Top Asian Dividend Stocks To Consider In July 2025

As global markets experience a boost from favorable trade deals, Asian indices have shown positive momentum, with regions like Japan and China benefiting from recent agreements. In this environment, dividend stocks in Asia can offer investors a stable income stream and potential for growth, making them an attractive option to explore.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.24% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.13% | ★★★★★★ |

| NCD (TSE:4783) | 4.13% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.43% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.25% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.42% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.06% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.44% | ★★★★★★ |

| Daicel (TSE:4202) | 4.59% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.93% | ★★★★★★ |

Click here to see the full list of 1159 stocks from our Top Asian Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

China BlueChemical (SEHK:3983)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China BlueChemical Ltd., with a market cap of HK$10.56 billion, is involved in processing natural gas and developing, producing, and selling chemical fertilizers and chemical products both in China and internationally.

Operations: China BlueChemical Ltd.'s revenue segments are comprised of CN¥3.71 billion from Urea, CN¥3.09 billion from Methanol, CN¥2.01 billion from Acrylonitrile, and CN¥2.69 billion from Phosphorus and Compound Fertiliser.

Dividend Yield: 5.7%

China BlueChemical's dividend payments, while covered by earnings and cash flows, have been volatile over the past decade. A recent dividend decrease to RMB 0.1208 per share reflects this instability. Despite a reasonable payout ratio of 52%, profit margins have declined from 18.3% to 9%. The company's price-to-earnings ratio is favorable at 9x compared to the Hong Kong market average of 12x, but its yield remains below top-tier levels in the region.

- Take a closer look at China BlueChemical's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that China BlueChemical is priced higher than what may be justified by its financials.

