What National Australia Bank (ASX:NAB)'s Disaster Recovery Partnerships Mean For Shareholders

- Earlier in 2025, National Australia Bank supported more than 3,700 customers impacted by natural disasters by providing disaster relief grants and extra financial assistance.

- NAB’s partnership with Disaster Relief Australia and the introduction of the Foundation Recovery Crew aim to boost long-term community resilience and involvement in disaster recovery efforts nationwide.

- We'll examine how NAB’s focus on disaster recovery partnerships shapes the company’s investment narrative in the current environment.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is National Australia Bank's Investment Narrative?

For anyone looking at National Australia Bank as a shareholder, much of the big picture revolves around stable dividend income, disciplined capital management, and moderate long-term growth rather than rapid expansion. The recent news of NAB’s disaster relief programs and the Foundation Recovery Crew initiative signals ongoing community engagement, which fits with the bank’s image as a socially responsible institution. While these steps foster goodwill and can positively influence brand reputation, the immediate impact on the key short-term investment catalysts, like earnings growth, cost management, or the upcoming potential bid for HSBC’s Australian retail operations, seems limited. The bank continues to face familiar risks: softer profit growth, relative underperformance versus peers, a low allowance for bad loans, and board turnover. This latest disaster relief effort adds another layer of ESG focus but doesn’t substantially shift the main risk and opportunity profile the market was evaluating before the announcement. On the other hand, NAB’s allowance for bad loans may warrant closer attention as conditions change.

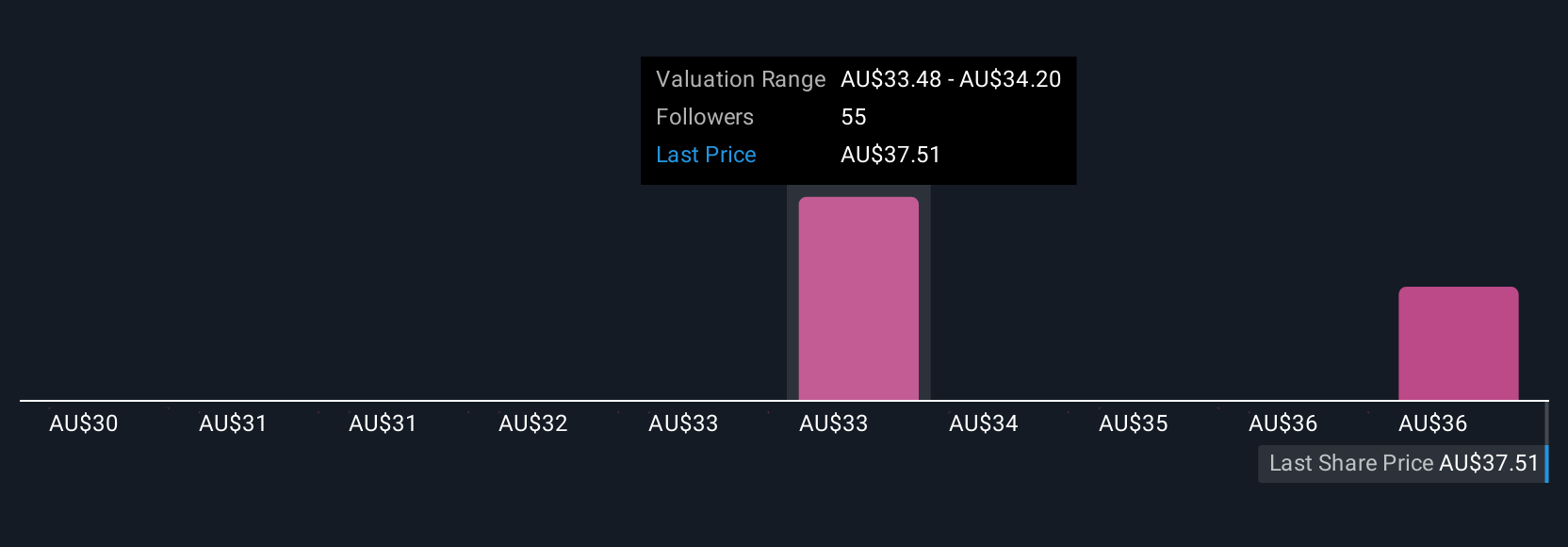

National Australia Bank's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 4 other fair value estimates on National Australia Bank - why the stock might be worth as much as A$37.09!

Build Your Own National Australia Bank Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your National Australia Bank research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free National Australia Bank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate National Australia Bank's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Australia Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10