3 Dividend Stocks Beating the S&P in 2025

-

Enthusiasm for AI stocks has benefited shares of IBM and Seagate so far in 2025.

-

AT&T says that passage of the One Big, Beautiful Bill has presented a growth opportunity.

-

Investors appreciate the strong free cash flow generated by IBM, Seagate, and AT&T.

Setting an all-time high in mid-July, the S&P 500 has executed a swift turnaround from its nosedive in April. As of this writing, the index is up more than 7% since the start of the year.

But some components of the S&P 500 -- dividend paying stocks no less -- have provided even better performances than the index as a whole. Let's take a look at three of them today.

Image source: Getty Images.

Big Blue has delivered big returns this year

Climbing 30% since the start of the year, IBM (IBM 0.02%) is a dividend-paying company that has benefited from its significant business related to artificial intelligence (AI). While it may not have the same name recognition as other AI stocks (I'm looking at you, Nvidia), the company's first-quarter 2025 financial results reaffirmed how robust the AI business is for Big Blue.

From the second quarter of 2023 through the first quarter of 2025, IBM has grown its generative-AI book of business -- essentially a running total of active contracts and orders it has secured -- to $6 billion, after securing $1 billion alone in the first quarter of 2025.

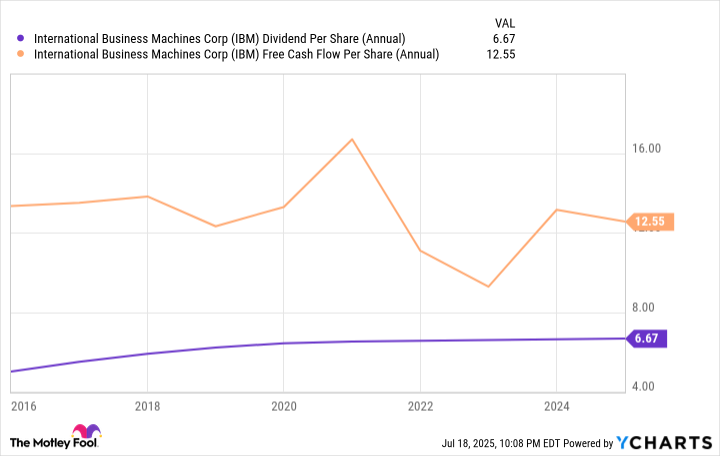

The company is generating strong free cash flow (FCF) as well. In the first quarter, it reported $2 billion in FCF, and management projects 2025 FCF of about $13.5 billion.

For 30 consecutive years, Big Blue has consistently hiked its dividend, a feat that many tech stocks haven't achieved. With the steadfast dedication to rewarding shareholders, the fact that IBM consistently generates FCF to cover its dividend, and the ample AI exposure, it's no wonder the stock has flourished recently.

IBM Dividend Per Share (Annual) data by YCharts.

A flood of free cash flow has Seagate on investors' minds

Another company helping to satiate investors' appetite for AI stocks in 2025 is Seagate Technology (STX 4.21%). It has been one of the best performing S&P 500 components, skyrocketing about 73% as of this writing. It's not merely the fact that the company has AI-related business that has excited investors over the past few months; Seagate is seeing the high demand for its mass-capacity data storage products translate to greater cash flow.

After reporting $27 million in FCF for the first quarter, Seagate generated $150 million and $216 million in the second and third quarters of fiscal 2025, respectively. Management doesn't expect it to taper off anytime soon, forecasting "free cash flow generation to improve sequentially through the rest of the calendar year" on the most recent conference call.

With the company's increase in cash flow, investors are more confident that the dividend, which currently has a 2% forward yield, is on solid ground.

AT&T provides plentiful passive income

After shares of AT&T (T 1.11%) soared 35.7% in 2024, some may have speculated that the stock would slow down in 2025 -- but it hasn't happened yet.

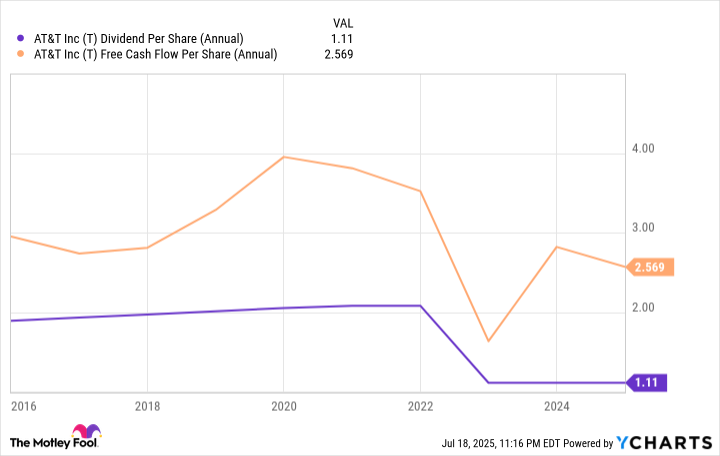

AT&T's stock price has risen some 18% year to date, starting the year on an auspicious note in late January, when the company reported strong fourth-quarter 2024 results. Besides beating analysts' top- and bottom-line estimates, management projected 3% year-over-year growth in adjusted earnings before interest, taxes, depreciation, and amortization and $16 billion in FCF for 2025.

While some companies fear how provisions in the "One Big, Beautiful Bill" will affect them, AT&T is optimistic. In response to the bill's passage, management said that it expects to invest more rapidly in next-generation networks, adding another 1 million fiber customer locations a year starting in 2026.

Currently, the stock's forward dividend yield is 4.1%. Lest cautious investors fret that the high yield is a warning flag, the company's consistently strong FCF demonstrates that the payout is on solid ground.

T Dividend Per Share (Annual) data by YCharts.

Is it too late to click the buy button on these dividend darlings?

Due to their recent rises, IBM, Seagate, and AT&T stocks are all trading at premiums to their historical valuations. Nonetheless, IBM and Seagate are both worth further investigation as ways to collect some passive income as well as gain exposure to the burgeoning AI industry.

For those more interested in yield, AT&T is a great option -- though investors may want to wait until the company reports second-quarter results later this month when management will update guidance after passage of the One Big, Beautiful Bill.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10