Why SharpLink Gaming (SBET) Is Down 5.4% After Auditor Switch to KPMG LLP And What's Next

- On July 7, 2025, SharpLink Gaming, Inc. dismissed Cherry Bekaert LLP as its independent registered public accounting firm and appointed KPMG LLP for the current fiscal year.

- This transition, absent any reported disputes or adverse audit opinions, brings a notable change in external oversight for the company's financial reporting.

- We'll explore how the move to KPMG LLP as auditor may influence perceptions of governance and reporting quality in SharpLink's investment narrative.

These 17 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is SharpLink Gaming's Investment Narrative?

For investors considering SharpLink Gaming, belief in the company's turnaround and capital access is at the core of the story. Recent moves, substantial capital raising, board reshuffling, regulatory compliance measures, and now the transition to KPMG as auditor, signal a push for stronger governance and fresh oversight as SharpLink works to stabilize operations. The switch to KPMG may help reinforce confidence in the company’s financial reporting at a time when credibility matters. However, the big picture remains shaped by SharpLink’s persistent losses, volatile share price, dilution from equity offerings, and the recent "going concern" language from auditors. While the appointment of an internationally recognized firm like KPMG could support near-term catalysts linked to investor trust, it does not remove key risks, such as unprofitable operations or Nasdaq compliance challenges. Overall, the auditor change strengthens oversight, but does not materially alter the company's fundamental risk profile in the short-term. But investor confidence can be easily shaken when financial viability is questioned.

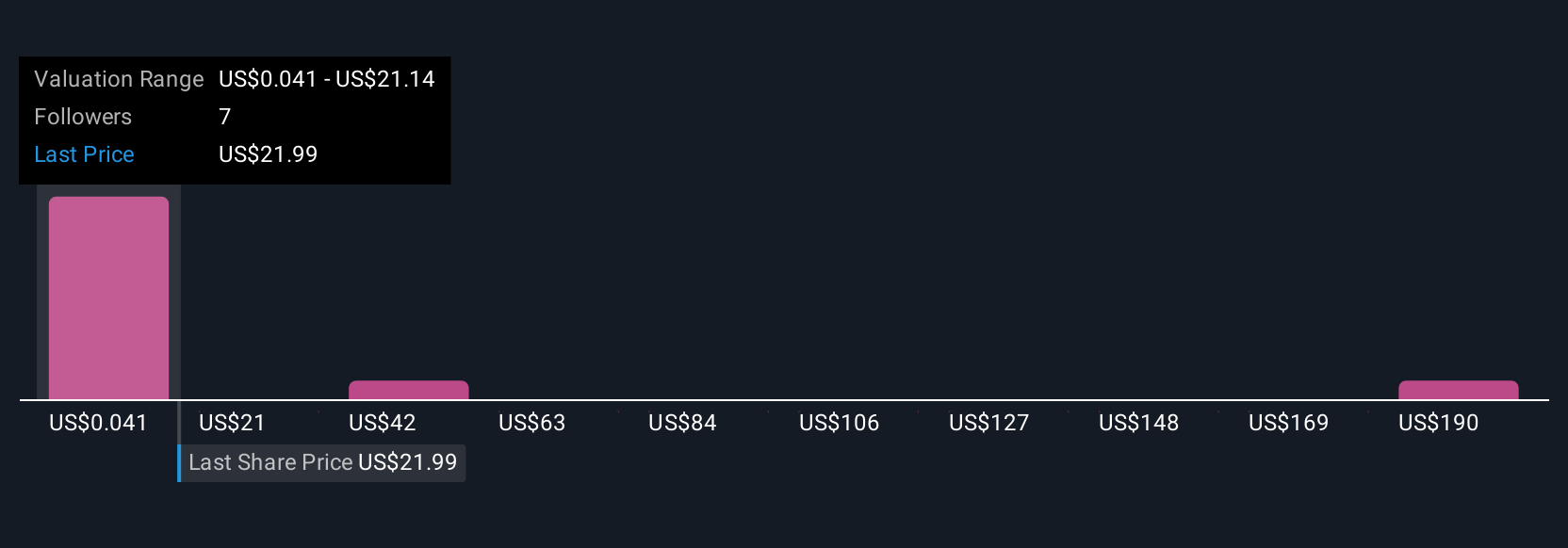

According our valuation report, there's an indication that SharpLink Gaming's share price might be on the expensive side.Exploring Other Perspectives

Explore 9 other fair value estimates on SharpLink Gaming - why the stock might be worth as much as 74% more than the current price!

Build Your Own SharpLink Gaming Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SharpLink Gaming research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free SharpLink Gaming research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SharpLink Gaming's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 27 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10