High Growth Tech Stocks to Watch in the US July 2025

As the S&P 500 and Nasdaq Composite reach new highs, buoyed by strong corporate earnings and positive economic data, investors are keenly observing how these trends impact high-growth tech stocks in the United States. In a market environment characterized by optimism around earnings and trade developments, identifying stocks that demonstrate robust innovation and adaptability can be crucial for those looking to capitalize on growth opportunities within the tech sector.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 25.17% | 38.20% | ★★★★★★ |

| Circle Internet Group | 30.81% | 60.66% | ★★★★★★ |

| Ardelyx | 20.96% | 62.26% | ★★★★★★ |

| TG Therapeutics | 26.14% | 39.04% | ★★★★★★ |

| Alkami Technology | 20.57% | 76.67% | ★★★★★★ |

| AVITA Medical | 27.39% | 61.05% | ★★★★★★ |

| Alnylam Pharmaceuticals | 24.07% | 59.30% | ★★★★★★ |

| Ascendis Pharma | 34.90% | 59.91% | ★★★★★★ |

| Caris Life Sciences | 24.80% | 72.64% | ★★★★★★ |

| Lumentum Holdings | 21.59% | 106.24% | ★★★★★★ |

Click here to see the full list of 222 stocks from our US High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Blackbaud (BLKB)

