ASX Growth Stocks With High Insider Ownership To Watch

The Australian market has seen some fluctuations recently, with the ASX experiencing a dip despite early gains, largely influenced by movements in major banks and materials stocks. In this environment, growth companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| Meteoric Resources (ASX:MEI) | 19.9% | 75.7% |

| Image Resources (ASX:IMA) | 22.3% | 79.9% |

| Findi (ASX:FND) | 33.8% | 91.2% |

| Fenix Resources (ASX:FEX) | 21.1% | 53.4% |

| Echo IQ (ASX:EIQ) | 18% | 51.4% |

| Cyclopharm (ASX:CYC) | 11.3% | 97.8% |

| Brightstar Resources (ASX:BTR) | 11.2% | 115.1% |

| Alfabs Australia (ASX:AAL) | 10.8% | 41.3% |

| Adveritas (ASX:AV1) | 18.1% | 88.8% |

Click here to see the full list of 94 stocks from our Fast Growing ASX Companies With High Insider Ownership screener.

We'll examine a selection from our screener results.

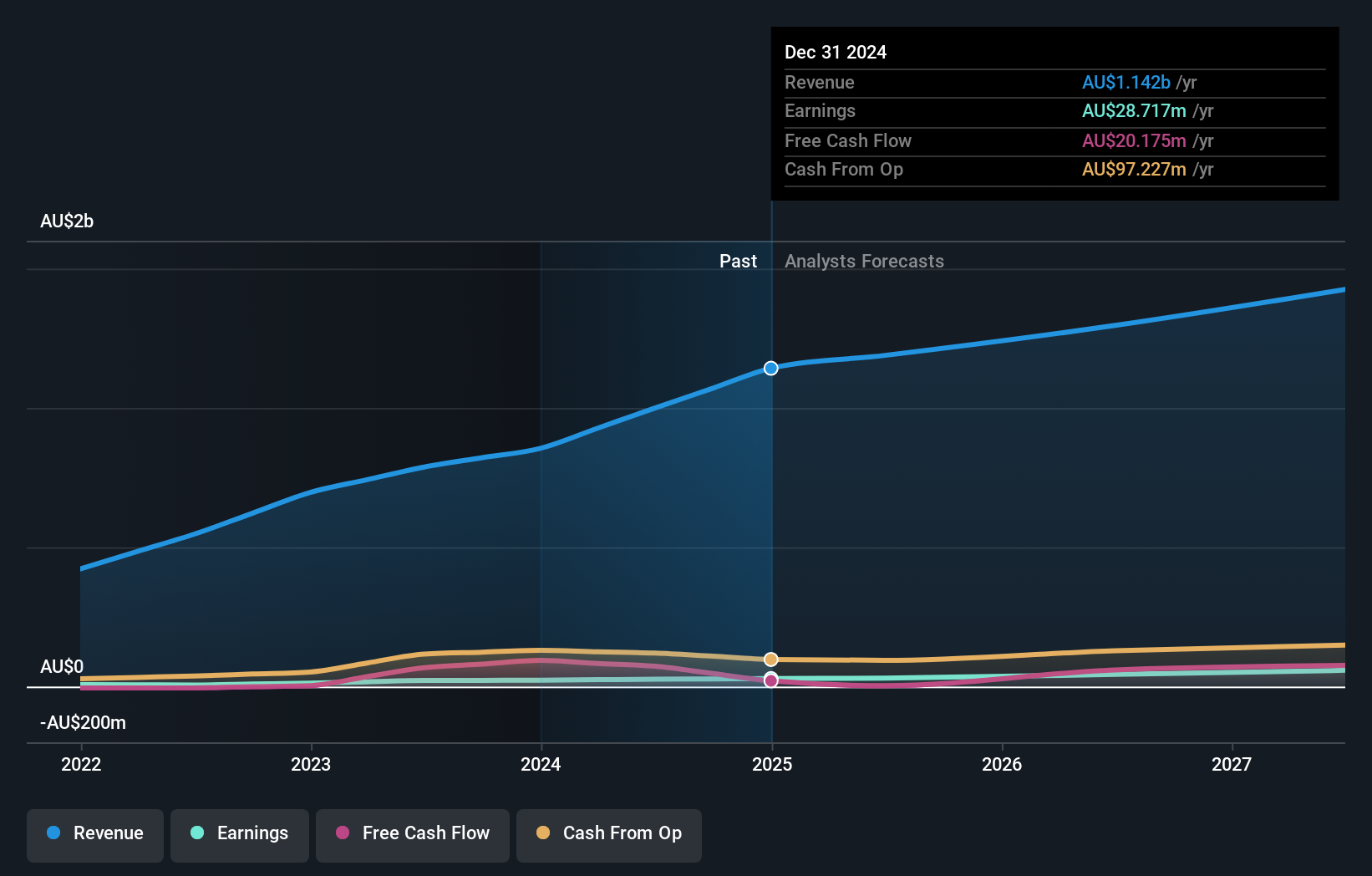

Aussie Broadband (ASX:ABB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Aussie Broadband Limited offers telecommunications and technology services in Australia, with a market cap of A$1.21 billion.

Operations: The company's revenue is primarily derived from its Residential segment at A$628.51 million, followed by Wholesale at A$143.55 million, Business at A$102.99 million, and Enterprise and Government at A$93.51 million.

Insider Ownership: 11.2%

Earnings Growth Forecast: 27.2% p.a.

Aussie Broadband is trading significantly below its fair value, with expected earnings growth of 27.2% annually, outpacing the Australian market. Despite substantial insider selling recently, no major insider buying occurred in the past three months. Revenue growth is projected at 8.6% per year, exceeding the broader market's pace but not reaching high-growth thresholds. The recent appointment of Sarah Adam-Gedge to the board brings extensive leadership experience that could bolster strategic direction and governance.

- Click here to discover the nuances of Aussie Broadband with our detailed analytical future growth report.

- Our valuation report unveils the possibility Aussie Broadband's shares may be trading at a premium.