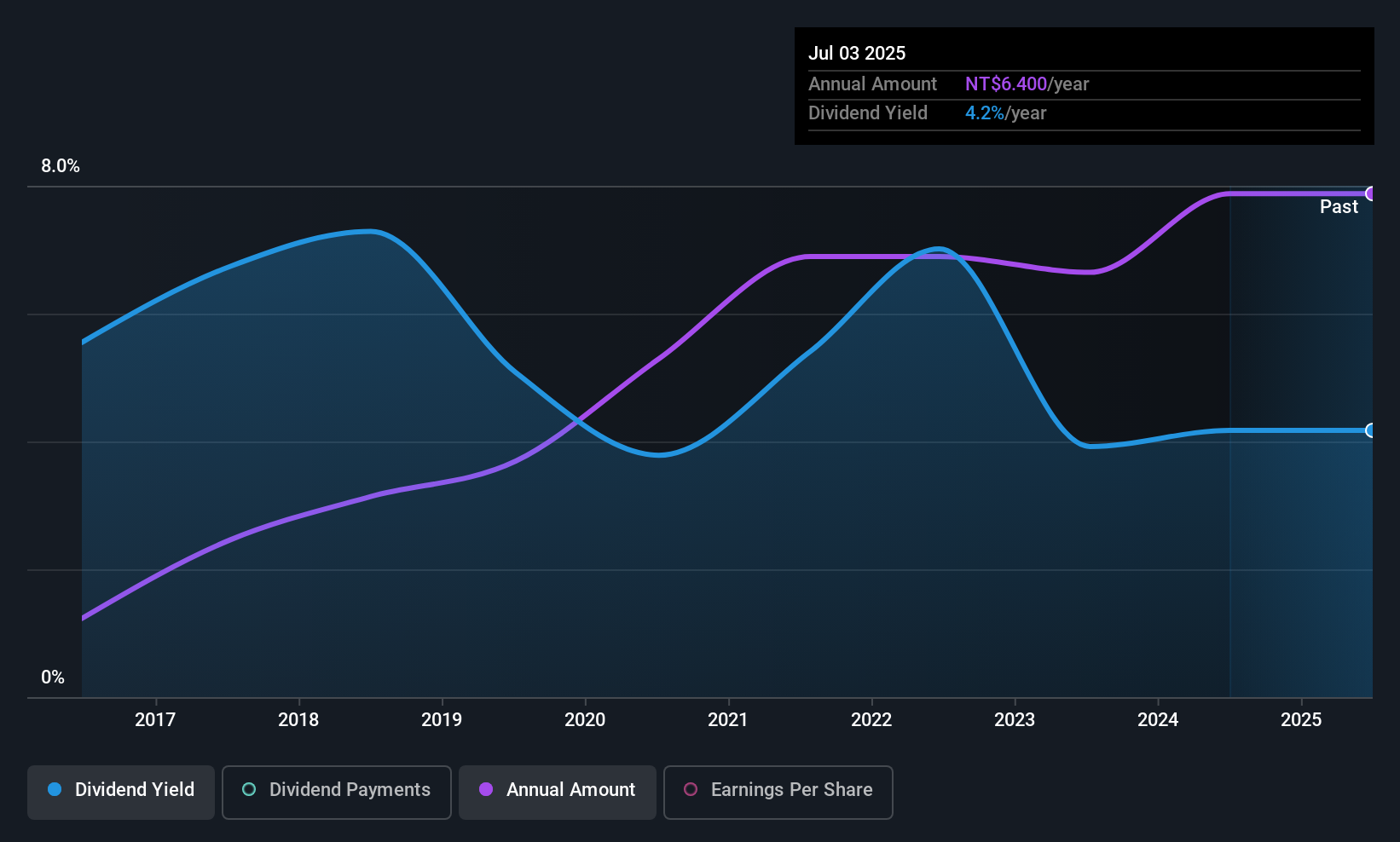

Argosy Research (TPEX:3217)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Argosy Research Inc. manufactures and sells electronic components and connectors across Asia, the United States, and internationally, with a market cap of NT$15.34 billion.

Operations: Argosy Research Inc.'s revenue from its manufacturing and sales of electronic component products is NT$3.71 billion.

Dividend Yield: 3.8%

Argosy Research's dividend payments have been unreliable over the past decade, with volatility noted despite recent increases to TWD 8.81 per share. The company's dividends are covered by earnings and cash flows, with payout ratios of 62.3% and 56.8%, respectively. A recent share buyback completed for TWD 19.51 million may positively impact future distributions due to a reduced number of outstanding shares, though the dividend yield remains below top-tier levels in Taiwan's market.

- Dive into the specifics of Argosy Research here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Argosy Research shares in the market.

