ASX Penny Stocks: Botanix Pharmaceuticals And 2 Other Promising Picks

Australian shares are showing resilience as they head into Week 31 with a slight uptick, buoyed by a significant trade deal between the U.S. and European Union that promises to bring stability to global markets. In such an environment, investors often look for stocks that can offer growth potential without excessive risk, which is where penny stocks come into play. Although the term "penny stocks" might seem outdated, these smaller or newer companies continue to present unique opportunities for growth at lower price points when supported by strong financials and promising business models.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.40 | A$114.64M | ✅ 3 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.14 | A$100.95M | ✅ 4 ⚠️ 3 View Analysis > |

| GTN (ASX:GTN) | A$0.59 | A$112.49M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$3.00 | A$462.55M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.38 | A$2.71B | ✅ 5 ⚠️ 1 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.78 | A$470.65M | ✅ 4 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.90 | A$975.05M | ✅ 4 ⚠️ 2 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.815 | A$889.49M | ✅ 5 ⚠️ 3 View Analysis > |

| Austco Healthcare (ASX:AHC) | A$0.38 | A$138.44M | ✅ 4 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.86 | A$149.81M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 464 stocks from our ASX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Botanix Pharmaceuticals (ASX:BOT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Botanix Pharmaceuticals Limited focuses on the research and development of dermatology and antimicrobial products in Australia and the United States, with a market cap of A$333.39 million.

Operations: The company's revenue is derived entirely from its research and development efforts in dermatology and antimicrobial products, totaling A$2.07 million.

Market Cap: A$333.39M

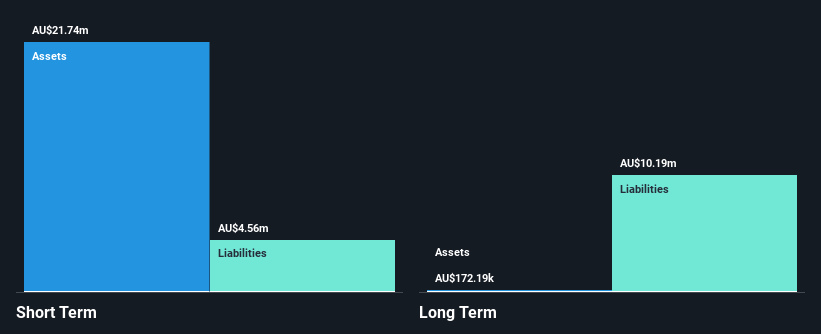

Botanix Pharmaceuticals, a pre-revenue company with a market cap of A$333.39 million, is focused on dermatology and antimicrobial R&D. Recent updates highlight the increasing launch momentum for SofdraTM topical gel and its potential path to profitability. The company secured a A$48 million loan facility from Kreos Capital, enhancing its cash position to support operations. Botanix's short-term assets significantly exceed liabilities, indicating strong financial health despite being unprofitable with no meaningful revenue yet. While the board is experienced, the management team is relatively new, and share price volatility remains high over recent months.

- Dive into the specifics of Botanix Pharmaceuticals here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Botanix Pharmaceuticals' future.

Champion Iron (ASX:CIA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Champion Iron Limited focuses on the acquisition, exploration, development, and production of iron ore properties in Canada with a market cap of A$2.67 billion.

Operations: The company's revenue is primarily generated from its Iron Ore Concentrate segment, amounting to CA$1.61 billion.

Market Cap: A$2.67B

Champion Iron, with a market cap of A$2.67 billion, generates significant revenue from its iron ore concentrate operations in Canada, reporting CA$1.61 billion in sales for the year ending March 2025. The company faces challenges with declining profit margins and net income compared to the previous year, alongside high debt levels that are well-covered by operating cash flow. Despite stable weekly volatility and an experienced management team, Champion Iron's earnings growth has been negative recently. Its dividend yield is not fully supported by free cash flows, though interest payments are securely covered by EBIT.

- Jump into the full analysis health report here for a deeper understanding of Champion Iron.

- Gain insights into Champion Iron's outlook and expected performance with our report on the company's earnings estimates.

Dimerix (ASX:DXB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Dimerix Limited is an Australian biopharmaceutical company focused on developing and commercializing pharmaceutical products for unmet medical needs, with a market cap of A$339.08 million.

Operations: Dimerix generates revenue from its biotechnology segment, amounting to A$0.74 million.

Market Cap: A$339.08M

Dimerix Limited, with a market cap of A$339.08 million, is pre-revenue and currently unprofitable. The company recently entered an exclusive U.S. licensing agreement for its Phase 3 drug candidate DMX-200 with Amicus Therapeutics, retaining commercialization rights elsewhere. Positive interim results from the ACTION3 trial in FSGS kidney disease were reported, showing efficacy over placebo without safety concerns. Dimerix's short-term assets exceed liabilities, and it remains debt-free; however, it has less than a year of cash runway if historical cash flow reduction continues. Despite high share price volatility, shareholders haven't faced significant dilution recently.

- Get an in-depth perspective on Dimerix's performance by reading our balance sheet health report here.

- Gain insights into Dimerix's historical outcomes by reviewing our past performance report.

Where To Now?

- Unlock more gems! Our ASX Penny Stocks screener has unearthed 461 more companies for you to explore.Click here to unveil our expertly curated list of 464 ASX Penny Stocks.

- Ready To Venture Into Other Investment Styles? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10