Newell Brands (NASDAQ:NWL) Seems To Be Using A Lot Of Debt

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Newell Brands Inc. (NASDAQ:NWL) does carry debt. But should shareholders be worried about its use of debt?

This technology could replace computers: discover the 20 stocks are working to make quantum computing a reality.

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

What Is Newell Brands's Net Debt?

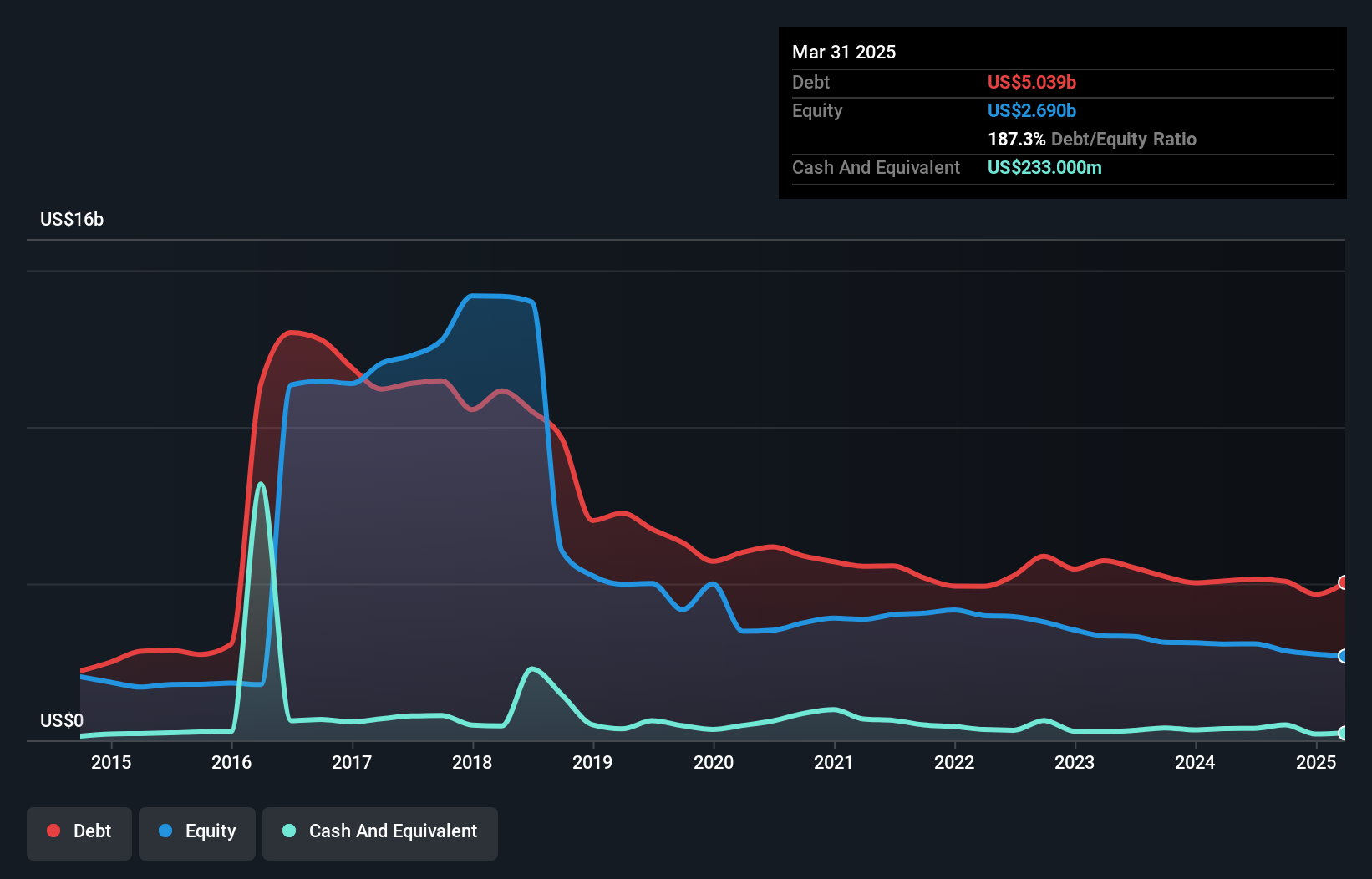

The chart below, which you can click on for greater detail, shows that Newell Brands had US$5.04b in debt in March 2025; about the same as the year before. However, it also had US$233.0m in cash, and so its net debt is US$4.81b.

A Look At Newell Brands' Liabilities

The latest balance sheet data shows that Newell Brands had liabilities of US$2.69b due within a year, and liabilities of US$5.90b falling due after that. Offsetting these obligations, it had cash of US$233.0m as well as receivables valued at US$892.0m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$7.46b.

The deficiency here weighs heavily on the US$2.55b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. After all, Newell Brands would likely require a major re-capitalisation if it had to pay its creditors today.

See our latest analysis for Newell Brands

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Newell Brands shareholders face the double whammy of a high net debt to EBITDA ratio (5.8), and fairly weak interest coverage, since EBIT is just 1.7 times the interest expense. The debt burden here is substantial. The good news is that Newell Brands improved its EBIT by 5.3% over the last twelve months, thus gradually reducing its debt levels relative to its earnings. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Newell Brands's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Looking at the most recent three years, Newell Brands recorded free cash flow of 23% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

To be frank both Newell Brands's net debt to EBITDA and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. Having said that, its ability to grow its EBIT isn't such a worry. After considering the datapoints discussed, we think Newell Brands has too much debt. That sort of riskiness is ok for some, but it certainly doesn't float our boat. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 1 warning sign for Newell Brands you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if Newell Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10