3 Promising Penny Stocks With Market Caps Up To $600M

The market has climbed by 1.7% over the past week, and 18% in the last year, with earnings forecast to grow by 15% annually. Though the term 'penny stock' might sound like a relic of past trading days, these smaller or newer companies can still present significant opportunities for investors when built on solid financials. We've selected three examples of penny stocks that combine balance sheet strength with potential for outsized gains, giving investors the chance to discover hidden value in quality companies.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| ATRenew (RERE) | $3.63 | $790.52M | ✅ 3 ⚠️ 1 View Analysis > |

| Waterdrop (WDH) | $1.82 | $603.98M | ✅ 4 ⚠️ 0 View Analysis > |

| CuriosityStream (CURI) | $4.65 | $265.46M | ✅ 3 ⚠️ 3 View Analysis > |

| WM Technology (MAPS) | $0.9763 | $167.02M | ✅ 4 ⚠️ 1 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $103.12M | ✅ 3 ⚠️ 1 View Analysis > |

| Safe Bulkers (SB) | $4.31 | $423.56M | ✅ 2 ⚠️ 3 View Analysis > |

| Cardno (COLD.F) | $0.1701 | $6.64M | ✅ 2 ⚠️ 4 View Analysis > |

| BAB (BABB) | $0.8398 | $5.82M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.87 | $104.23M | ✅ 3 ⚠️ 2 View Analysis > |

| Tandy Leather Factory (TLF) | $3.44 | $29.28M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 408 stocks from our US Penny Stocks screener.

We'll examine a selection from our screener results.

Talkspace (TALK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Talkspace, Inc. is a virtual behavioral healthcare company in the U.S. that connects patients with licensed mental health providers, with a market cap of $435.02 million.

Operations: The company generates revenue primarily through its Pharmacy Services segment, which reported $194.36 million.

