Advanced Micro Devices (AMD) Collaborates with USC to Advance AI with MEGALODON

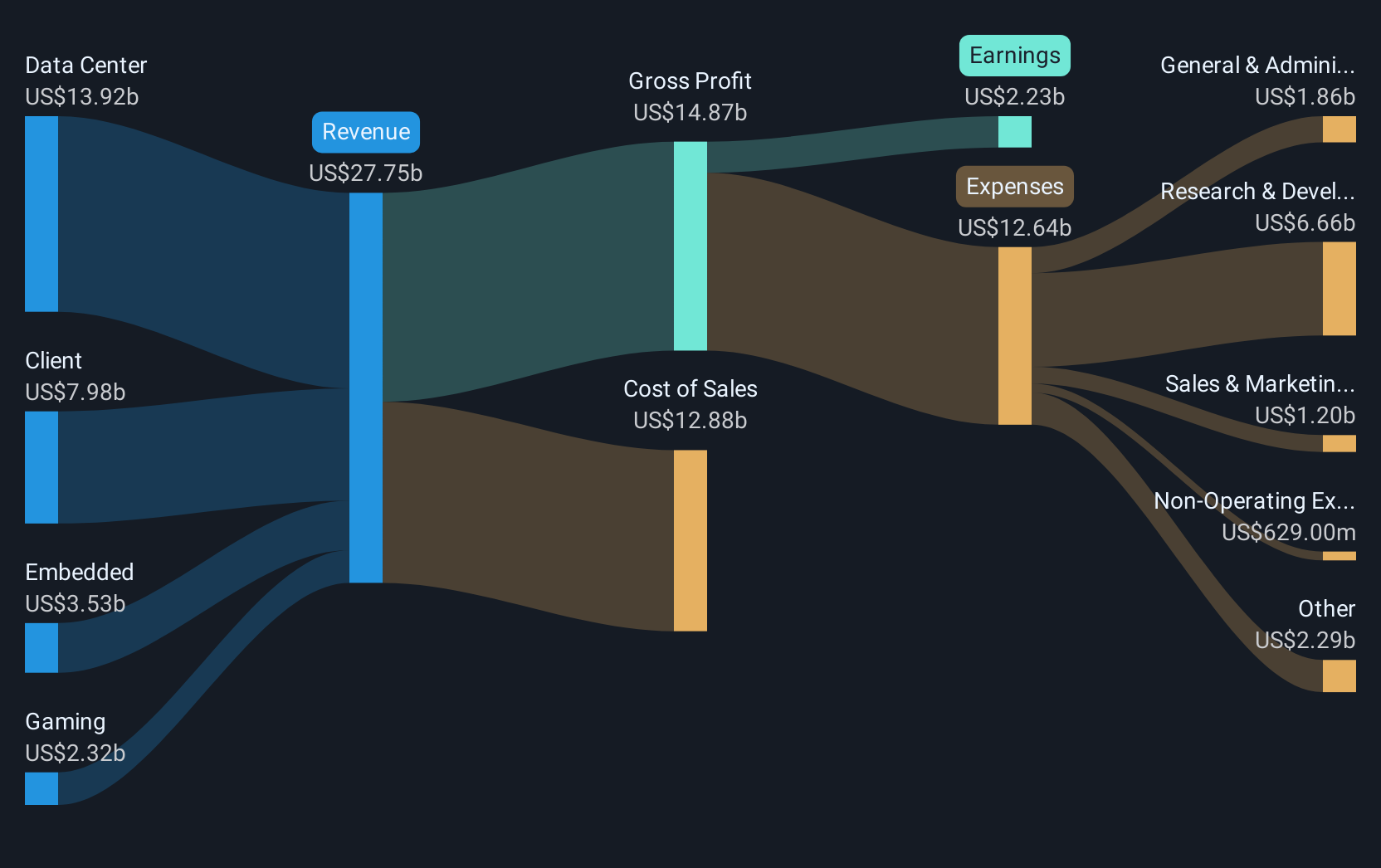

Advanced Micro Devices (AMD) experienced a notable 68% price increase over the past quarter, a surge partly attributed to its strategic collaboration with Aligned and USC ISI to develop the MEGALODON large language model. This partnership, which utilizes AMD's Instinct™ MI300 GPUs, highlights the company's capability in AI and cross-platform development, potentially augmenting its market position. Meanwhile, AMD's impressive Q1 earnings growth and expanded equity buyback plan further strengthened investor confidence. Though the broader market rose 18% over the last 12 months, AMD's advancements in AI and strategic alliances likely added weight to its substantial performance.

Buy, Hold or Sell Advanced Micro Devices? View our complete analysis and fair value estimate and you decide.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

The recent collaboration between AMD and partners to develop the MEGALODON large language model underscores AMD's advancements in AI, which could significantly affect the company's future revenue and earnings forecasts. The efficient utilization of AMD's Instinct™ MI300 GPUs in AI-driven projects signals potential revenue growth from increased demand in AI and cross-platform products. Despite these advancements, AMD's shares are trading at approximately US$158.65, which is higher than the consensus analyst price target of US$145.97, indicating the market's elevated expectations for AMD's future performance compared to analyst projections.

Over the past five years, AMD's total shareholder return has been very large, 108.50%, reflecting robust investor confidence and substantial growth, even as the company recently underperformed the broader US Semiconductor industry, which saw a 33.9% increase over the past year. While AMD's recent annual earnings growth of 100.1% outpaced the industry's 4.7% growth, challenges such as regulatory barriers and competition could threaten this momentum. The strong recent quarter and strategic initiatives in AI could contribute to higher future earnings, as outlined by the anticipated increase to US$7.2 billion by 2028.

Gain insights into Advanced Micro Devices' historical outcomes by reviewing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10