Why Indivior (INDV) Is Up 7.1% After London Delisting for Sole Nasdaq Listing and What's Next

- On July 25, 2025, Indivior completed its delisting from the London Stock Exchange, maintaining a sole primary listing on the Nasdaq Stock Market.

- This shift puts a sharper spotlight on the company's US market focus and may streamline how global investors access Indivior shares.

- We'll explore how the London delisting sharpens Indivior's profile for US-based investors and influences its investment narrative going forward.

This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

What Is Indivior's Investment Narrative?

To own Indivior shares, investors generally need to believe in the company’s ability to carve out a stronger US-focused profile and demonstrate the real-world impact of products like SUBLOCADE and BUP-XR, especially in treating opioid use disorder. The recent delisting from the London Stock Exchange, with trading now solely on Nasdaq, reinforces this US-centered ambition and could make Indivior more visible to American institutional investors. This shift, combined with the company’s entry into the S&P Global BMI Index, may bring short-term interest but likely does not remove the most prominent risks: persistently high debt levels, negative equity, and an unprofitable core business, as highlighted by the most recent earnings. Ongoing real-world product results and recent regulatory wins are encouraging, but the impact of the delisting appears more administrative than transformative for near-term financial catalysts or risk factors. On the other hand, the company’s persistently high debt level remains a detail investors should not overlook.

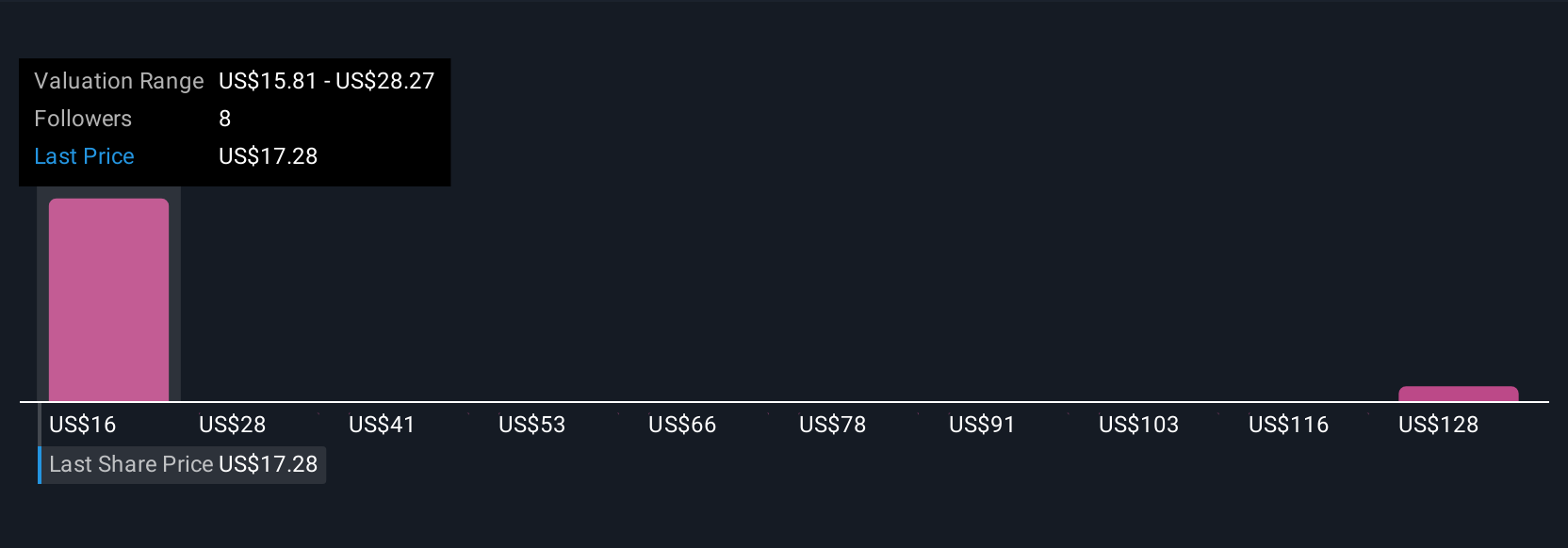

Indivior's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 3 other fair value estimates on Indivior - why the stock might be worth over 8x more than the current price!

Build Your Own Indivior Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Indivior research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Indivior research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Indivior's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover 14 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10