Market Cap: $435.02M

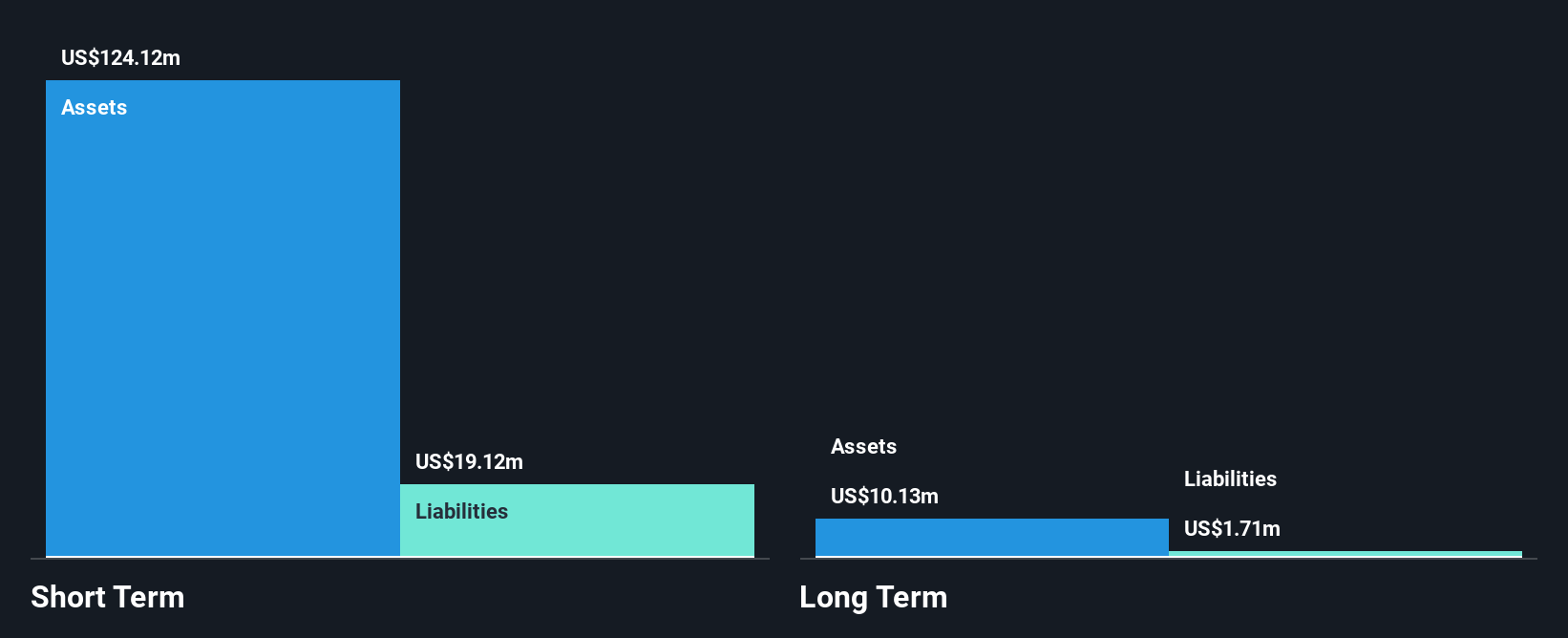

Talkspace, with a market cap of US$435.02 million, is making strides in the digital mental health sector through strategic partnerships and improving financials. Recent collaborations with Tia Health and Amazon Pharmacy highlight its focus on expanding women's health services and enhancing medication management for members. Talkspace reported first-quarter revenues of US$52.18 million, marking profitability compared to a previous net loss. The company has no debt, strong short-term asset coverage over liabilities, and its stock trades significantly below fair value estimates. However, recent insider selling may warrant attention from potential investors evaluating stability concerns amidst growth prospects.

- Jump into the full analysis health report here for a deeper understanding of Talkspace.

- Evaluate Talkspace's prospects by accessing our earnings growth report.

Definitive Healthcare (DH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Definitive Healthcare Corp. offers a SaaS healthcare commercial intelligence platform both in the United States and internationally, with a market cap of approximately $600 million.

Operations: The company's revenue is derived from its Internet Information Providers segment, totaling $247.91 million.

Market Cap: $599.99M

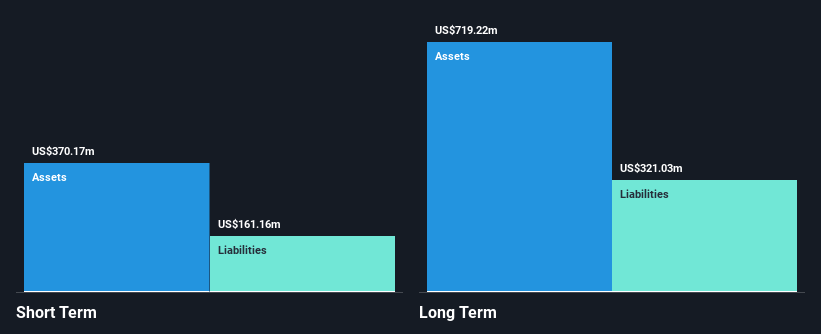

Definitive Healthcare, with a market cap of US$600 million, faces challenges as an unprofitable entity despite its SaaS healthcare platform's revenue of US$247.91 million. Recent executive changes and a significant goodwill impairment charge of US$176.53 million highlight internal adjustments amidst financial strain. The company reported a substantial net loss for Q1 2025 but raised its annual revenue guidance slightly to between US$234 million and US$240 million. With more cash than debt and sufficient short-term assets to cover liabilities, the company maintains a positive cash flow runway for over three years despite high stock volatility and management turnover concerns.

- Click here to discover the nuances of Definitive Healthcare with our detailed analytical financial health report.

- Review our growth performance report to gain insights into Definitive Healthcare's future.

Ranpak Holdings (PACK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ranpak Holdings Corp. offers product protection and end-of-line automation solutions for e-commerce and industrial supply chains across North America, Europe, and Asia, with a market cap of $315.03 million.

