3 Dividend Stocks Offering Yields From 3% To 4.9%

The United States market has experienced a notable upswing, climbing 1.7% over the past week with all sectors showing positive movement, and an impressive 18% rise over the past year. In this robust environment, selecting dividend stocks with yields ranging from 3% to 4.9% can be a strategic choice for investors seeking steady income alongside potential growth as earnings are forecast to grow by 15% annually.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Universal (UVV) | 5.88% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.46% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.69% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.17% | ★★★★★★ |

| Ennis (EBF) | 5.49% | ★★★★★★ |

| Dillard's (DDS) | 5.26% | ★★★★★★ |

| Credicorp (BAP) | 4.63% | ★★★★★☆ |

| CompX International (CIX) | 4.90% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.91% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.66% | ★★★★★☆ |

Click here to see the full list of 136 stocks from our Top US Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

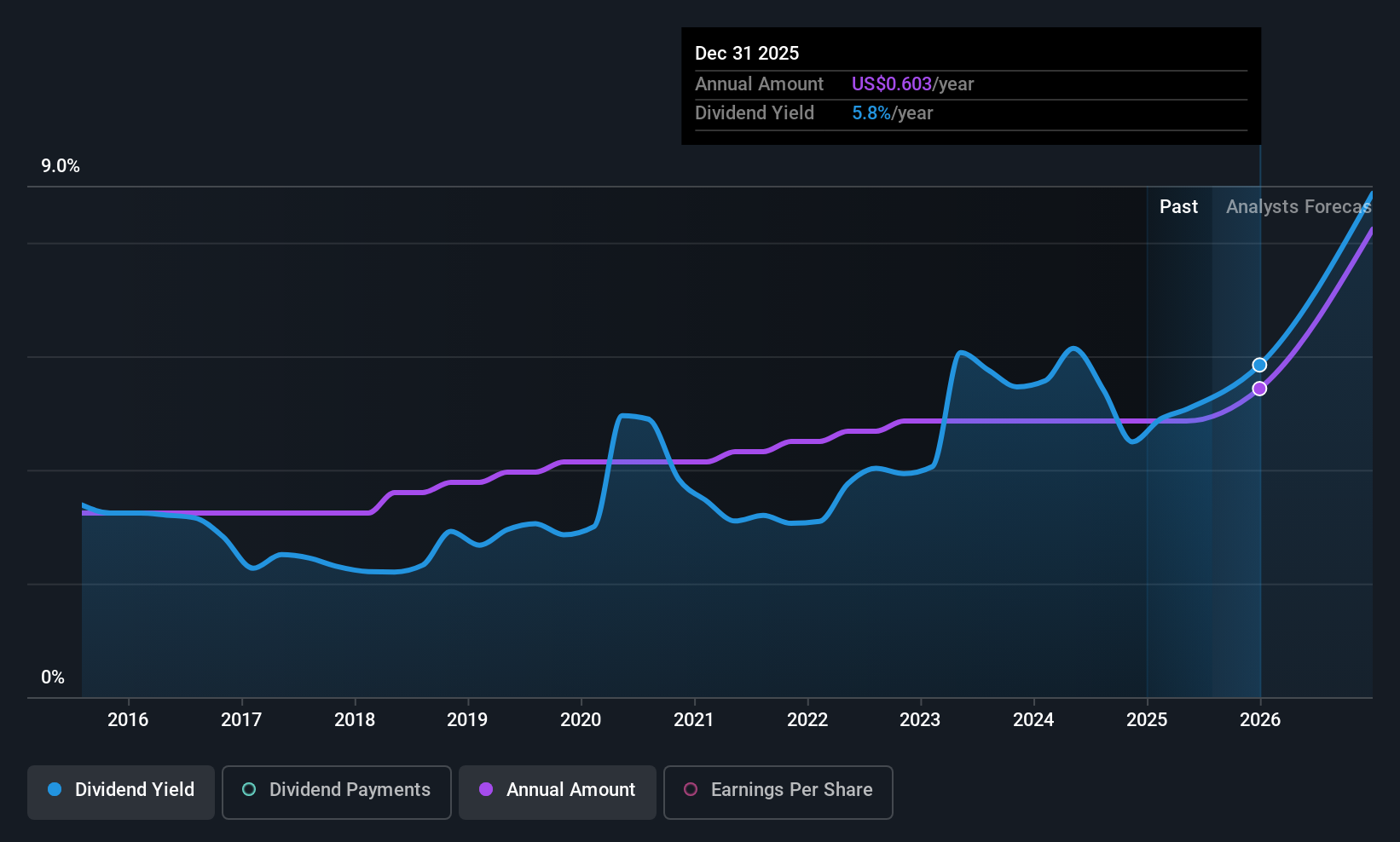

Brookline Bancorp (BRKL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Brookline Bancorp, Inc. is a bank holding company for Brookline Bank, offering commercial, business, and retail banking products and services to corporate, municipal, and retail customers in the United States with a market cap of $986.39 million.

Operations: Brookline Bancorp generates its revenue primarily from its banking business, which accounted for $338.57 million.

Dividend Yield: 4.9%

Brookline Bancorp has demonstrated stable and reliable dividend payments over the past decade, with a recent quarterly dividend of US$0.135 per share. The company's payout ratio of 65.7% suggests dividends are covered by earnings, supported by rising net income—US$22.03 million in Q2 2025 compared to US$16.37 million a year ago. Although recently dropped from the Russell 2000 Dynamic Index, its current dividend yield of 4.91% remains attractive among top-tier U.S. payers.

- Unlock comprehensive insights into our analysis of Brookline Bancorp stock in this dividend report.

- In light of our recent valuation report, it seems possible that Brookline Bancorp is trading behind its estimated value.

