Top Growth Companies With Insider Stakes July 2025

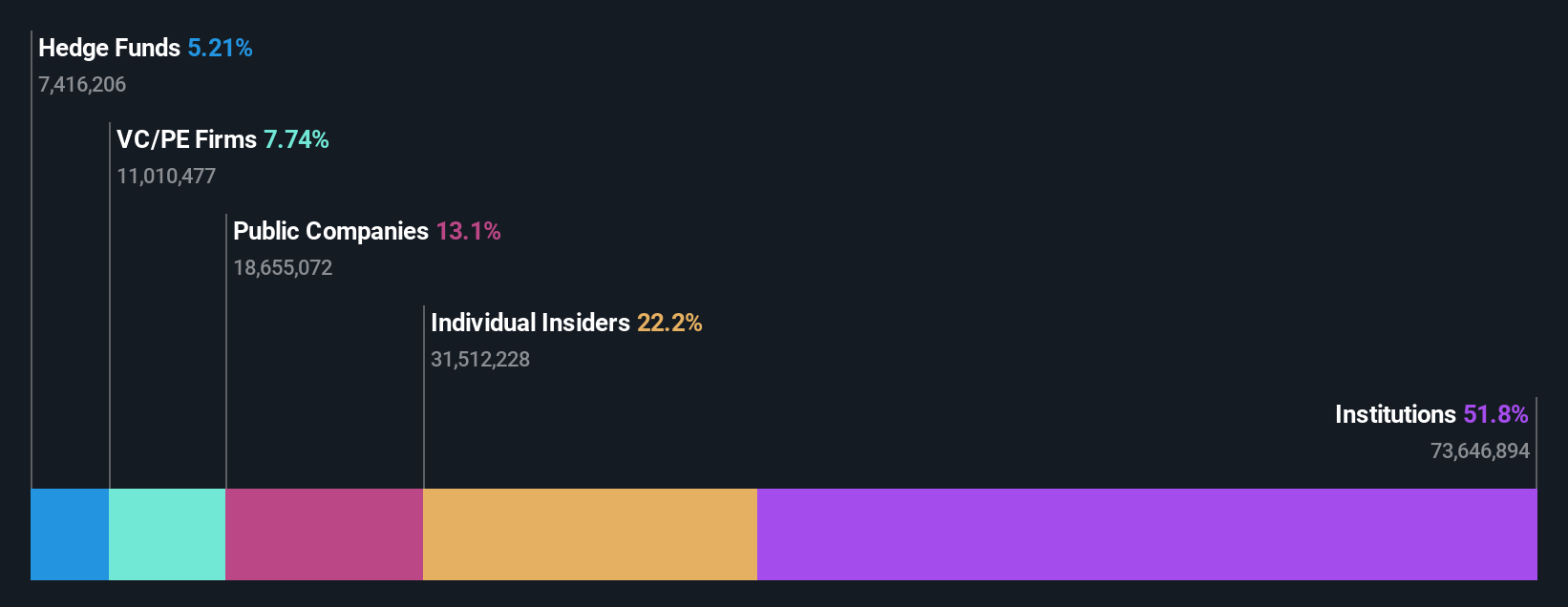

As the U.S. stock market reaches new heights with the S&P 500 and Nasdaq hitting record highs, investors are buoyed by strong earnings reports and positive economic data despite ongoing trade uncertainties. In this thriving environment, growth companies with high insider ownership can offer unique insights into potential investment opportunities, as insiders' stakes often signal confidence in a company's long-term prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Wallbox (WBX) | 15.4% | 75.8% |

| Super Micro Computer (SMCI) | 13.9% | 38.2% |

| Prairie Operating (PROP) | 34.4% | 80.8% |

| Niu Technologies (NIU) | 36% | 88.1% |

| FTC Solar (FTCI) | 28.3% | 62.5% |

| Enovix (ENVX) | 12.1% | 47% |

| Credo Technology Group Holding (CRDO) | 11.7% | 36.9% |

| Atour Lifestyle Holdings (ATAT) | 21.8% | 23.7% |

| Astera Labs (ALAB) | 12.9% | 44.4% |

| ARS Pharmaceuticals (SPRY) | 14.3% | 63.1% |

Click here to see the full list of 188 stocks from our Fast Growing US Companies With High Insider Ownership screener.

