Why Piper Sandler Companies (PIPR) Is Up 6.7% After Hiring Tech Banking Expert Anson Tsai and What's Next

- Piper Sandler Companies recently announced the hiring of Anson Tsai as a managing director for its technology investment banking team, with Tsai joining the Burlingame office after a decade at Bank of America Securities focused on software sector transactions.

- Tsai's extensive background in technology finance and operational roles may signal Piper Sandler's intention to enhance its technology sector capabilities.

- We’ll explore how Tsai’s leadership in technology deals could influence Piper Sandler’s investment banking growth prospects in this sector.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Piper Sandler Companies' Investment Narrative?

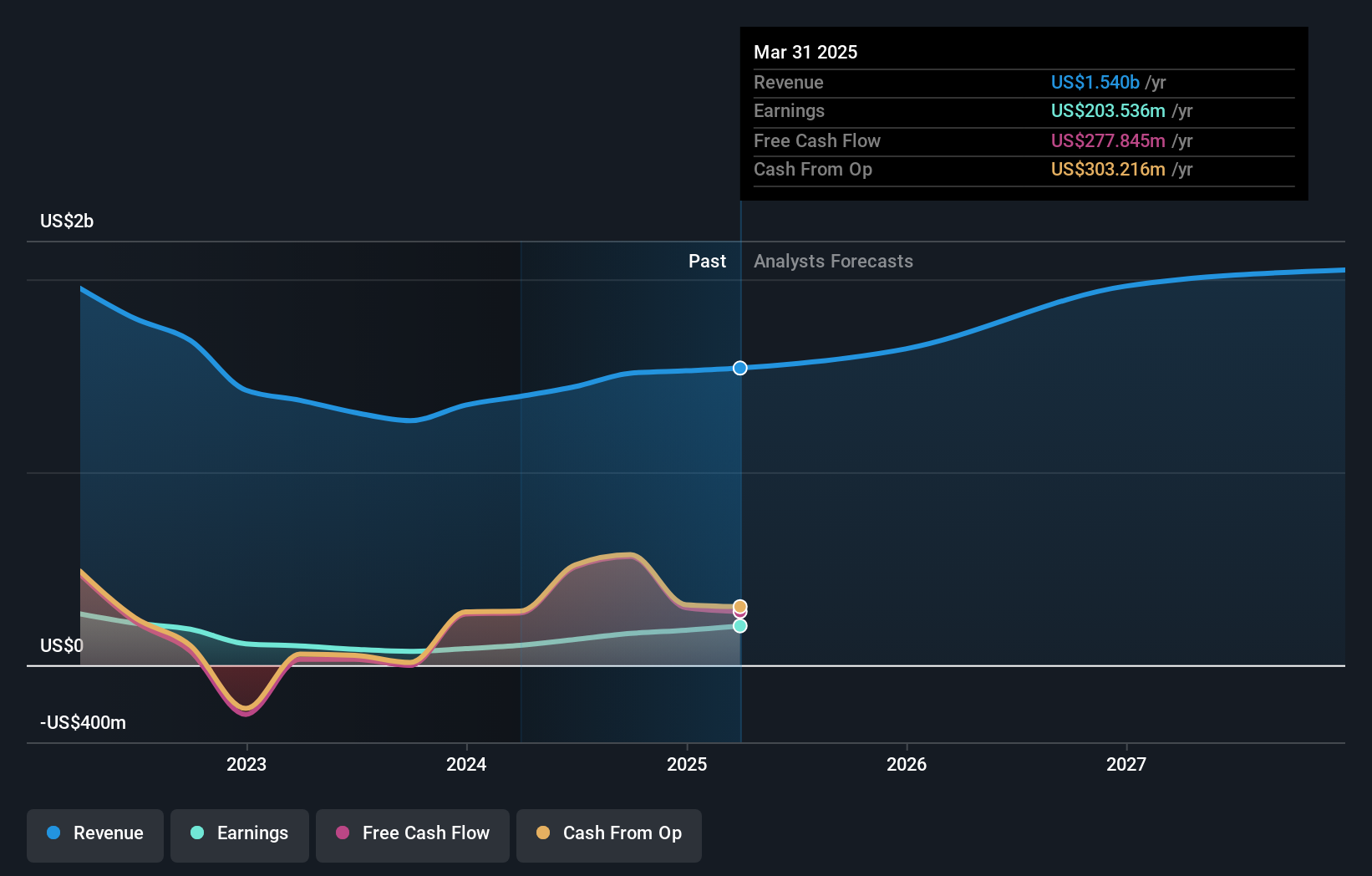

To see value in Piper Sandler Companies as a shareholder, you need confidence in the firm’s ability to expand and maintain relevance across capital markets, grow its core businesses, and effectively deploy capital for shareholder returns via dividends and buybacks. The recent addition of Anson Tsai to lead technology investment banking is an interesting potential catalyst for growth in a sector where the firm has sought to bolster its capabilities, especially as technology dealmaking remains a key revenue opportunity industry-wide. However, given the firm’s size and already broad sector representation, Tsai’s appointment alone may not move the needle much for short-term revenue or earnings unless it triggers a meaningful uptick in high-profile technology transactions. At the same time, Piper Sandler’s relatively high price-to-earnings ratio, fluctuating dividend track record, and recent large one-off items still represent risks that could affect earnings quality and market sentiment moving into upcoming quarters. The news of Tsai’s arrival fits into the ongoing refresh of executive talent, but does not on its own change the core risk and catalyst profile unless quickly followed by visible deal-making success in technology. On the other hand, dividend sustainability still presents a concern worth noting.

Piper Sandler Companies' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 3 other fair value estimates on Piper Sandler Companies - why the stock might be worth less than half the current price!

Build Your Own Piper Sandler Companies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Piper Sandler Companies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Piper Sandler Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Piper Sandler Companies' overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover 17 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10