Marvell Technology (MRVL) Welcomes Veteran Tech Leader Rajiv Ramaswami to Board

Marvell Technology (MRVL) recently saw a notable board addition with Rajiv Ramaswami, the CEO of Nutanix, enhancing the company’s leadership depth. MRVL's shares jumped 28% over the last quarter, a move above the broader market rise of 18% over the past year and 2% in the latest week. This boost aligns with Marvell's strong earnings report showing significant sales and net income growth and strategic technology partnerships, such as those with NVIDIA and Empower Semiconductor, which likely reinforced investor confidence alongside key executive promotions and product launches in the AI space.

Buy, Hold or Sell Marvell Technology? View our complete analysis and fair value estimate and you decide.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

The addition of Rajiv Ramaswami to Marvell Technology's board could significantly enhance the company's leadership. His insights, particularly from Nutanix, might influence Marvell's focus in the AI and data center sectors, potentially impacting revenue and earnings forecasts. The recent partnerships with NVIDIA and Empower Semiconductor are already aligning with Marvell's growth strategies, aiming to surpass its $2.5 billion AI revenue target by fiscal 2026.

Over the longer-term period of five years, Marvell's total shareholder return reached 113.20%, reflecting strong company performance. Despite this, the company's one-year return underperformed both the US Market, which returned 17.7%, and the US Semiconductor industry, which returned 33.9%. These contrasting performance metrics underscore the importance of strategic decisions and market perception affecting both short-term and long-term valuation.

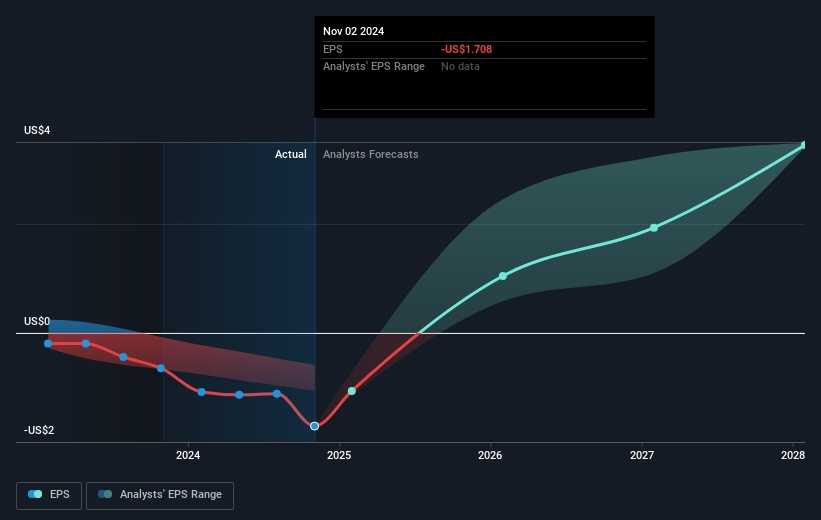

Marvell's current share price of US$73.27 indicates a significant discount from the analysts' consensus price target of US$90.27. This price movement highlights potential growth opportunities, as recent developments may bolster investor confidence. However, with the company currently unprofitable, forecasting future earnings and revenue growth remains complex. Analysts expect both revenue and earnings to improve, assuming robust demand in the AI and data center markets coupled with efficiency-boosting technological advancements Marvell is introducing.

Gain insights into Marvell Technology's future direction by reviewing our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10