Citigroup (C) Appointed Depositary Bank for Youlife ADR Program on Nasdaq

Citigroup (C) has recently been designated as the depositary bank for Youlife Group Inc.'s ADR program, a move reinforcing its prominent role in global financial services. Over the last quarter, Citigroup shares have experienced a significant price increase of 41%, driven in part by robust financial performance, including a net income rise and strategic initiatives like its substantial buyback program. These developments align with a broader market uptrend, where the overall market has risen, adding weight to Citigroup's impressive quarterly performance, as they report increasing dividends and secure strategic partnerships.

Buy, Hold or Sell Citigroup? View our complete analysis and fair value estimate and you decide.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

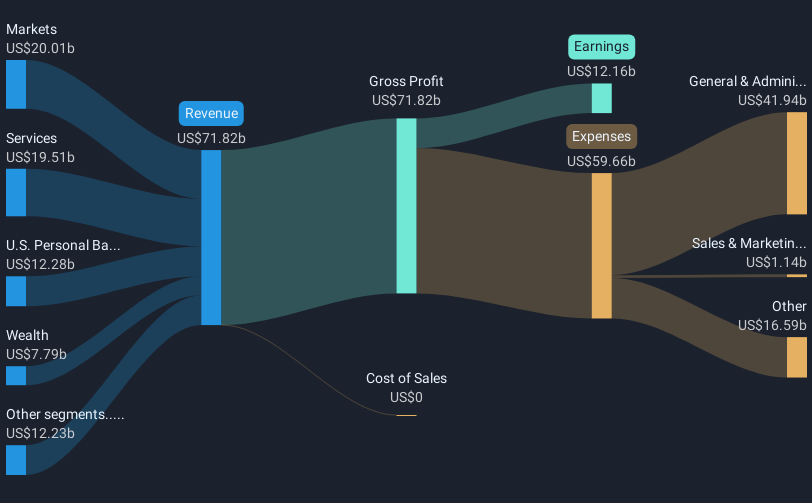

Citigroup's recent role as the depositary bank for Youlife Group Inc.'s ADR program could enhance its global financial service reputation, potentially boosting both its revenue and earnings forecasts. By securing this strategic partnership, Citigroup may see increased revenue from transaction fees, positively impacting future financial performance as indicated by bullish analyst expectations. The development is part of Citigroup's broader strategic initiatives aimed at increasing operational efficiency and client acquisition through AI and infrastructure modernization.

Over the last five years, Citigroup has achieved a total shareholder return of 120.67%, including share price growth and dividends. This performance highlights a consistent upward trend, contrasting with the company's recent significant 41% increase in shares over the last quarter alone. On a one-year basis, Citigroup's earnings growth of 85.6% surpassed the Banks industry's 7.7% growth, further signifying its strong performance against market standards.

The current share price of US$95.99 remains slightly below the analyst consensus price target of US$99.45. This indicates moderate room for appreciation according to the current market sentiment. The company's ongoing investments in wealth management and AI could align with optimistic forecasts for revenue, which bullish analysts expect to grow by 8.3% annually over the next three years. However, potential global trade and economic uncertainties could pose risks to these optimistic projections.

Understand Citigroup's earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10