High Growth Tech Stocks in Australia for July 2025

As the Australian market navigates fluctuations with key players like Commonwealth Bank and BHP influencing the ASX200, investors are keenly observing how sectors such as materials and health care respond to global economic shifts. In this dynamic environment, high growth tech stocks in Australia stand out for their potential to capitalize on innovation and adaptability, offering intriguing opportunities amid broader market rotations.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Pro Medicus | 20.17% | 22.26% | ★★★★★★ |

| Gratifii | 42.14% | 113.99% | ★★★★★★ |

| Echo IQ | 49.20% | 51.35% | ★★★★★★ |

| WiseTech Global | 24.60% | 23.18% | ★★★★★★ |

| BlinkLab | 51.57% | 52.67% | ★★★★★★ |

| Wrkr | 55.92% | 116.30% | ★★★★★★ |

| Pointerra | 50.42% | 159.12% | ★★★★★☆ |

| Immutep | 70.84% | 42.55% | ★★★★★☆ |

| Adveritas | 52.34% | 88.83% | ★★★★★★ |

| SiteMinder | 18.78% | 55.56% | ★★★★★☆ |

Click here to see the full list of 46 stocks from our ASX High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Catapult Group International (ASX:CAT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Catapult Group International Ltd is a sports science and analytics company that develops and supplies technologies to enhance athlete and team performance across various regions including Australia, Europe, the Middle East, Africa, the Asia Pacific, and the Americas with a market cap of A$1.62 billion.

Operations: Catapult generates revenue through three main segments: Performance & Health ($63.47 million), Tactics & Coaching ($36.66 million), and Media & Other ($16.40 million).