Below we spotlight a couple of our favorites from our exclusive screener.

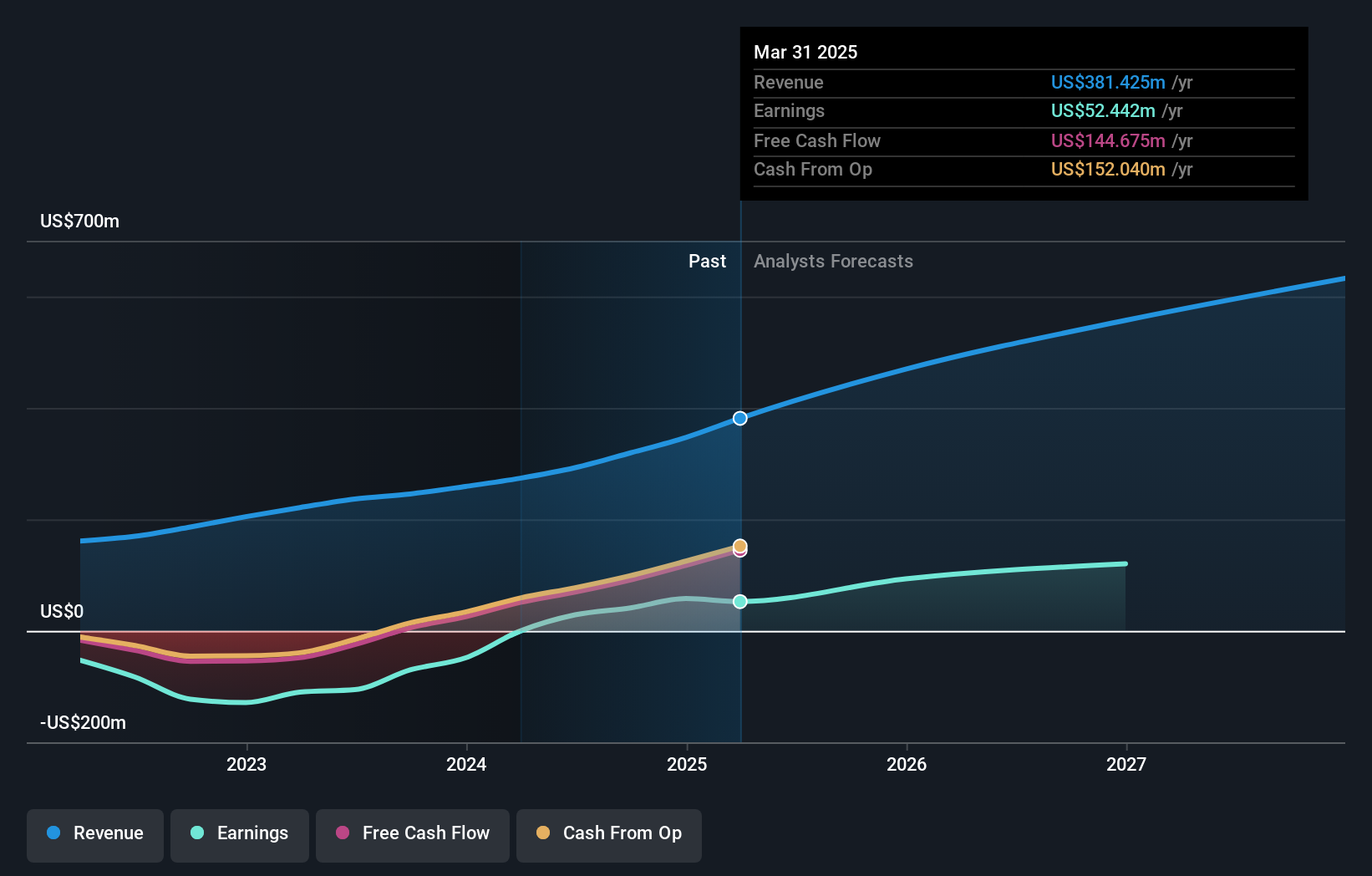

Dave (DAVE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dave Inc. operates a financial services platform offering a range of financial products and services in the United States, with a market cap of approximately $2.90 billion.

Operations: The company's revenue is primarily derived from its service-based and transaction-based operations, amounting to $381.43 million.

Insider Ownership: 20.4%

Earnings Growth Forecast: 43.1% p.a.

Dave Inc. demonstrates strong growth potential with earnings forecasted to grow significantly at 43.06% annually, outpacing the US market. Despite recent insider selling, substantial buying by insiders suggests confidence in the company's trajectory. Recent executive changes highlight a focus on operational excellence and sustainable growth, as seen with Kyle Beilman's promotion to COO/CFO. Additionally, Dave's inclusion in the Russell 2000 Growth-Defensive Index underscores its evolving market position amidst revenue guidance revisions upwards for fiscal year 2025.

- Unlock comprehensive insights into our analysis of Dave stock in this growth report.

- Upon reviewing our latest valuation report, Dave's share price might be too optimistic.

