Kohl's (KSS) Is Up 7.3% After Back-to-School Launch and New Chief Digital Officer Has The Bull Case Changed?

- Last week, Kohl's rolled out an expanded back-to-school product lineup with hundreds of items under US$10 and announced Arianne Parisi as its new chief digital officer.

- These efforts reflect Kohl's focus on appealing to value-oriented families and enhancing its omnichannel capabilities through experienced digital leadership.

- We'll explore how the appointment of a new chief digital officer might influence Kohl's investment narrative and digital transformation plans.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Kohl's Investment Narrative Recap

To be a shareholder in Kohl’s, an investor needs to believe that strong value propositions for families and a revitalized digital strategy can help stabilize declining sales and restore growth. Last week’s appointment of Arianne Parisi as chief digital officer is an important step for Kohl’s ongoing digital transformation, but it may not materially affect the most immediate catalyst: convincing customers to return to stores and the website, while the biggest short-term risk remains persistent sales and digital declines. Of the recent announcements, the expanded back-to-school product lineup under US$10 stands out as directly relevant to reversing sales declines. It builds on Kohl’s strategy to offer greater value through its proprietary brands and simplified promotions, seeking to draw back families who may have shifted to competitors for basic apparel and essentials. Yet, despite these promising moves, investors should also be aware that digital sales were down sharply last year, and if this trend continues...

Read the full narrative on Kohl's (it's free!)

Kohl's is projected to reach $14.0 billion in revenue and $234.5 million in earnings by 2028. This outlook is based on an expected annual revenue decline of 4.4% and an increase in earnings of $113.5 million from the current $121.0 million.

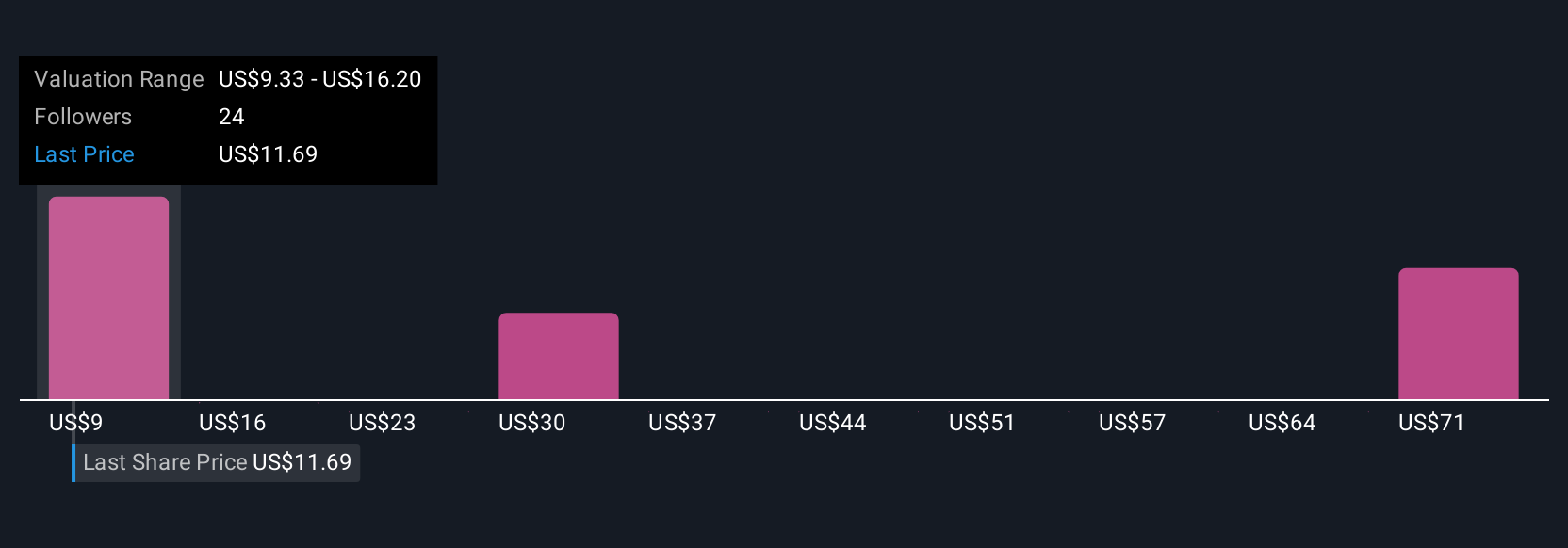

Uncover how Kohl's forecasts yield a $9.33 fair value, a 10% downside to its current price.

Exploring Other Perspectives

Four different fair value estimates from the Simply Wall St Community range from US$9.33 to a high of US$90.08 per share. The diversity of these views is especially important given ongoing risks such as sustained declines in both net and digital sales, which could continue to pressure results and influence market expectations moving forward.

Explore 4 other fair value estimates on Kohl's - why the stock might be worth over 8x more than the current price!

Build Your Own Kohl's Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kohl's research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Kohl's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kohl's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kohl's might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10