BTC shows early divergence warning, but trend remains intact

BTC Prints TBT Bearish Divergence As Slow Line Holds Strong

Bitcoin printed a TBT Bearish Divergence in progress on today’s daily candle, signaling an early warning of a potential pullback. The TBT Divergence incorporates multiple factors beyond just price and RSI to identify hidden weaknesses. Historical patterns show these signals often appear early and require confirmation. The TBO Slow line remains bullishly curled upward, and daily Volume and OBV still trend healthy, so the macro trend is intact for now.

ETH Holds Strong Despite Red Candle, Macro Bullish Intact

Ethereum continues to hold strong after a two-week rally, even as yesterday’s red candle halted its upward momentum. RSI remains elevated at 83, and daily Volume and OBV continue to confirm strength. No significant bearish signals are yet visible on ETH’s 4h timeframe, supporting the view of a short-term pause rather than a major reversal.

Stablecoin and Bitcoin Dominance Show Mixed Short-Term Signals

STABLE.C.D is showing conflicting signals — macro bearish after last week’s TBO Breakdown Cluster and RSI low, yet a 4h TBT Bullish Divergence Cluster hints at a minor bounce. Historically, these short-term bounces have not reversed the larger trend. BTC.D closed green yesterday for the first time in nine days, but remains deeply oversold with daily RSI at 2.50 — a level last seen in 2017. While a small bounce is possible, the broader trend favors ALTs as BTC.D and STABLE.C.D both remain pressured.

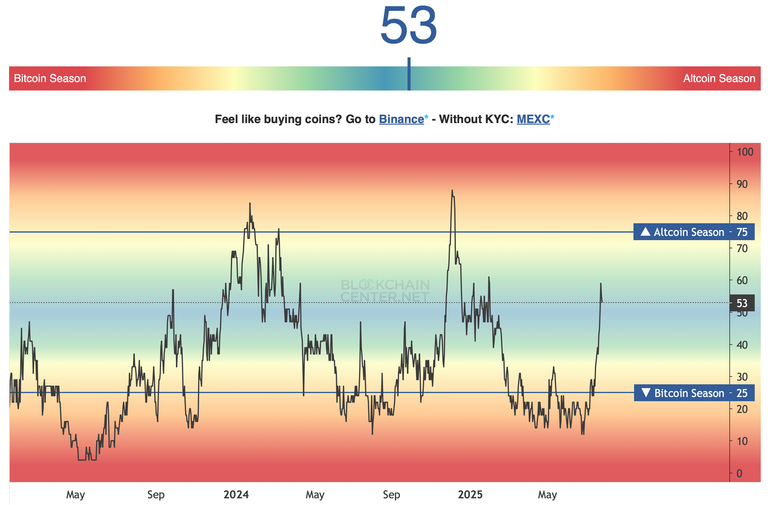

ALT Season Indicators Still Firmly In Place

TOTALE50 held green despite a volatile daily candle, printing a rare and powerful third daily TBO Breakout earlier this week. The ALT Season index remains elevated at 53, echoing late-2023 patterns that preceded major moves. Top 10 Dominance looks toppy, but OTHERS.D remains above its daily Cloud, showing strength in mid-caps. Liquidity rotation into smaller caps like TOTALE50 and TOTALE100 has not fully played out yet, suggesting more upside potential as the rally broadens.

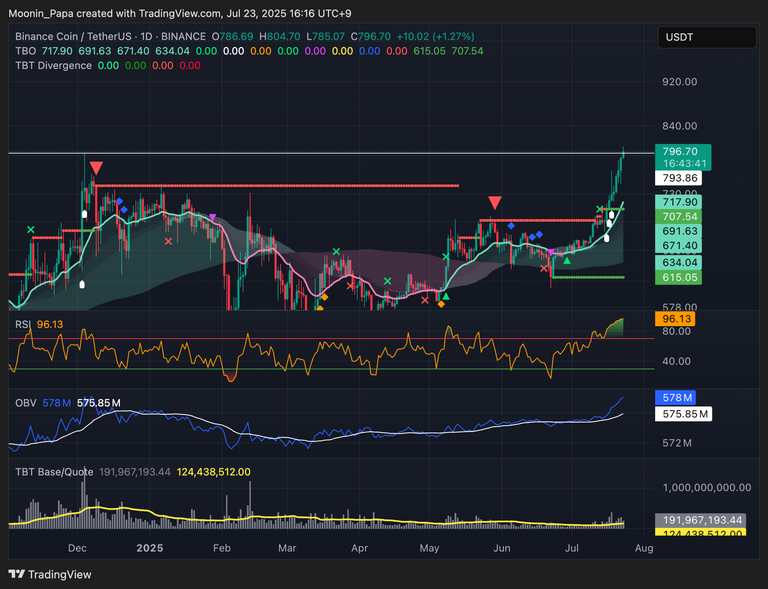

Select ALTs Continue to Lead With Confirmations and Volume

BNB pierced its prior ATH today as ALTs continue to show resilience even with BTC signaling a pause. XRP, SOL, ONDO, JUP, FLR, PENGU, WIF, and ecosystem-based names like JUP and VIRTUAL continue to post breakout signals or strong price action.

Memes such as BONK, FLOKI, and PENGU also show steady gains, while early signals on names like SDEX and MASA hint at potential broader moves as ALT Season matures.

Key Takeaways:

While BTC’s TBT Bearish Divergence warns of a short-term pullback, the broader trend remains bullish with strong Slow line support and healthy volume trends. ALTs continue to confirm breakouts across market caps, supported by historic signals on dominance and seasonality indicators. Traders should expect normal volatility and use DCA strategies to manage entries as the rally continues to unfold.

For a disciplined strategy to capitalize on these trends, see The Complete Cryptocurrency Investor by Mastering Assets.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10