Simply Wall St Growth Rating: ★★★★☆☆

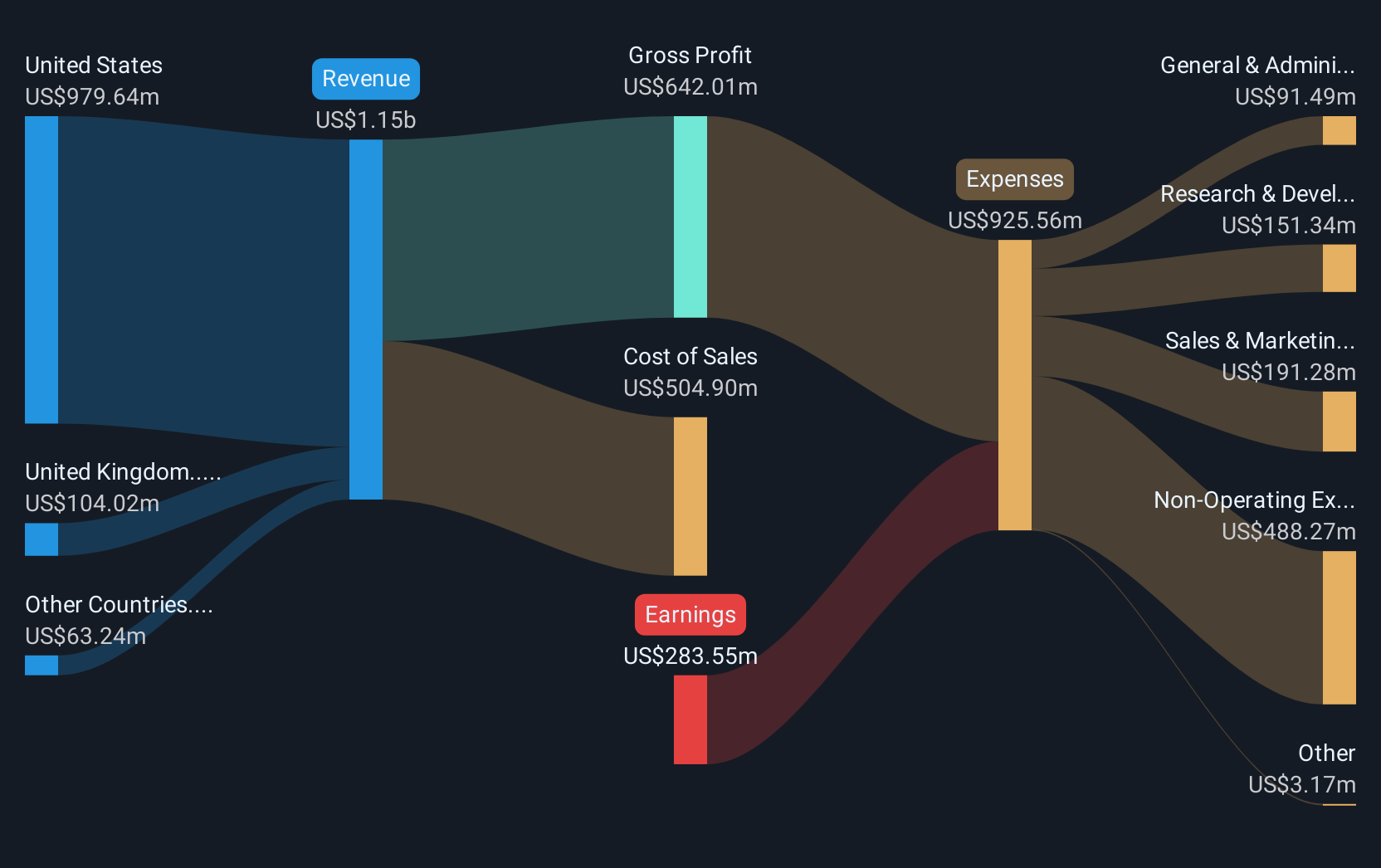

Overview: Blackbaud, Inc. provides cloud software and services globally, with a market capitalization of approximately $3.14 billion.

Operations: The company generates revenue primarily from its Software & Programming segment, which contributed $1.15 billion.

Blackbaud's strategic integration with Constant Contact, announced on July 8, 2025, exemplifies its commitment to enhancing digital engagement in the social impact sector. This collaboration introduces AI-driven marketing tools into Blackbaud’s Raiser's Edge NXT®, promising more effective supporter outreach through personalized multi-channel campaigns. Recent inclusion in multiple Russell indexes underscores market recognition and could influence investor perception positively. Despite a modest annual revenue growth forecast at 3.1%, Blackbaud is positioning itself innovatively by integrating cutting-edge technology to streamline operations and increase campaign efficacy, setting a foundation for potential future profitability enhancements.

- Take a closer look at Blackbaud's potential here in our health report.

Review our historical performance report to gain insights into Blackbaud's's past performance.

Dynavax Technologies (DVAX)