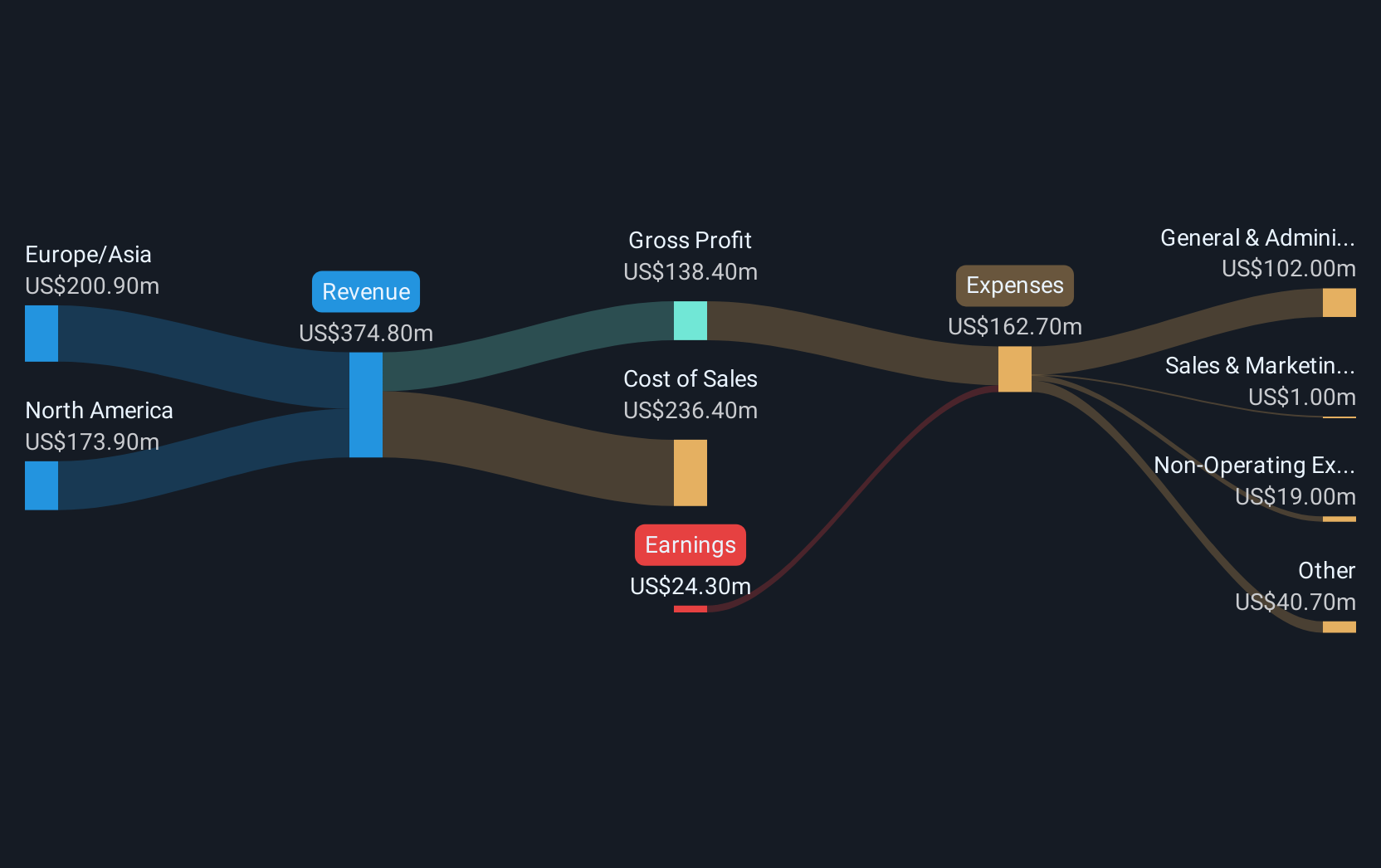

Operations: The company's revenue is derived from its operations in North America, Europe, and Asia, totaling $374.8 million.

Market Cap: $315.03M

Ranpak Holdings, with a market cap of US$315.03 million, is navigating challenges as an unprofitable entity in the packaging solutions sector. Despite its seasoned management and board, the company reported a net loss of US$10.9 million for Q1 2025 on revenue of US$91.2 million, indicating increased losses over five years. Recent strategic partnerships, like with Thalia for automated systems installation, aim to enhance operational efficiency and sustainability. However, the high net debt to equity ratio (61.7%) and significant executive turnover may pose risks despite having a cash runway exceeding three years if current cash flow levels are maintained.

- Dive into the specifics of Ranpak Holdings here with our thorough balance sheet health report.

- Learn about Ranpak Holdings' future growth trajectory here.

Next Steps

- Gain an insight into the universe of 408 US Penny Stocks by clicking here.

- Want To Explore Some Alternatives? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10