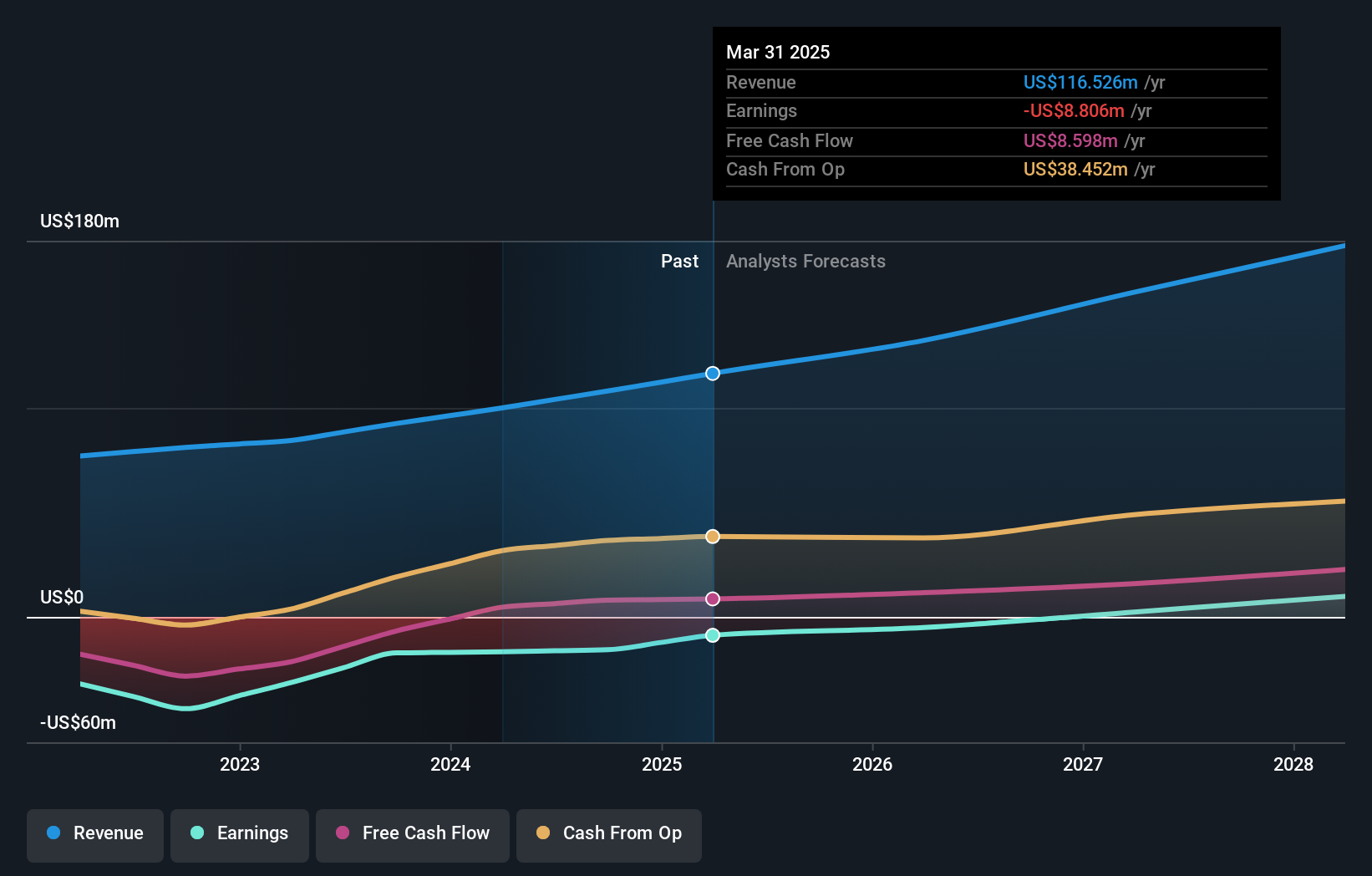

Catapult Group International, amid a challenging landscape, reported a significant reduction in net loss to USD 8.81 million from the previous year's USD 16.7 million, showcasing robust control over its financial health. The company's revenue surged by 13.9% annually to USD 116.53 million, outpacing the Australian market's growth rate of 5.6%. This performance is underpinned by strategic mergers and acquisitions that strengthen its market position despite ongoing profitability challenges. Additionally, recent executive board enhancements aim to bolster governance and stakeholder relations, positioning Catapult for future governance stability and potential profitability within three years as forecasted earnings growth hits an impressive annual rate of 69.32%.

- Dive into the specifics of Catapult Group International here with our thorough health report.

Assess Catapult Group International's past performance with our detailed historical performance reports.

FINEOS Corporation Holdings (ASX:FCL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: FINEOS Corporation Holdings plc develops and sells enterprise claims and policy management software for life, accident, and health insurers, as well as employee benefits providers across North America, the Asia Pacific, the Middle East, and Africa, with a market cap of A$930.92 million.