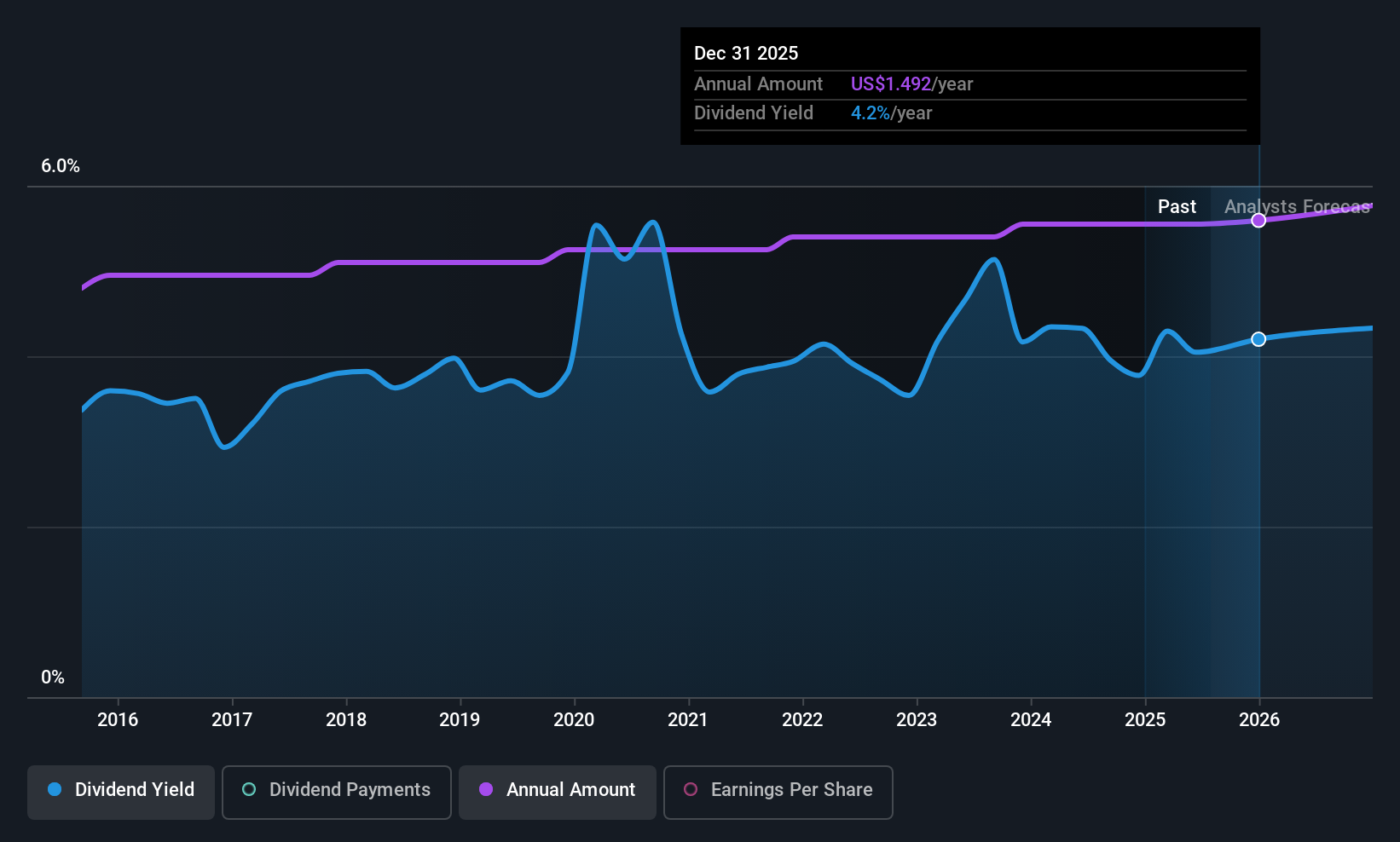

United Bankshares (UBSI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: United Bankshares, Inc. operates as a provider of commercial and retail banking products and services in the United States with a market cap of approximately $5.26 billion.

Operations: United Bankshares, Inc. generates revenue through its subsidiaries by offering a range of commercial and retail banking products and services across the United States.

Dividend Yield: 4%

United Bankshares has consistently increased dividends for 51 years, with a stable payout ratio of 54.8% indicating coverage by earnings. The recent dividend was US$0.37 per share, yielding 4.02%, which is below the top U.S. payers' average of 4.52%. In Q2 2025, net income rose to US$120.72 million from US$96.51 million year-over-year, despite rising net charge-offs and ongoing share buybacks totaling US$65.59 million since May 2022.

- Click here and access our complete dividend analysis report to understand the dynamics of United Bankshares.

- The analysis detailed in our United Bankshares valuation report hints at an deflated share price compared to its estimated value.