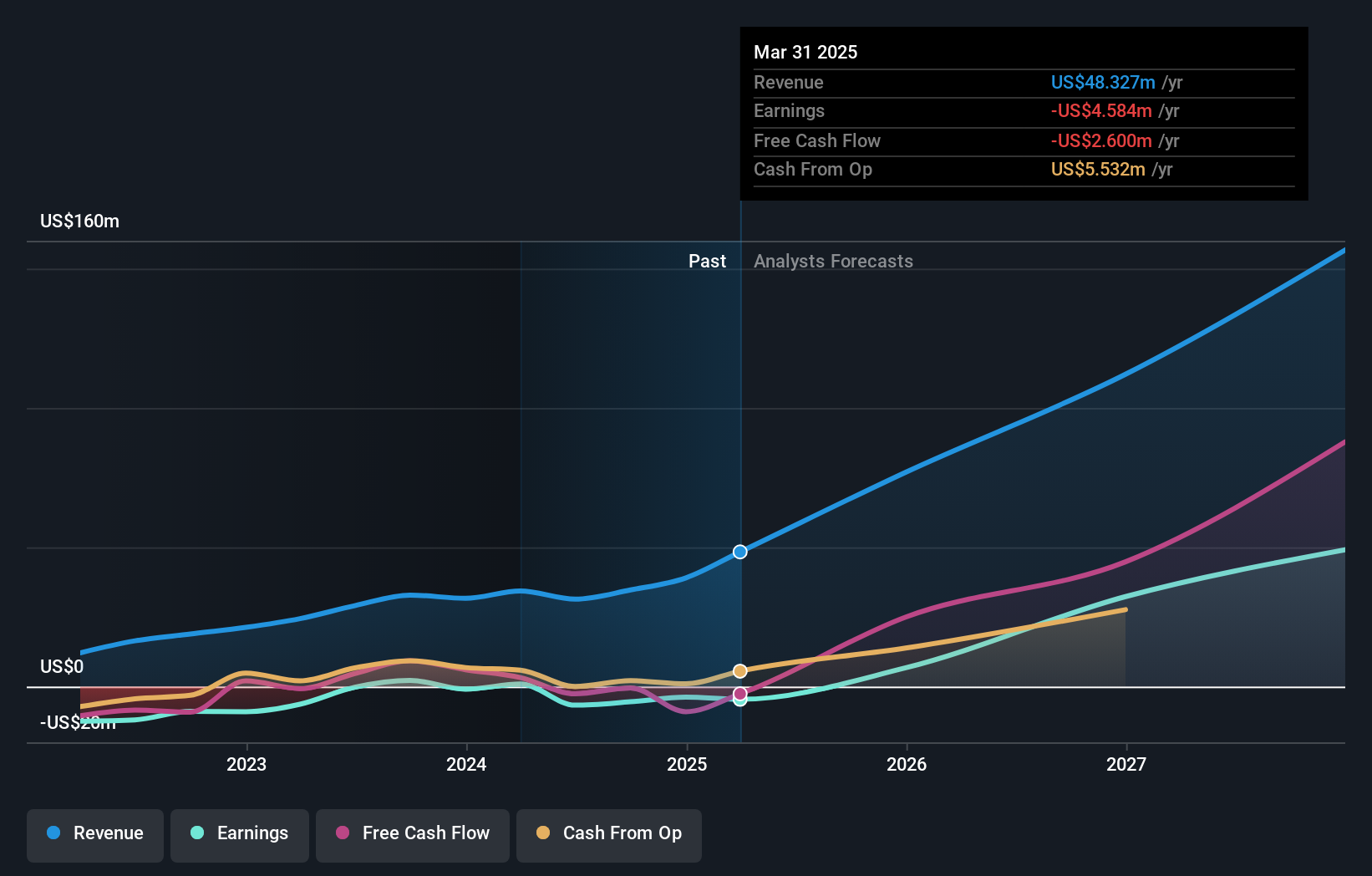

Eton Pharmaceuticals (ETON)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Eton Pharmaceuticals, Inc. is a pharmaceutical company that develops and commercializes treatments for rare diseases, with a market cap of $402.80 million.

Operations: The company's revenue is primarily derived from its activities in developing and commercializing prescription drug products, amounting to $48.33 million.

Insider Ownership: 14.1%

Earnings Growth Forecast: 47.4% p.a.

Eton Pharmaceuticals is poised for significant growth with forecasted annual revenue increases of 28.5%, surpassing the US market average. Despite recent insider selling, Eton's inclusion in multiple Russell Growth Indexes reflects its expanding market presence. The FDA's acceptance of Eton's NDA for ET-600 and approval of KHINDIVI™ highlight its innovative pipeline, potentially boosting future revenues. However, a net loss reported in Q1 2025 suggests ongoing financial challenges as it aims to achieve profitability within three years.

- Click here to discover the nuances of Eton Pharmaceuticals with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Eton Pharmaceuticals is priced lower than what may be justified by its financials.

Atour Lifestyle Holdings (ATAT)

Simply Wall St Growth Rating: ★★★★★★

Overview: Atour Lifestyle Holdings Limited, with a market cap of $4.94 billion, develops lifestyle brands centered around hotel offerings in the People’s Republic of China through its subsidiaries.

Operations: The company's revenue segment, Atour Group, generated CN¥7.69 billion.

Insider Ownership: 21.8%

Earnings Growth Forecast: 23.7% p.a.

Atour Lifestyle Holdings is experiencing robust growth, with earnings projected to increase significantly over the next three years. Revenue growth is expected to outpace the US market at 20.6% annually. The company recently announced a share repurchase program worth US$400 million, enhancing shareholder value. Despite a slight decrease in Q1 net income, Atour's strong revenue forecast and high return on equity projections underscore its potential for sustained expansion amid minimal insider trading activity.

- Navigate through the intricacies of Atour Lifestyle Holdings with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Atour Lifestyle Holdings is trading behind its estimated value.

Summing It All Up

- Delve into our full catalog of 188 Fast Growing US Companies With High Insider Ownership here.

- Looking For Alternative Opportunities? The end of cancer? These 25 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Eton Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10