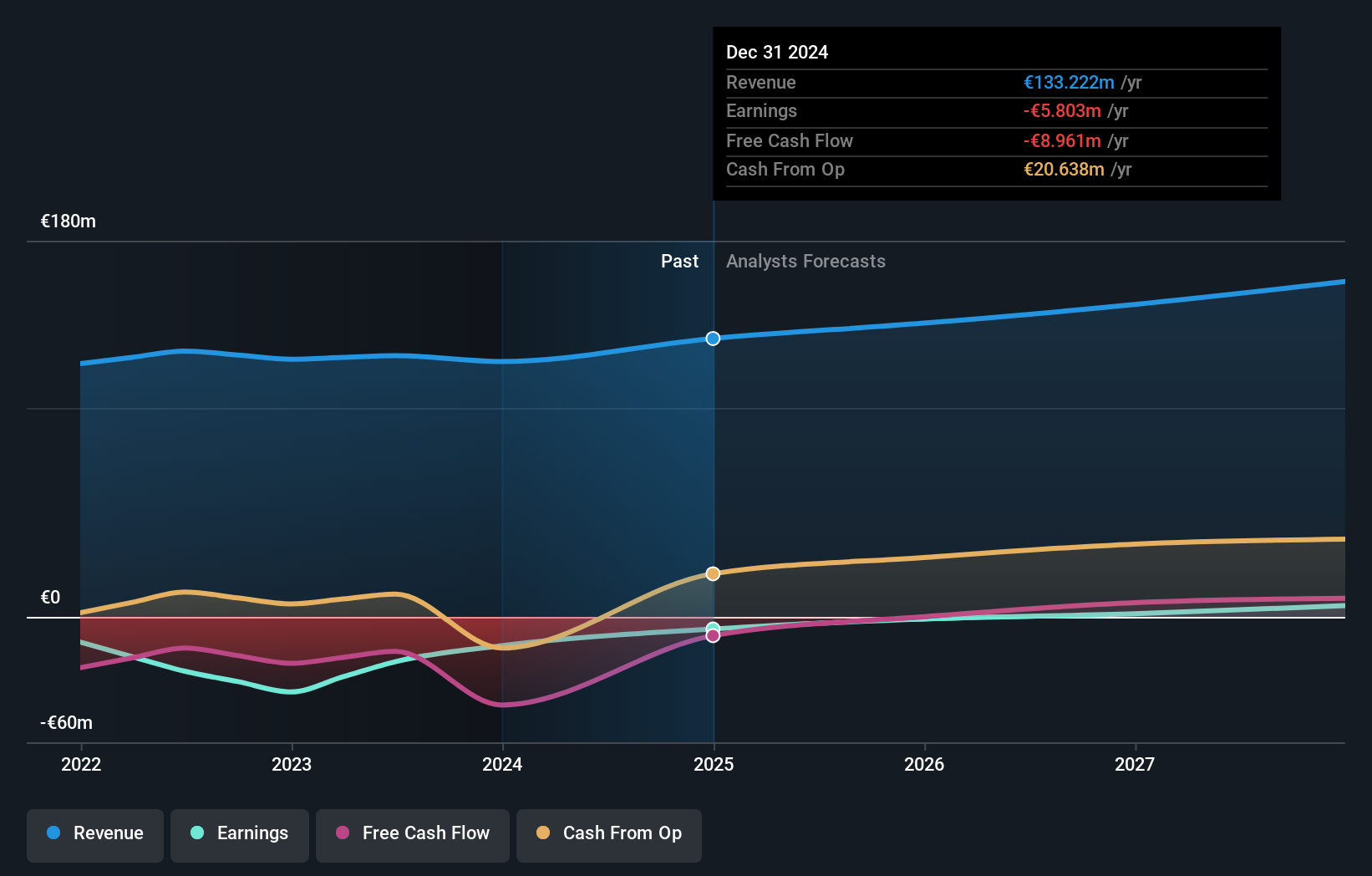

Operations: FINEOS generates revenue primarily through its Software & Programming segment, which reported €133.22 million. The company's operations focus on providing specialized software solutions for insurers and employee benefits providers across several regions.

FINEOS Corporation Holdings has demonstrated a robust commitment to innovation, as evidenced by the recent launch of a Personal Injury Portal by its client Nationale-Nederlanden. This portal, powered by FINEOS Claims APIs, underscores the company's prowess in delivering scalable and secure data solutions that enhance user engagement and operational efficiency. Despite challenges in achieving profitability, with earnings expected to grow at an annual rate of 61.1%, FINEOS continues to outpace average market revenue growth (9.3% annually compared to the market's 5.6%). The firm’s strategic focus on integrating its technology into client operations, as seen with Medavie Blue Cross consolidating claims management on the FINEOS platform, positions it well for future growth in the tech-driven insurance sector.

- Delve into the full analysis health report here for a deeper understanding of FINEOS Corporation Holdings.

Understand FINEOS Corporation Holdings' track record by examining our Past report.

Nuix (ASX:NXL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nuix Limited offers investigative analytics and intelligence software solutions across various regions including the Asia Pacific, the Americas, Europe, the Middle East, and Africa with a market capitalization of approximately A$793.76 million.