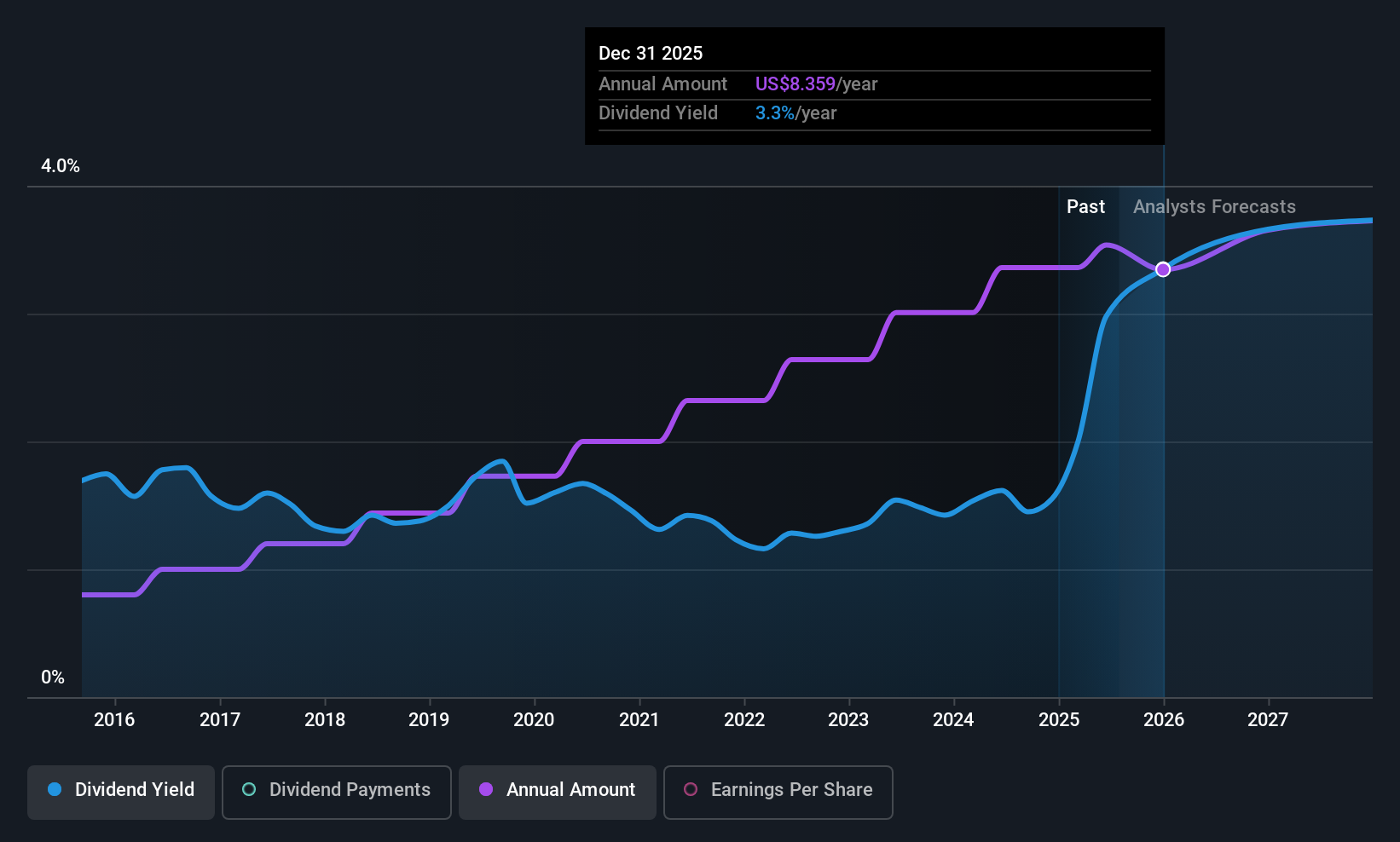

UnitedHealth Group (UNH)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: UnitedHealth Group Incorporated is a healthcare company that operates both in the United States and internationally, with a market cap of $258.65 billion.

Operations: UnitedHealth Group's revenue segments include United Healthcare at $307.47 billion, Optum Rx at $137.53 billion, Optum Health at $103.94 billion, and Optum Insight at $18.89 billion.

Dividend Yield: 3%

UnitedHealth Group's dividend payments are well-covered, with a payout ratio of 34.9% and cash payout ratio of 32.3%. The company pays a reliable dividend yield of 3.02%, although this is below the top U.S. payers' average. Recent executive changes include Mike Cotton leading Medicaid and Bobby Hunter overseeing government programs as CEO, while Stephen Hemsley returned as CEO amid strategic shifts like exiting Latin America and addressing legal settlements totaling US$69 million related to its 401(k) plan fiduciary duties breach.

- Click here to discover the nuances of UnitedHealth Group with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of UnitedHealth Group shares in the market.

Make It Happen

- Get an in-depth perspective on all 136 Top US Dividend Stocks by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10