Simply Wall St Growth Rating: ★★★★☆☆

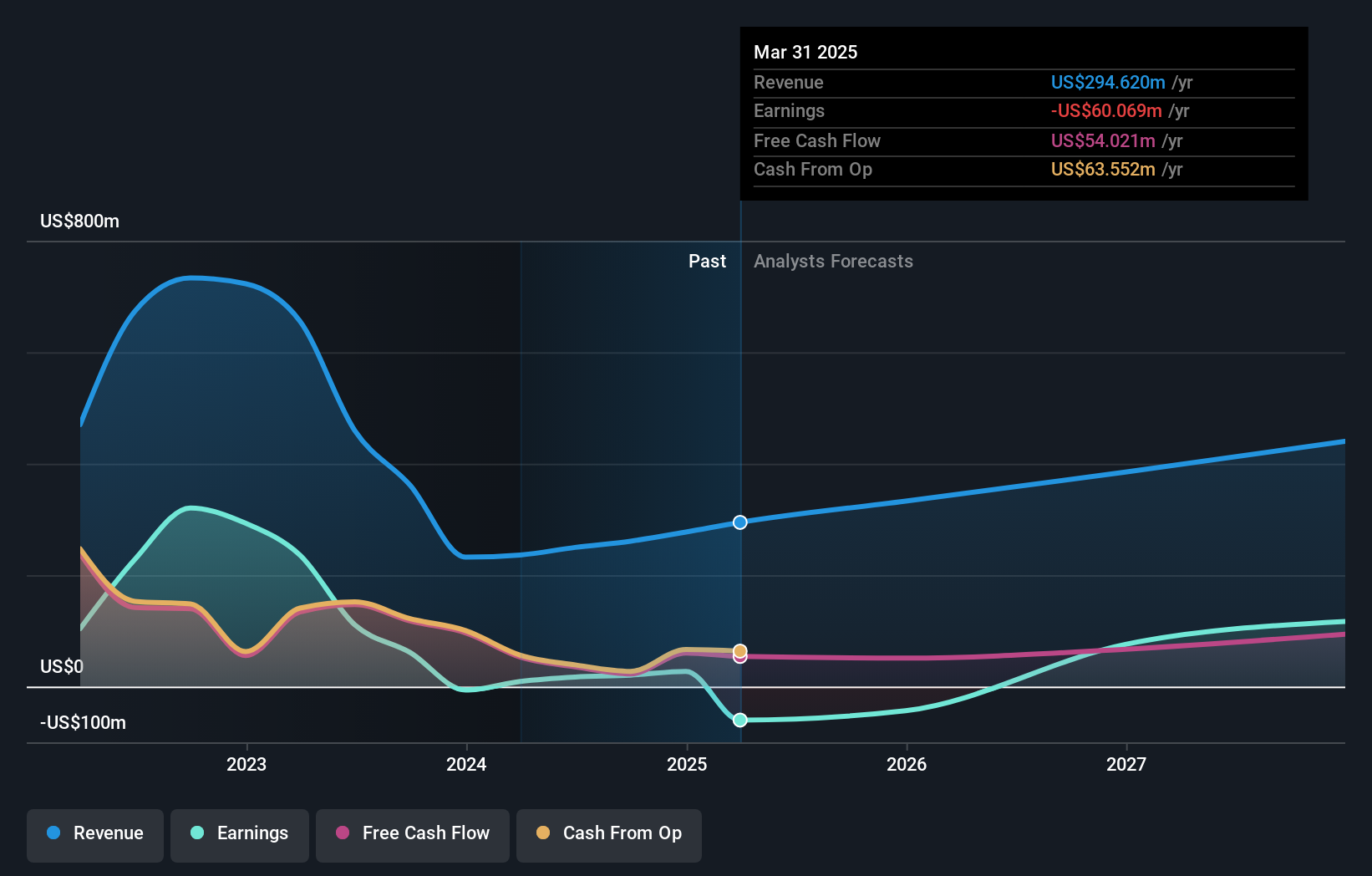

Overview: Dynavax Technologies Corporation is a commercial-stage biopharmaceutical company that develops and commercializes vaccines both in the United States and internationally, with a market cap of approximately $1.36 billion.

Operations: Dynavax Technologies focuses on the discovery, development, and commercialization of novel vaccines, generating $294.62 million in revenue from these activities.

Despite recent setbacks, including being dropped from several Russell indices, Dynavax Technologies remains a company to watch in the biotech sector. Its strategic focus on vaccine development has led to substantial revenue growth, with a reported increase from $50.79 million to $68.16 million year-over-year as of Q1 2025. However, challenges persist as evidenced by a significant net loss increase to $96.1 million in the same period. The company's commitment is further demonstrated through its aggressive share repurchase program, buying back 7.4 million shares for $94.36 million within five months of 2025, underscoring confidence in its long-term strategy despite current volatility.

- Click to explore a detailed breakdown of our findings in Dynavax Technologies' health report.

Gain insights into Dynavax Technologies' historical performance by reviewing our past performance report.

QuinStreet (QNST)

