OptimizeRx (NASDAQ:OPRX) shareholders are up 11% this past week, but still in the red over the last three years

It is doubtless a positive to see that the OptimizeRx Corporation (NASDAQ:OPRX) share price has gained some 66% in the last three months. But that cannot eclipse the less-than-impressive returns over the last three years. Truth be told the share price declined 36% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

While the last three years has been tough for OptimizeRx shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

Trump has pledged to "unleash" American oil and gas and these 15 US stocks have developments that are poised to benefit.

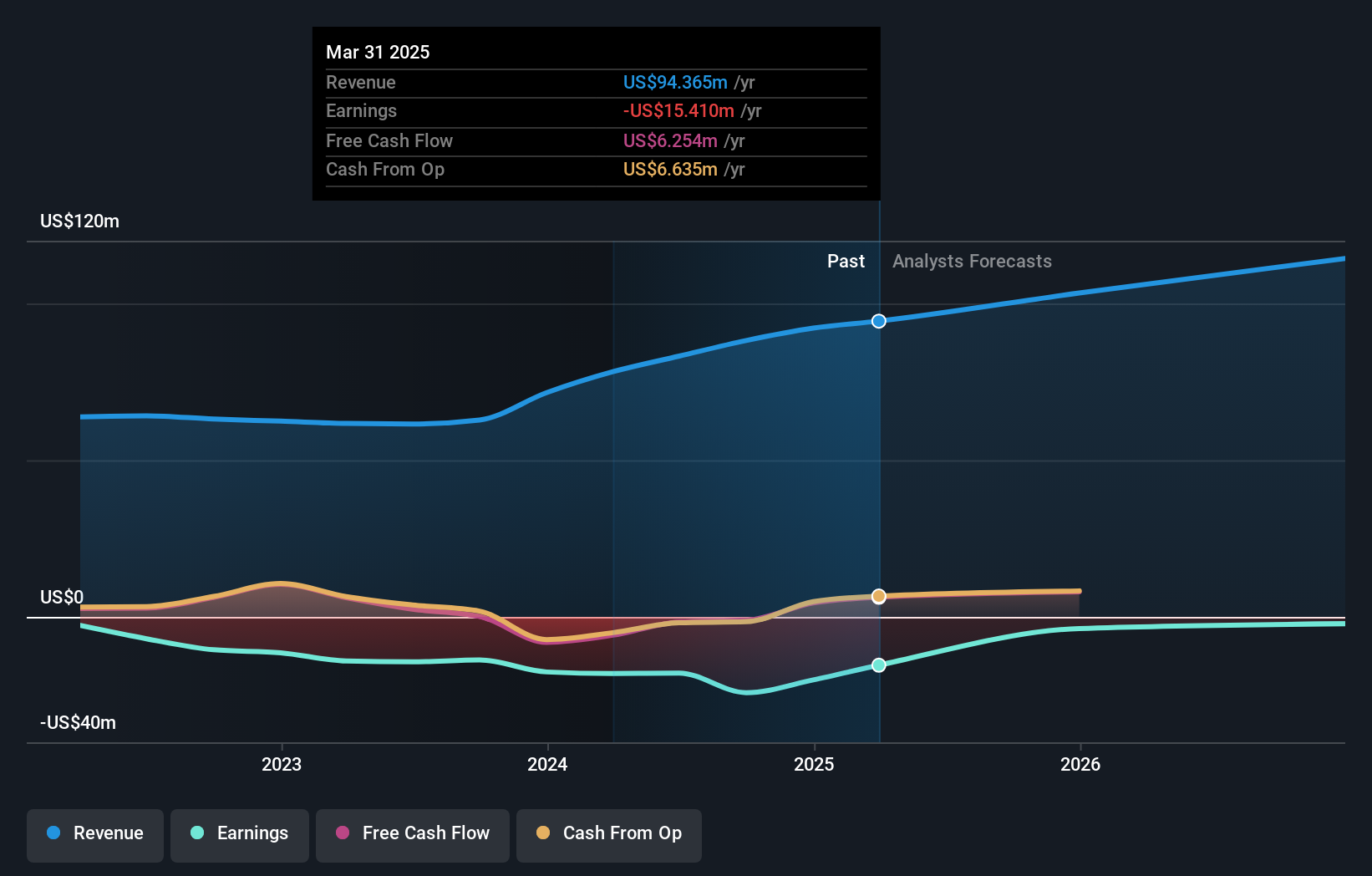

OptimizeRx wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years, OptimizeRx saw its revenue grow by 16% per year, compound. That's a pretty good rate of top-line growth. Shareholders have endured a share price decline of 11% per year. This implies the market had higher expectations of OptimizeRx. With revenue growing at a solid clip, now might be the time to focus on the possibility that it will have a brighter future.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. So it makes a lot of sense to check out what analysts think OptimizeRx will earn in the future (free profit forecasts).

A Different Perspective

We're pleased to report that OptimizeRx shareholders have received a total shareholder return of 34% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 0.3% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 1 warning sign for OptimizeRx that you should be aware of before investing here.

OptimizeRx is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10