecast: 34.5% p.a.

VTEX's recent inclusion in multiple Russell Growth indexes highlights its growth potential. The company has become profitable this year, with earnings expected to grow significantly at 34.52% annually, outpacing the US market. Despite a revenue growth forecast of 13.5% per year, which is below the 20% mark but above the US average, VTEX trades at a substantial discount to its estimated fair value. No significant insider trading activity has been reported recently.

- Click here to discover the nuances of VTEX with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that VTEX is priced higher than what may be justified by its financials.

Summing It All Up

- Unlock more gems! Our Fast Growing US Companies With High Insider Ownership screener has unearthed 182 more companies for you to explore.Click here to unveil our expertly curated list of 185 Fast Growing US Companies With High Insider Ownership.

- Interested In Other Possibilities? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10