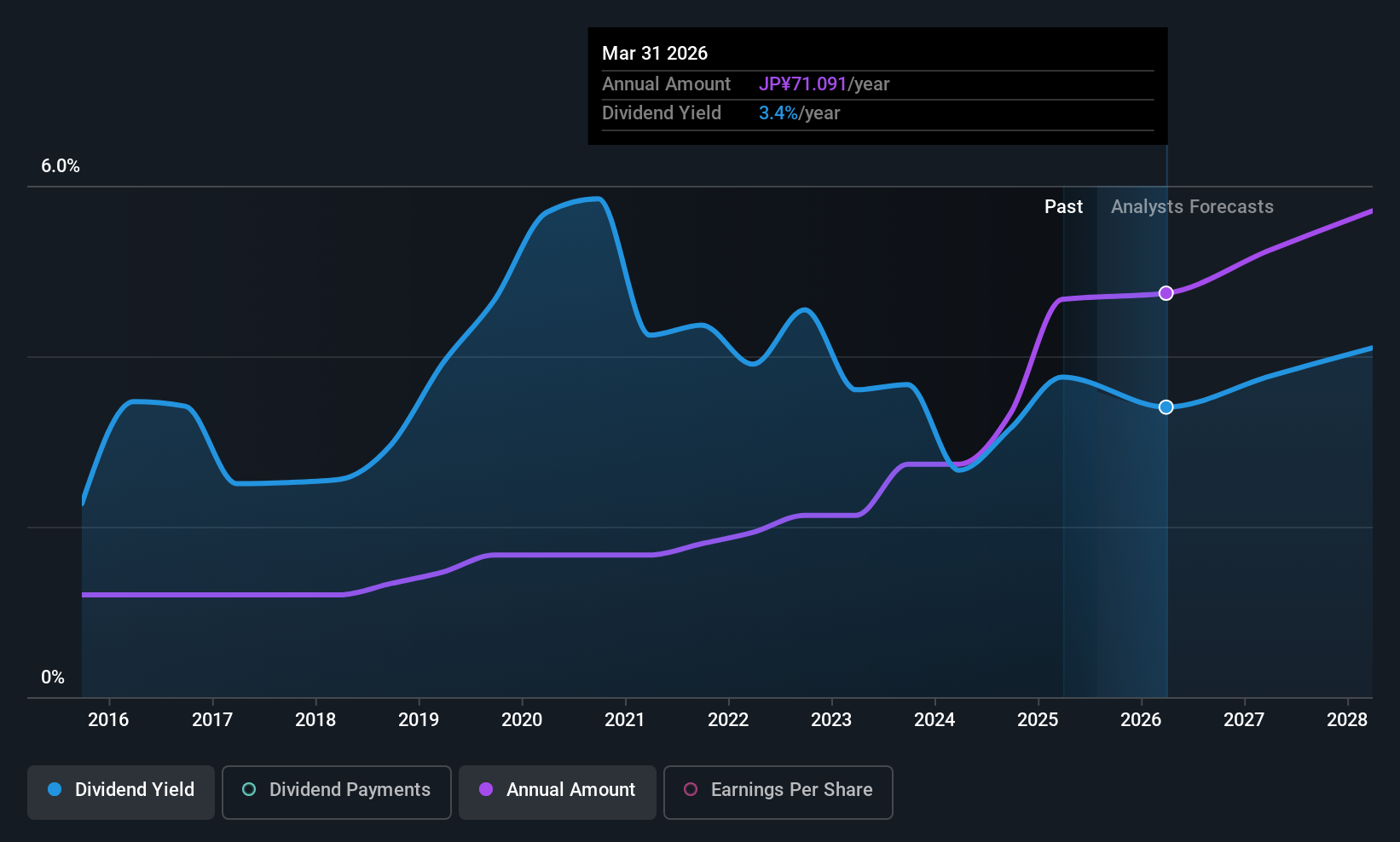

Mitsubishi UFJ Financial Group (TSE:8306)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mitsubishi UFJ Financial Group, Inc. is a bank holding company involved in various financial services across Japan, the United States, Europe, Asia/Oceania, and globally with a market cap of ¥24.69 trillion.

Operations: Mitsubishi UFJ Financial Group generates revenue primarily from its Customer Business segments, including Retail & Digital Business Group (¥944.60 billion), Japanese Corporate & Investment Banking (¥1.03 trillion), Global Commercial Banking Business Headquarters (¥969.30 billion), Global Corporate & Investment Banking Business Group (¥913 billion), and Commercial Banking & Wealth Management Business Group (¥726.60 billion), along with the Asset Management & Investor Services Business Group contributing ¥534.20 billion, while the Global Markets Business Group reported a negative revenue of ¥330.60 million.

Dividend Yield: 3.2%

Mitsubishi UFJ Financial Group offers a stable dividend history, with payments increasing over the past decade and a current yield of 3.25%, though this is below Japan's top-tier payers. The payout ratio stands at 58.9%, indicating dividends are covered by earnings. Recent strategic alliances, such as with Curiosity Lab, may enhance growth prospects but have no immediate impact on dividends. A share buyback worth ¥169 billion could improve shareholder value despite recent dividend guidance suggesting a decrease to ¥35 per share for fiscal year 2026.

- Delve into the full analysis dividend report here for a deeper understanding of Mitsubishi UFJ Financial Group.

- According our valuation report, there's an indication that Mitsubishi UFJ Financial Group's share price might be on the expensive side.

Make It Happen

- Get an in-depth perspective on all 1159 Top Asian Dividend Stocks by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10