Should Infosys AI-First Collaboration Prompt Action From Telstra (ASX:TLS) Investors?

- Earlier this week, Infosys announced an expanded partnership with Telstra International to accelerate the modernization of Telstra’s global operations by deploying an AI-first approach and aligning with the company’s Connected Future 30 strategy.

- This collaboration is designed to enhance operational efficiency and advance Telstra’s adoption of artificial intelligence, positioning the company to better meet customer needs and unlock new areas of business growth.

- We'll explore how Infosys's AI-first collaboration could enhance Telstra's operational efficiency and shape its overall investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Telstra Group Investment Narrative Recap

To be a Telstra shareholder, one needs to have confidence in its ability to maintain telecommunications leadership while managing the costs and complexities of innovation and global expansion. The recently announced Infosys partnership accelerates Telstra’s AI and operational initiatives but does not appear to materially impact the timeline or risk profile relating to its intercity fiber network rollout, currently the company’s biggest short-term catalyst and a major risk if delays persist.

Among recent announcements, the November 2023 expansion of Telstra’s intercity fibre network stands out, given its role in driving long-term revenue growth. While the Infosys collaboration highlights operational advances and international focus, successful fiber rollout directly addresses rising connectivity demand and remains key to capital efficiency and future earnings momentum.

But even as Telstra advances its AI ambitions globally, investors should not overlook the cost pressures and execution risks surrounding Australia’s critical infrastructure build…

Read the full narrative on Telstra Group (it's free!)

Telstra Group's outlook anticipates A$25.0 billion in revenue and A$2.5 billion in earnings by 2028. This is based on a projected 2.6% annual revenue growth rate and a A$0.8 billion increase in earnings from the current A$1.7 billion.

Uncover how Telstra Group's forecasts yield a A$4.84 fair value, in line with its current price.

Exploring Other Perspectives

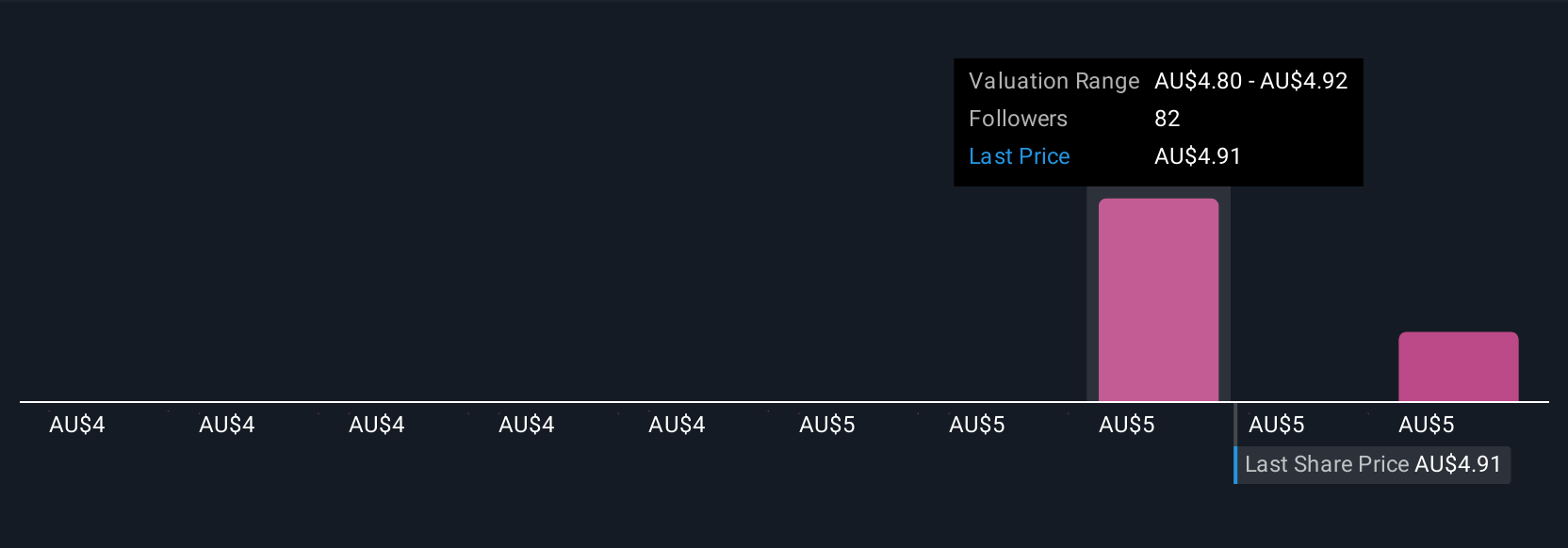

Four members of the Simply Wall St Community set fair value estimates for Telstra between A$4.02 and A$5.14 per share. While these opinions vary, the ongoing capacity and cost challenges in the intercity fiber network remain central for future expectations, take a look at several viewpoints to see how others frame this issue.

Explore 4 other fair value estimates on Telstra Group - why the stock might be worth 18% less than the current price!

Build Your Own Telstra Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Telstra Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Telstra Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Telstra Group's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

- Uncover 16 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telstra Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10