Simply Wall St Growth Rating: ★★★★☆☆

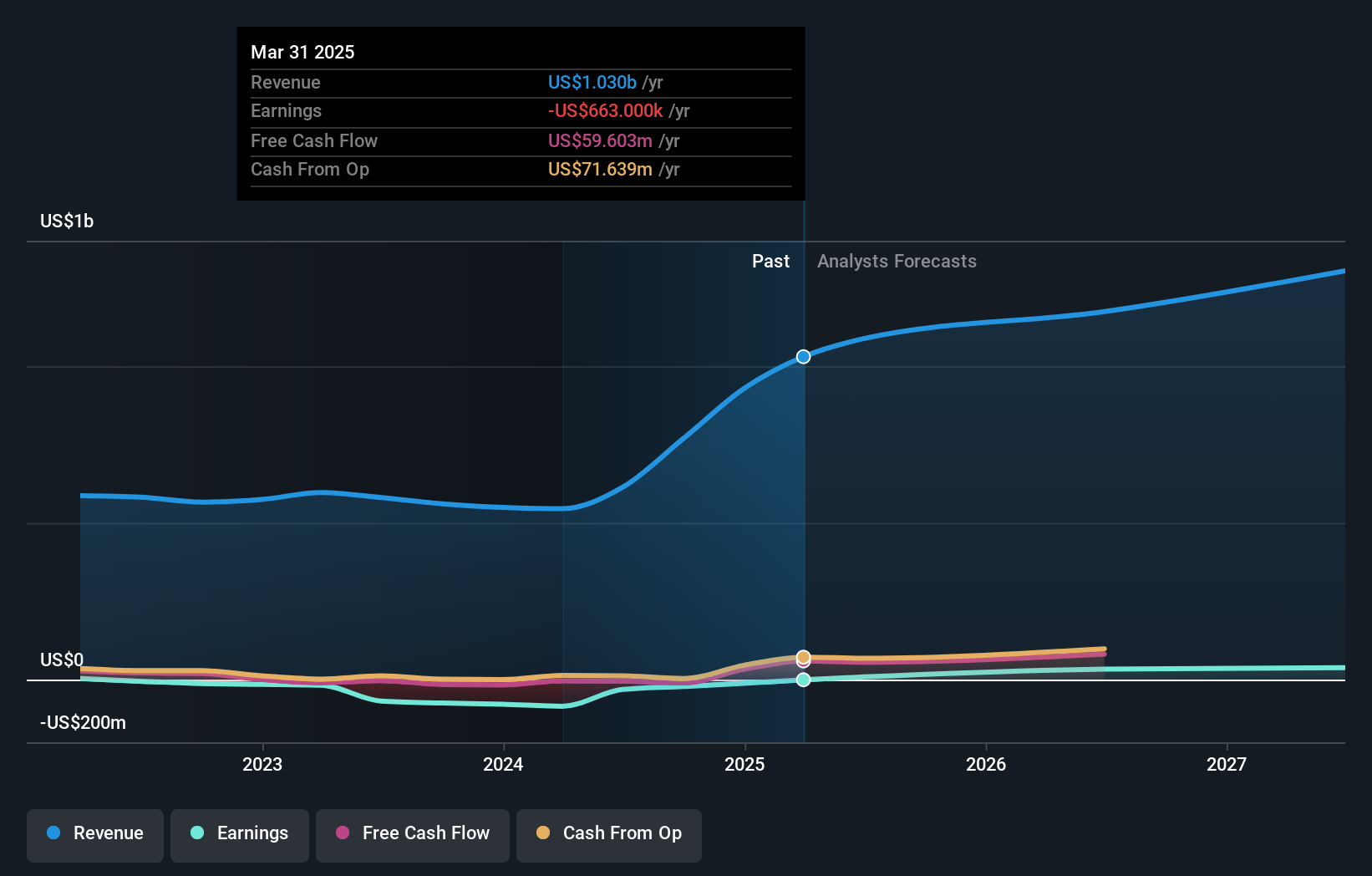

Overview: QuinStreet, Inc. is an online performance marketing company that offers customer acquisition services both in the United States and internationally, with a market cap of $929.46 million.

Operations: QuinStreet generates revenue primarily through its direct marketing segment, which accounts for $1.03 billion. The company's focus is on providing customer acquisition services to clients across various industries in the U.S. and internationally.

QuinStreet, a participant in the competitive tech landscape, has demonstrated a notable turnaround with its recent earnings. In Q3 2025, the company reported a shift to profitability with net income of $4.42 million compared to a loss the previous year, alongside robust sales growth from $168.59 million to $269.84 million. This financial rebound is underpinned by strategic presentations at multiple industry conferences, signaling active engagement within the tech community and potential for sustained growth. Moreover, QuinStreet's commitment to innovation is evident as they maintain guidance for annual revenues between $1.065 billion and $1.105 billion for 2025, reflecting an optimistic outlook on their operational strategies and market positioning.

- Navigate through the intricacies of QuinStreet with our comprehensive health report here.

Examine QuinStreet's past performance report to understand how it has performed in the past.

Next Steps

- Investigate our full lineup of 222 US High Growth Tech and AI Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10