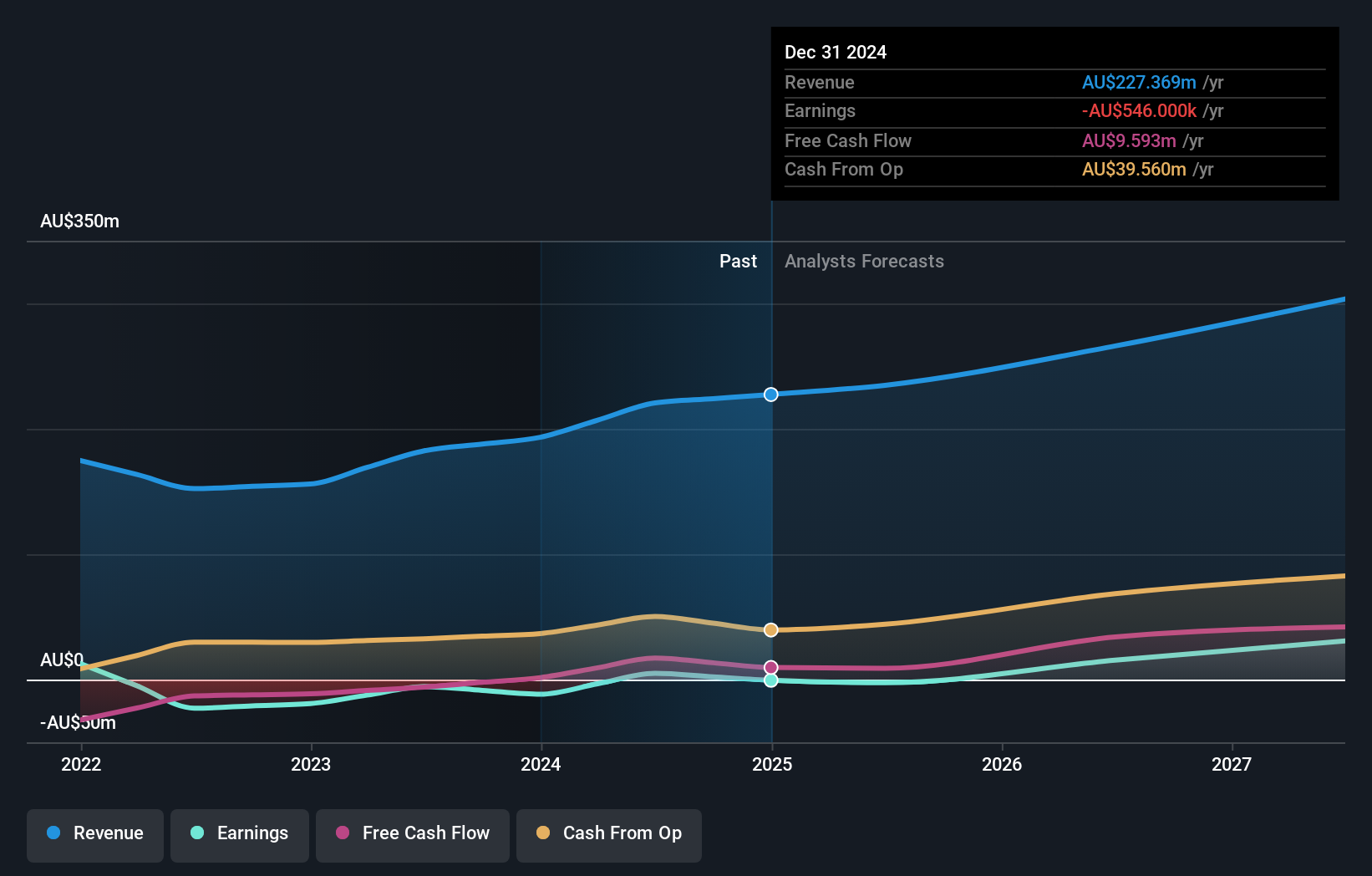

Operations: Nuix generates revenue primarily from its Software & Programming segment, which reported A$227.37 million. The company's market capitalization stands at approximately A$793.76 million, reflecting its presence in the global software solutions industry.

Nuix, amidst an executive shuffle with Jeff Bleich transitioning to Anthropic AI, continues to navigate its growth trajectory with a notable 13.8% annual revenue increase, outpacing the Australian market average of 5.6%. Despite current unprofitability, projections indicate a shift towards profitability within three years, supported by an impressive forecasted earnings growth of 51.8% annually. This potential turnaround is underpinned by Nuix's commitment to enhancing its software capabilities and expanding its market reach, positioning it favorably in the competitive tech landscape. The company's strategic adaptations and robust R&D focus are critical as it aims to leverage emerging tech trends and meet evolving customer demands effectively.

- Take a closer look at Nuix's potential here in our health report.

Gain insights into Nuix's historical performance by reviewing our past performance report.

Where To Now?

- Click here to access our complete index of 46 ASX High Growth Tech and AI Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10