Here's Why We Think Westpac Banking (ASX:WBC) Is Well Worth Watching

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Westpac Banking (ASX:WBC), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Westpac Banking's Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Over the last three years, Westpac Banking has grown EPS by 12% per year. That's a pretty good rate, if the company can sustain it.

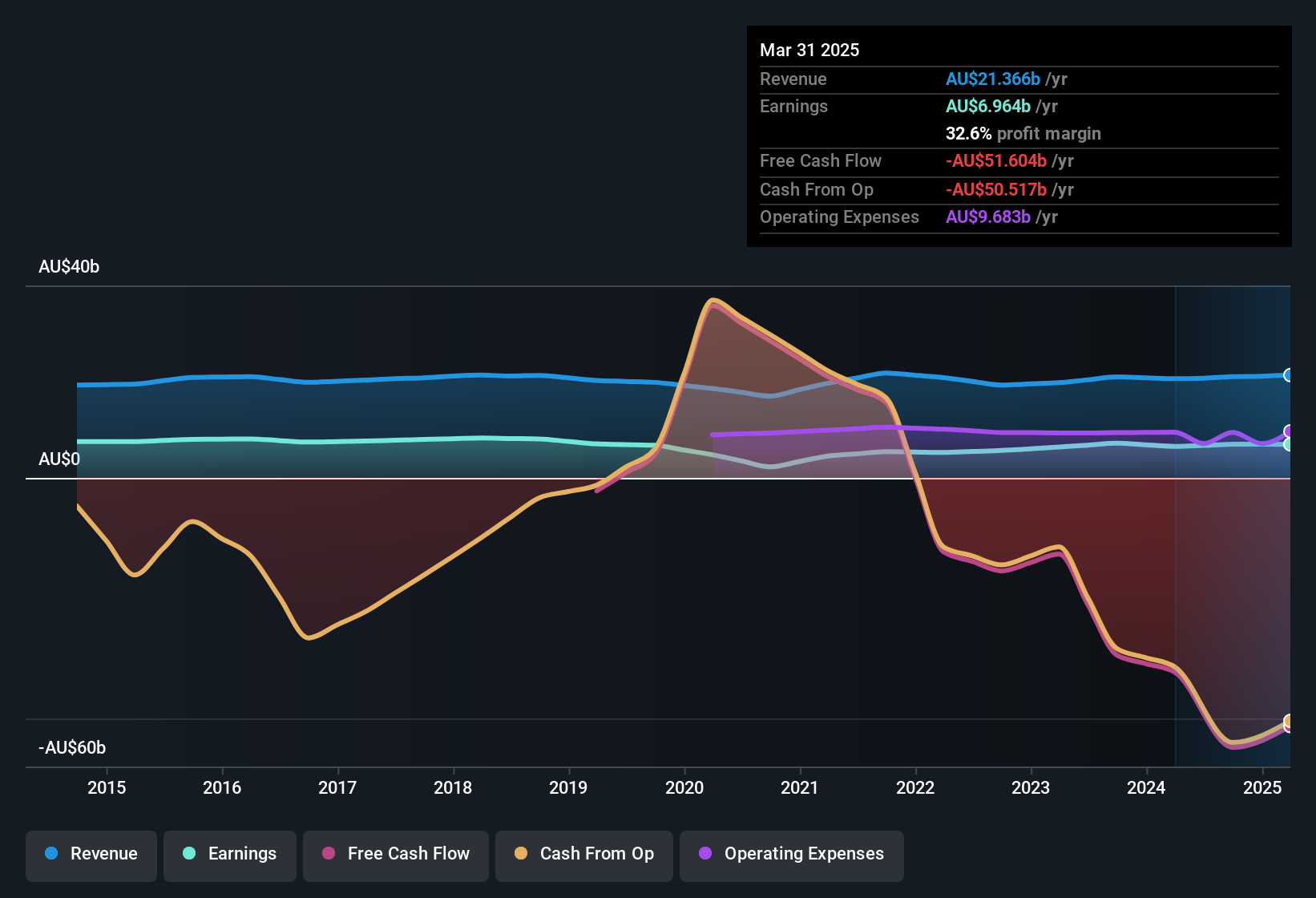

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Not all of Westpac Banking's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. While we note Westpac Banking achieved similar EBIT margins to last year, revenue grew by a solid 3.7% to AU$21b. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

See our latest analysis for Westpac Banking

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Westpac Banking.

Are Westpac Banking Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Belief in the company remains high for insiders as there hasn't been a single share sold by the management or company board members. But more importantly, Independent Non-Executive Director Andy Maguire spent AU$214k acquiring shares, doing so at an average price of AU$32.40. Strong buying like that could be a sign of opportunity.

On top of the insider buying, it's good to see that Westpac Banking insiders have a valuable investment in the business. To be specific, they have AU$55m worth of shares. This considerable investment should help drive long-term value in the business. While their ownership only accounts for 0.05%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. The cherry on top is that the CEO, Anthony Miller is paid comparatively modestly to CEOs at similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like Westpac Banking, with market caps over AU$12b, is about AU$6.4m.

The Westpac Banking CEO received AU$3.6m in compensation for the year ending September 2024. That is actually below the median for CEO's of similarly sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Does Westpac Banking Deserve A Spot On Your Watchlist?

One positive for Westpac Banking is that it is growing EPS. That's nice to see. In addition, insiders have been busy adding to their sizeable holdings in the company. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. You should always think about risks though. Case in point, we've spotted 2 warning signs for Westpac Banking you should be aware of, and 1 of them shouldn't be ignored.

Keen growth investors love to see insider activity. Thankfully, Westpac Banking isn't the only one. You can see a a curated list of Australian companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Westpac Banking might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10