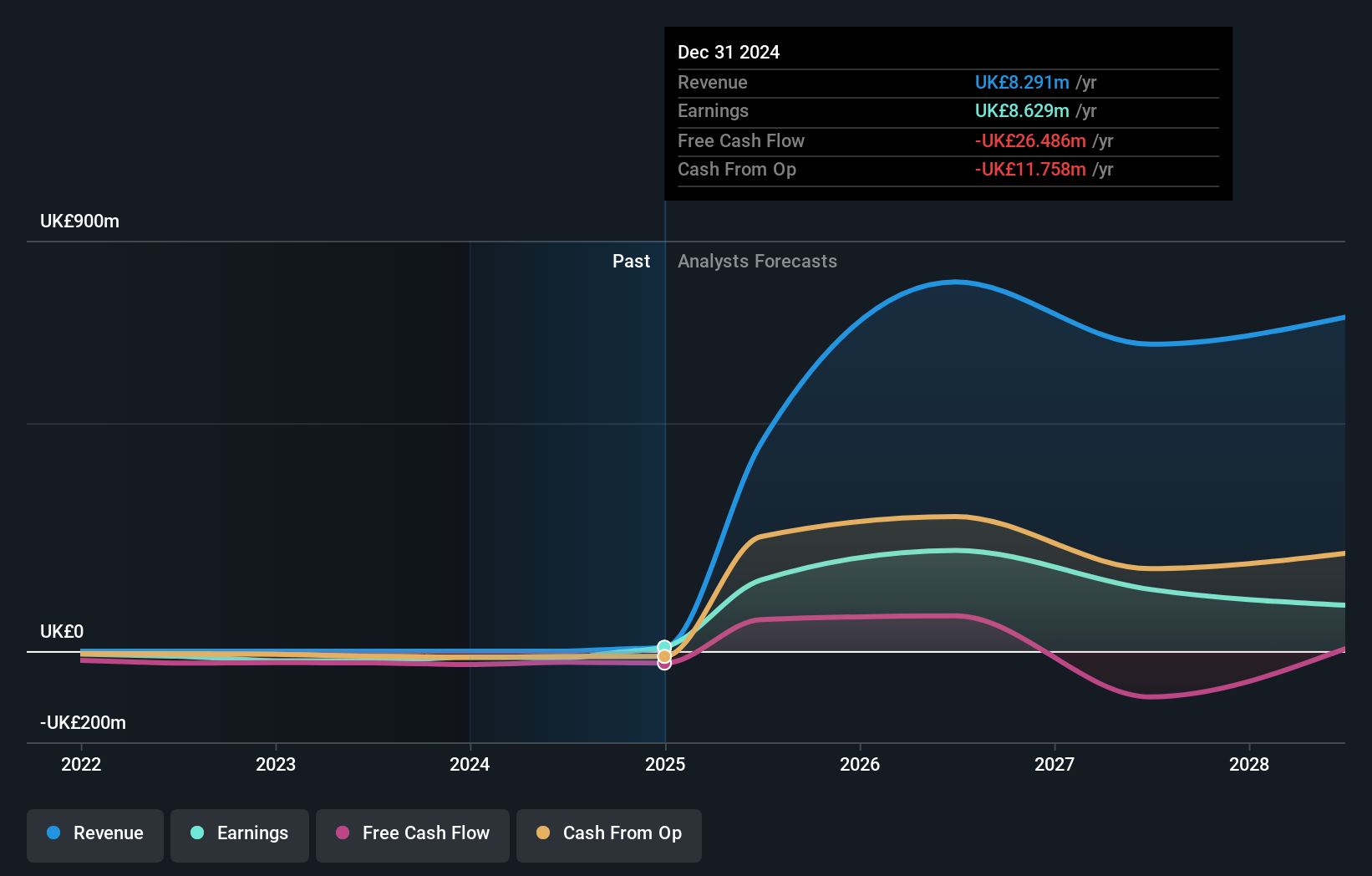

Catapult Group International (ASX:CAT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Catapult Group International Ltd is a sports science and analytics company that develops and supplies technologies to enhance athlete and team performance across various regions, with a market cap of A$1.62 billion.

Operations: The company generates revenue through its key segments: Performance & Health ($63.47 million), Tactics & Coaching ($36.66 million), and Media & Other ($16.40 million).

Insider Ownership: 15.5%

Earnings Growth Forecast: 69.3% p.a.

Catapult Group International is poised for growth, with revenue projected to increase by 13.9% annually, surpassing the Australian market's average. Despite a net loss of US$8.81 million for the year ending March 31, 2025, this marks an improvement over the previous year's losses. Insider activity shows more shares bought than sold recently, indicating confidence in future prospects. Governance enhancements include Jim Orlando's appointment as Lead Independent Director to strengthen board effectiveness and shareholder engagement.

- Click here and access our complete growth analysis report to understand the dynamics of Catapult Group International.

- Our valuation report here indicates Catapult Group International may be overvalued.

Greatland Resources (ASX:GGP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Greatland Resources Limited is a gold and copper mining company with a market cap of A$4.69 billion.

Operations: Greatland Resources Limited generates its revenue from its operations in gold and copper mining.

Insider Ownership: 13.9%

Earnings Growth Forecast: 15% p.a.

Greatland Resources is experiencing substantial growth, with revenue expected to rise by 23.3% annually, outpacing the Australian market. Despite a recent stock split and changes in auditors, insider ownership remains strong with no significant insider trading activity recently. The company became profitable this year, though past shareholder dilution and low liquidity are concerns. Its earnings growth forecast of 15% annually exceeds market averages but falls short of significant levels, while trading below estimated fair value suggests potential upside.

- Navigate through the intricacies of Greatland Resources with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Greatland Resources implies its share price may be too high.

Turning Ideas Into Actions

- Reveal the 94 hidden gems among our Fast Growing ASX Companies With High Insider Ownership screener with a single click here.

- Contemplating Other Strategies? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10